What is Steem? | A Beginner’s Guide to a Potentially Huge Content Solution

Steem is the name of the token that can be bought and sold on the open market, based on the blockchain-based platform Steemit.

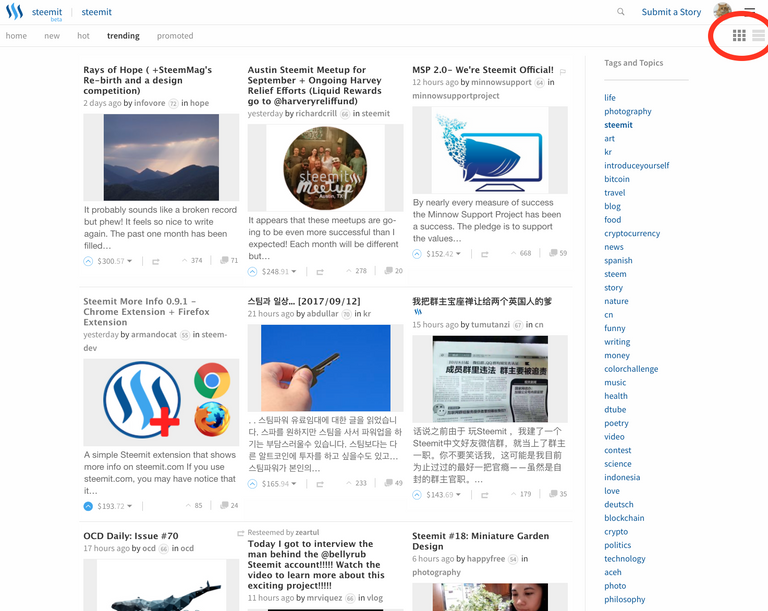

Steemit is a platform that allows publishers to monetize their content that functions similarly to many other social content networks.

Think Reddit, but in a way that pays writers and content curators.

How Does Steem work?

In order to really focus on Steem, we have to go over a bit about the Steemit platform.

Every day, the Steemit network creates new Steem units and distributes them to its users. The users can then exchange these units on the open market for Bitcoin, other cryptocurrencies, or fiat.

Steemit has really gathered some “steam” (excuse the bad pun) in the content and cryptocurrency community because it virtually allows anyone to write about interesting topics and start earning money.

Steemit is different from other cryptocurrencies like Bitcoin because it doesn’t solely rely on mining to generate new currency units. While you can technically mine Steem, the network creates new Steemit currency units and automatically distributes them to people who are writing on and engaging with the platform. The amount you get is correlated with the number of upvotes the content you write gets and the amount you engage with the site (upvoting and commenting).

Steemit solves a HUGE problem the content world is facing.

Outside of Steemit, the current content economy is broken.

Content creators work hard to make awesome content, but their only way to monetize is via advertising, affiliate marketing, leading readers into a funnel, or some other way of leveraging their content to get paid.

Since there’s no way to directly monetize their hard work, the best content creators often have to rely on things that could substantially impact the partisanship and direction of the content.

However, that’s just the start of it.

Not only are the current routes for monetization potentially credibility corrupting, they’ve become less and less effective. Content consumers have proven to show a strong distaste for paying for online content. The sheer amount of content available online mixed with a general avoidance of consuming content that requires a whitelisting or venturing past a paywall.

Digital advertising, for example, has been greatly minimized by the explosive rise of ad blocking. At the end of 2016, there were roughly $615 million devices around the world blocking ads, and the percentage of people blocking ads has been consistently growing.

This is something that affects both individual content creators, as well as large-scale media companies. Dozens of publications now ask you to “whitelist” them in order to read their content, and as you can imagine, is driving casual readers away in troops.

On the other end of the content exchange, the Steemit platform gives content consumers an incentive to naturally and organically engage with the content they read. People who upvote and help curate the best content on the site, as well as commenters who contribute to discussions, are all rewarded by the platform.

Steem Coin Supply and Sustainability

Steemit actually has three different kinds of currency units: Steem, Steem Power, and Steem Dollars.

Steem

Steem:

Steem is bought and sold on the open market the same way you would any other token. Holding Steem for long periods of time since the Steemit platform creates more every single day, and you run the risk of dilution. Steem currently erodes at a rate of 9.5% every year due to this production. Steem’s price, however, has generally gone up and some investors have been able to combat Steem’s orchestrated inflation and profit significantly.

Steem Power:

When you buy a Steem Power Unit, you can’t sell it for 13 weeks. What was originally a 2-year period, the is meant to prevent people from suddenly dumping all their units on the market and crashing the price. This is essentially a long-term investment in the platform, as holding Steem Power units entitles you to a proportionate ownership in the network. So, as the network grows (as it has been), so will the value of your piece of ownership.

Currently, around 15% of the new Steem that is generated every day is distributed to those people holding Steem Power Units as additional Steem Power Units. The remaining 85% goes to the content creators and curators.

Half of what content creators receive in their payout per post is in Steem Power Units.

The more Steem Power Units you have, the more your upvotes will count, helping users to build up more influence in the site. You will also receive a higher payout when upvoting someone else’s work, and when you upvote someone else’s content, they receive a higher payment as well.

Steem Dollars:

Steem Dollars is another type of Steemit currency and is meant to be to be stable. Steem dollars are pegged to the U.S. Dollar. When content creators make popular content, 50% of their pay per post is going to be in Steem Dollars (the rest being in Steem Power Units).

Steem Dollars are interesting because they give content creators three different choices:

Convert Steem Dollars to Steem and sell it on the open market (cash out). This takes about 3.5 days.

Hold the Steem Dollars and essentially earn 10% interest.

Exchange Steem Dollars for Steem Power (long-term invest).

Steem Distribution and Supply:

The Steemit platform creates new tokens every single day.

15% of these new units are proportionately distributed to people who hold Steem Power.

85% of these new units are paid out to content creators, upvoters, and commenters.

Content creators that create content worthy of payment receive half their compensation in Steem Dollar Units, and the rest in Steem Power (locked up for 2 years).

Steem History:

Steemit was founded by Ned Scott and the CEO of BitShares, Dan Larimer in 2016.

The concept was introduced in a whitepaper in March 2016. It aimed to create a social content platform similar to Reddit, but where the text content and metadata was preserved in blockchain. The use of blockchain would also facilitate the creation of a system that rewards comments and posts.

Steemit also introduced a reputation system where accounts can receive notes that impact their reputation in an attempt to incentivize good online behavior (bye bye, trolls.)

Steemit was made to run on a decentralized network called Steem, where tokens could flow without friction between the platform and users. Steem accounts are made to be able to interact with the Steem database using simple user-chosen alphanumeric names (which are much easier than cryptographic hashes.)

Steem uses “proof-of-stake” to reach a consensus where accounts (called witnesses) are chosen by Steem stakeholders. According to the Steem whitepaper:

“75% of the new tokens that are generated go to fund the reward pool, which is split between authors and curators. 15% of the new tokens are awarded to holders of [Steem Power]. The remaining 10% pays for the witnesses to power the blockchain.”

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://coincentral.com/what-is-steem/

Congratulations @elmoukhtar! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP