Here is an Article I posted on the Libertarian Republic last year.

The original is available here : http://thelibertarianrepublic.com/8-reasons-government-sucks/

8 Reasons the Government Sucks

Efficiency is an important thing to consider in an economy. If a society produces too much of a good or service, it will go to waste, if it underproduces a good then the result is a shortage. Goods and services that are provided by free markets come very close to efficiency, thanks to the laws of supply and demand. Governments and central planners do a… less effective job of this for a few reasons.

8. Tendency for Government Growth

Governments like to do things. According to the state, and supporters of the state, any problem, whether real or imagined, can (or rather must) be solved by the government. This inclination to action results in ambitious welfare policies, increases in military and police spending, EPA programs that do more harm than good, etc. These increases in spending, by necessity are followed with increases in taxation. Just take a look at this graph (sourced from http://www.usgovernmentspending.com/total_spending_chart) which highlights the increase in government spending in relation to GDP over the years.

This is only expected to increase, due to the nature of government and state supporters demands for government solutions. This, along with the corresponding increase in taxation, squeezes out private businesses, and removes incentives for individuals to innovate and work productively, which will slowly turn the nation into a european style welfare state.

7. The Political Cycle

Modern Governments are notoriously short sighted. In the eyes of politicians, a policy is only as good, or effective as it will contribute to their re-election. This is why many government policies and initiatives are designed to show positive results within the four year election cycle, often with little regard to the long term consequences. One dramatic example of this is when the Federal Reserve held interest rates rates artificially low, in the hopes of stimulating the housing sector. The well documented result was a massive misallocation of capital, which lead to inefficient business practices, and a housing bubble that collapsed so catastrophically that it caused the Global Financial Crisis, the effects of which are still felt almost a decade later.

6. Agency

An important concept in economics is that of Homo Economicus, or the Economic man, which is the idea that an individual is rational, and makes decisions in pursuit of maximising his utility, or benefit.

Many people idealistically view their government as some massive and all knowing entity, usually with a three or four letter acronym for a name. In reality, governments are nothing more than a collection of individuals, each with their own preferences, abilities and incentives.

When a businessman makes a decision, he does so with profit as his incentive, and is using his own resources to carry his decisions out. When a politician makes decision, his motivation is political power, and the resources used to make these decisions belong to others. This presents a problem because the people tend to make decisions more carefully when they are risking their own resources, just give someone money to spend and see how careful they are with it. Businessmen are interested in minimising costs and maximising return. Politicians and bureaucrats are concerned with what will look good to their superiors or the public. This very often leads to government programs deliberately going over-budget.

Free markets embrace and benefit from the idea of Homo Economicus. Through voluntary exchange, individuals pursuing their own self interests have driven innovation and productivity.

Governments scorn the idea, and either enact policies in spite of, or try and regulate Homo Economicus from pursuing his self interests, and suffers for it.

5. Tax

One of the *many* problems with taxes is that there is usually a separation between the tax, and the goods and initiatives that the funds are spent on. This is a problem because it emotionally detaches people from the mechanics of the tax system, which makes it difficult to analyze the economics of a good using traditional supply/demand models.

Policy makers treat the tax system as a bottomless pit of money, without thought or care for where the money came from. This changes the incentives of policymakers, rather than comparing the costs and risks against the returns like a private individual or business would, he thinks of budgets and soaking as much funding as possible. Surely you have heard the concept of funding based on need, where a government department spends the entirety of its budget in order to increase its budget next period, which obviously leads to massive inefficiencies.

Taxpayers, being the rational individuals that they are (Trump and Sanders supporters excluded), tend to lie about their taxable income, and welfare. Even the most upstanding, honest, flag waving citizens lie without without thinking about it claiming they earn less than they do, or their costs are higher than they really are, in order to either reduce their tax costs or increase the government welfare they receive.

4. Human nature

Much like trying to hold water in your hands, human nature is a difficult thing to contain. People tend to try and do what they want regardless of the will of any planner, and when someone attempts to contain or control them, they will find creative solutions. A good example is the black market that arose in schools after the first lady implemented new tough “healthy” lunch rules in schools. If a government tries to restrict people from accessing a good on the marketplace, the good will inevitably arise on the black market. The goods will always be available, but after considering the costs of attempting to enforce regulation, the criminal elements, and other factors, the goods will be provided at a greater cost to society than before. As is the usual case, the government's attempt to “help” makes situations much worse.

Another downside of human nature however, is that, being rational self interested individuals, people will make decisions in their own interests. This becomes a problem when government is in the equation, as it gives some self interested individuals more power than others. These people will make decisions in their favour, often at the expense of others. This problem is exacerbated in democracy, where members of society will vote in their interests, whether or not it is good decision making, or if it violates the liberties of others.

3. Diversification

Anyone who knows the basics of investing, knows what diversification is: instead of putting your eggs in one basket, invest in a number of different things, to shield yourself from losses and to access gains from more than one avenue.

The market works in such a way when it comes to the production and distribution of resources. Many businesses, producing goods in their own way in an attempt to innovate. If one business uses a poor method, or makes a mistake, he will pay the price and the rest of the economy will continue to function, having learnt from his mistake.

Governments on the other hand find a method they like, sometimes from an analysis performed by the “smartest guy in the room” and sometimes from backroom political deals. This method, they decide as the greatest, most efficient method there is, and decree that everyone should produce in such a way. The problem with this is that even running with the wild assumption that the government is able to select the most efficient method, if anything in the future were to render this obsolete or reduce its effectiveness, it would affect the entire economy systematically. This is compounded by the fact that relying on single methods of production and allocation drastically limits the ability of an economy to innovate, as any innovation would have to be performed by government men, with white coats and pocket protectors, which is a much smaller talent pool than the wider population.

2. Rent Seeking

When governments regulate the supply and production of a good, it creates opportunities for rent seeking. Rent seeking in this case is when a business or individual profits, not by creating or providing a service, but through political coercion. A topical example is the taxi industry, where taxi licences are worth large amounts of money, which can be invested in by people with no intention other than to rent to actual drivers. These “licence investors” create no benefit to society, and are effectively a drain on the industry. The money being made in government revenue, and in profits by these rent seekers is money that is not being spent efficiently within the market.

The result, as everyone is aware, is a terribly uncompetitive taxi industry, relying on tight barriers to entry to shield inefficient practices from scrutiny. Taxis are expensive, and more often than not fail to provide an adequate level of service. When a more competitive business model arrives in the form of Uber and Lyft, the incumbent businesses, who have been protected from exposure to market forces over the years, fail to adapt, instead choosing to respond violently and lobbying to the government for added protection. These actions come to the cost of consumers, and society as a whole.

Rent seeking damages industries, as it allows plundering by rent seekers, invites corruption, and puts those without political clout at an economic disadvantage.

1. Information

This one is a doozy.

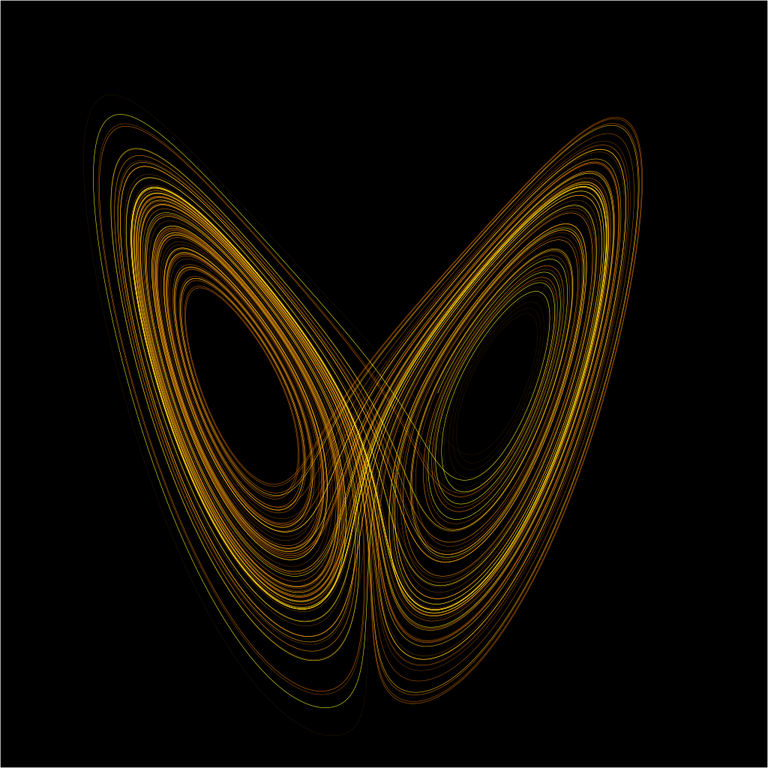

We have all heard about the butterfly effect. The idea that a butterfly flapping its wings can affect weather systems on the other side of the world. This is because the weather is a complex system, a system made up of so many inter-related variables that even if it were possible to obtain the information of every variable at a particular moment, it is literally impossible to accurately predict the state of the system in the future. The economy works in a very similar fashion. An economy consists of millions of individuals, in hundreds of different industries, producing, selling and consuming goods that are all interrelated.

Governments and central planners of a complex system, are at an informational disadvantage. This is not due to politics or opinion, it's a matter of mathematical fact. A central planner cannot possibly have the resources or computing capabilities to be able to calculate the state of all the factors of the economy at any given time.

Every businesses has their own operating costs and every individual has their own preferences, and these change all the time. For instance, I don’t know if I am going to want a banana or an apple when I next go into my local grocery store, but my decision will impact the business, which will then go on an influence other members of society.

In a centrally planned economy, an individual, or small group must analyse society, and make decisions on how much of a good to produce, who to produce it, who it is going to go to and how much is going to go to who. For the economy to operate at equilibrium, the government must have an omniscient awareness of all of these factors, including the preferences of each individual, at any given time, as well as be able to predict any freak events that could affect the future (For instance a bout of unexpected poor weather might change people's likelihood to eat out, which would affect restaurants). This is of efficiently imposed order is laughably impossible.

This is no problem for free markets. An individual needs only know enough information to make decisions that immediately affect himself. Through the act of voluntary exchange, self interested individuals share their information throughout the system, bringing the economy into a state of spontaneous order.

This is performed through the price mechanism, where the price of a good in the marketplace at any given time reflects the marginal cost, and marginal benefits of all the individuals that are engaged in trade. This means that the price also contains any information that the individuals possess. For instance, if a storm wipes out half the crops of bananas in a region, growers will raise the price at which they are willing to sell, to reflect the extra cost of their lost stock. Buyers will now have to decide if the benefit of a banana is worth the extra cost. So then, bananas will only be sold at a price where everyone is happy, and will only be sold to individuals who value the bananas at the new price, effectively setting a new equilibrium. If this same situation occurred in a centrally planned economy, the result would be a shortage, as the government would have no way of being able to distribute the stock in such an efficient way.

Milton Friedman made this point clear during his televised series Free to Choose in the Eighties with this famous quote:

great post you make alot of valid points! thank you

Thankyou. I appreciate the feedback.

Only eight?

Well I could have gone on forever, but I thought it would be better to try and cover everything under a few blanket arguments rather than list it all. Anything in particular you think I should have included? Always happy for feedback!

No, you covered everything. Just my attempt at humour.