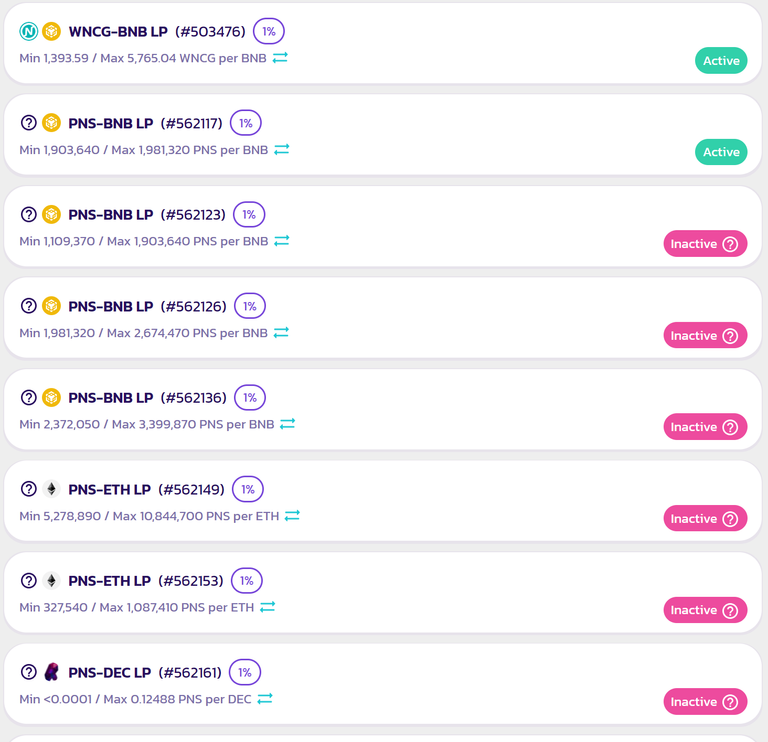

Set up my PNS lps to a tight range and then have set up upper and lower buy and sell liquidity for when prices either decease to pick up additional tokens or for when they inc to sell pns for bnb, eth or dec. Will add other positions as the lp produces fees hopefully at the 800% that is quoted but well see if it can maintain that price range or if it drifts into the non active positions in bnb, eth or dec and if it goes up it will automatically sell for bnb,eth and dec if it gets high enough so hopefully we have a spike in pns vs these tokens. Also hold a small amount in my wallet to sell for sps should the price diverge or any other token. May add a new token pair for it on usdc or usdt eventually so that the stable pair is a more stable than dec is and can directly be converted to stables as well.

Hopefully the removal of liquidity adds to the ROI of lp providers as well as volatility so that we get some price spikes and can pull my liquidity at that time to lock in gains in bnb and if it can get high enough eth and dec as well as i put those up a bit higher so the gain would be multiples of where it is now if it gets there. Also have a buy PNS set in bnb to buy if it decreases a lot to pick up extra holdings and the hope would be to grab on a pullback as well as earn the fees on the way down.