MSMEs are suffering the excruciating effects of the trade wars, ineffective economic policies and security upheavals, this challenges in different forms & different economies in the world has created a difficult situation for the banking industry to thrive and offer loan services to especially micro, small, & medium-sized enterprises (MSMEs). According to a recent earnest & young publication almost 200 million MSMEs have no access to bank services and this creates MSMEs growth constraints but with the blockchain innovation called PNGME their is bound to be an all-inclusive advanced mobile banking system. The choice of blockchain technology Stern's from the fact that blockchain is a unique ledger data base system that allows for the seamless storage and transmission of information blocks linked together by an encrypted system. Information blocks are programmed to function not just optimally but also independently with a great propensity to expand subsequently. Blockchain is unique because it operates by nodes and not by intermediaries this makes it practically impossible for informations to be altered. Informations can only be added only when everyone has the same consensus.

The choice of blockchain technology is poised towards ensuring exchange, high security, transparency and elimination of erstwhile bureaucracies and so PNGME collaboration with blockchain Provides the best of mobile banking service.

WHY PNGME ARE INDISPENSABLE BY MSMEs.

A good number of MSMEs before now are beguiled by stringent banking services, bad debt history, lack of transparency in financial statements, ineffective business plans are among the main reasons that have made MSMEs unable to access optimum banking Service. A good number of MSMEs have no specific strategic plans and so cannot withstand sudden macro- economic undulations & this is a red flag for business and an efficiency decline for production processes. PNGME offers enormous hope & promise for better MSMEs services, MSMEs Provides the best of loan services for MSMEs.

HOW PNGME CAN HELP GROW FINANCIAL INCLUSION.

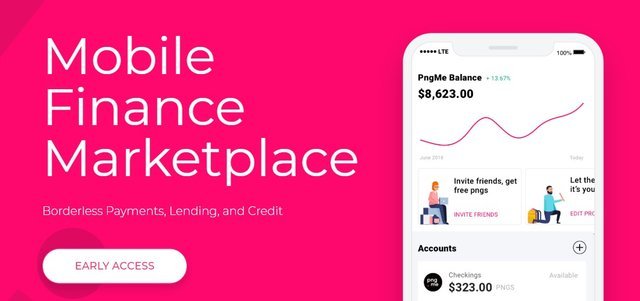

Having espoused on the myraids of difficulties faced by [MSMEs one can boldly say that PNGME offers opportunities that creates financial inclusion not just for MSMEs but also for financial institutions using PNGME credit scoring & less-fee payment with little or no restrictions. PNGME has a blockchain infrastructure that ensures quality delivery of financial services due to it reduced cost & Maximum security this makes it possible for PNGME to provide services to low-income consumers. PNGME parades features like piggy bank that provides avenues for passive income earners to save & earn interest, it also Provides an everyday account feature for managing daily expenses. PNGME financial inclusion is further enhanced by its ability to aid MSMEs to collect funds money and pay back at mouth watering interest rates. PNGME offers an unparalleled level of convenience using it's mobile low rate payments services in cryptocurrencies either as Bitcoin, pngcoin or in fiat currencies.

CONCLUSION.

With all that has been said PNGME is leveraging on it's very many unique features to not just be a game changer but also create optimal financial inclusion that will abruptly bridge the gap between the high & low income earners; PNGME recognizes & understands the presence & place of other contemporary project but with crop of impeccable team of experts behind PNGME I am very certain that PNGME will stand out in no time

For More Information on the project, please see Links Below:

🌐 Website

📑 Token Economics

📧 Telegram

📝 Bitcointalk ANN

🕊 Twitter

📘 Facebook

📝 Medium

🔗 LinkedIn

📱 Android App Early Access

Author

Bitcointalk username: Abulu730

Bitcointalk profile link