Bitcoin halving is the most prominent and important global event in the Bitcoin process, and despite the great importance of this event, few people talk about it, and few know what it means, this incident has been repeated twice in the past, and every time we notice catastrophic results For this incident on the crypto market.

Today we will talk about this important event, our goal today is to spread interest to those interested in digital currencies or even investors in them and everyone related to this interesting world, so follow us to get to know the meaning of Bitcoin rankings, how it affects the value of bitcoin, and how to prepare for it well. It is never a faraway event!

Bitcoin halving

In short, Bitcoin Half is a law or rule established by Bitcoin founder Satoshi Nakamoto, and this rule provides for reducing the prize given to miners when adding a block to the Block Chain in half.

To understand the description more accurately, it is necessary to clarify some matters, starting with the basics, Mr. Nakamoto set important terms and conditions in the Bitcoin business algorithm, and was keen to make it a deflationary and not inflationary currency, unlike the traditional government currencies that can be printed in central banks, and what makes these A deflationary currency is its limited number from the start, as it was defined by the fact that the number of its currencies offered on the market does not exceed the pre-determined limit of 21 million bitcoins only.

We all know that the cost of mining is very expensive these days, due to the cost of electricity consumed and expensive specialized equipment, and as a result of these high costs no one will work in mining digital currencies for free, so the interview was simply the prize or the collective reward given to the miners in the form of new bitcoins added to Metal Portfolio Every time a block is added it is added to a block chain or block chain and every 10 minutes a block is added, that is, every 10 minutes someone will get his work fee.

Now things have become a little clearer, as we can look with one comprehensive view that we can see the volume of Bitcoin currencies in the market, and the number of currencies is inflated by the collective reward, and the value of this reward was when Bitcoin first appeared 50 Bitcoin is delivered to a metal every ten minutes, and therefore it was from It is necessary to maintain the limit of the currencies offered in the market in order to establish the half law.

Today the bonus value is only 12.5 Bitcoin, which means that the bonus has been half done twice in the past, and in fact this is a software feature in Bitcoin since its first launch, and this incident is repeated every four years, i.e. when mining 210,000 Bitcoin blocks, according to a simple process a block every ten minutes, This process is ongoing until the last bitcoin is redacted one day in the year 2140 as expected.

So this is bitcoin rankings, and the next event will be in the first half of next year 2020 on the second day of next May according to the hourly bitcoin, and then the bonus value will be only 6.25 bitcoin, the questions remaining now, why does bitcoin consolidation happen in the first place? What is its purpose? What is its effect on the price and value of bitcoin on the market?

Why does bitcoin halving happen?

The main and main reason behind the Bitcoin rankings is controlling inflation, as we mentioned earlier. Inflation is one of the disadvantages of traditional fiat currencies that are controlled by central banks, as they can print whatever currencies they want; and in case a lot of a particular currency is printed, as happened in many countries During economic crises such as Weimar Germany in 1923 and Zimbabwe in 2007.

And inflation may lead to economic catastrophes. The laws of supply and demand guarantee a rapid decline in the price and value of the currency, and since we use currencies mainly for exchanges against commodities, the currency whose value decreases rapidly becomes unable to meet its main purpose, which is exchange. This leads to More inflation, and in the end the currency, regardless of the quantity offered, becomes worthless.

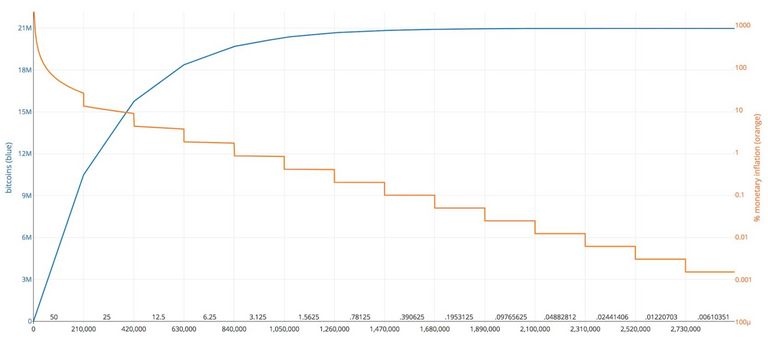

On this graph, you can see bitcoin inflation rate every period up to 2140 where the orange line represents bitcoin inflation during a specific period while the blue line is the total number of bitcoin currencies.

On the other hand, we can see bitcoin as a commodity, such as gold, which is a commodity and an asset that has maintained its value for more than 6000 years. The quantity of gold in the world is very limited, and the task of extracting and formulating gold becomes more complex with the passage of time, and as a result, the offered gold has become of great value As an international medium for financial exchange and storage, Bitcoin can take the same mechanism.

The effect of halving on the market value

We talked a little while ago about the importance of controlling inflation and its impact on price, when supply decreases with demand steady, the price will rise, but in reality the effect of half-price is not direct but occurs in the long run.

It would seem very strange for the miners to take control of the bitcoin market after the split occurs, but this is what will happen.You may wonder how that is, 4,380 blocks are usually mined every month and this amount is added to the bitcoin block chain, and now the reward is equivalent to 12.5 bitcoin, which is approximately $ 5,000, so if We multiply these numbers together, and we get the total revenue of the minerals per month, which equals $ 273.750 million.

After Halving, the number of equivalent bitcoins will decrease daily, and thus the total monthly revenue to approximately $ 136.875 million, and this leads to one of two things either the miners will give up or refuse to sell the bitcoins they earn at a price less than $ 10,000 and this is called HODling which is maintaining investment for a period of time long.

After successive bitcoin half-lives, experience has shown that the effect of half-lives on the two metals is a mixture of the previous two possibilities. Some of them give up and the majority prefer to hold cryptocurrencies.

The first rank was in November 2012 Bitcoin became about $ 11, and with the beginning of the following year it started to rise significantly until it reached its highest level ever and exceeded $ 1100 in 2013, then returned and the price declined in subsequent years, until the second half That happened on July 9, 2016, the bitcoin value was then in the range of $ 580-700 and held that value for several months before rising slowly at the end of the year to suddenly exceed $ 1,000, and according to these previous incidents analysts believe that history will repeat itself with Next bitcoin half.

However, these remain expectations and predictions and not certain facts. Each classification was accompanied by different economic and global factors and the impact of Bitcoin and its location in the world today is different from what was previously, and this of course has its impact on everything that will happen in the future, but it is clear and certain that Bitcoin's classification is linked in a way Very close with price fluctuations that follow it every time.

This post earned a total payout of 5.356$ and 2.678$ worth of author reward that was liquified using @likwid.

Learn more.

This post earned a total payout of 0.052$ and 0.026$ worth of author reward that was liquified using @likwid.

Learn more.

This year, it will be the first halving I can effectively monitor.

Thank for sharing this information about the previous event, it helps clarify some blank points on my side.

Peace

Posted via Steemleo

Congratulations @curation-man! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

You got a 97.35% upvote from @minnowvotes courtesy of @curation-man!

This post has received a 34.4 % upvote from @boomerang.

Congratulations @curation-man!

Your post was mentioned in the Steem Hit Parade for newcomers in the following category: