Hey All,

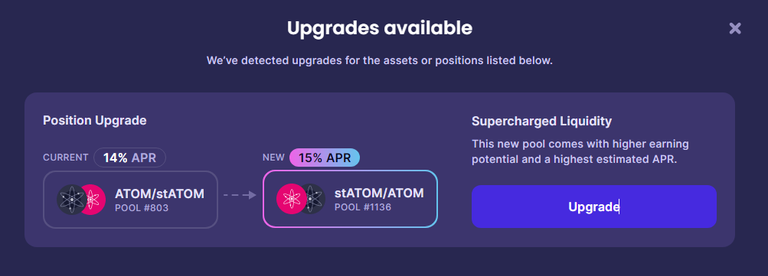

After a long time, I visited my liquidity on the Osmosis chain and found this new revamp on the chain with the name Supercharged liquidity. It is being called as an Revolution in Decentralized Market Making. When I checked into one of my liquidity pool which is ATOM/stATOM, I got this message as upgrade available to Supercharged Liquidity and it stated its a new pool #1136 with new APR of above 15% as compared to my earlier pool which was giving an APR of 14%; here is the message screen that popped up::

Supercharged liquidity - What is iT?

Supercharged liquidity is Osmosis’ take on concentrated liquidity, designed to equate to users specifying pool positions — and granting flexibility over the use of assets in the process.

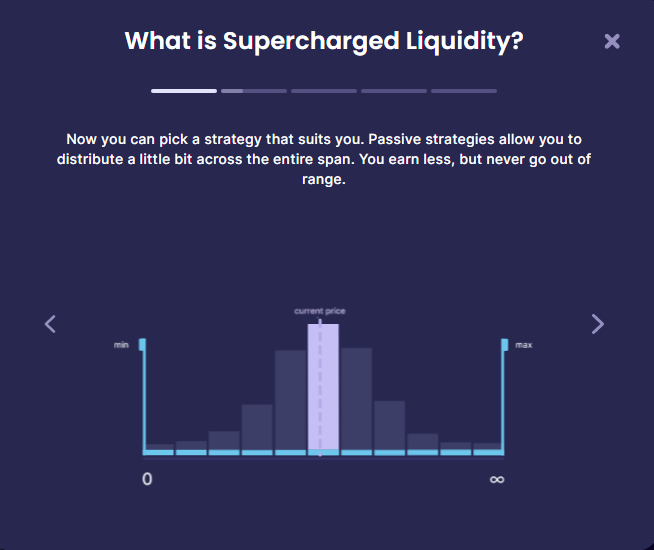

It basically revolutionizes the concept of decentralized market making. If you look at the traditional decentralized finance, liquidity providers (LPs) were often compelled to adopt a simplistic strategy that forced them to provide liquidity in infinite ranges. But now here with Supercharged liquidity it allows LPs to choose their preferred price range rather than sticking to the traditional full range (0 to infinity). This introduces an unprecedented level of capital efficiency i.e. to more return and practically estimated at a 100 to 300x increase.

The impact can be summed up by the increased efficiency it brings to the Osmosis DEX - we need 100x less liquidity to accommodate the same volume.

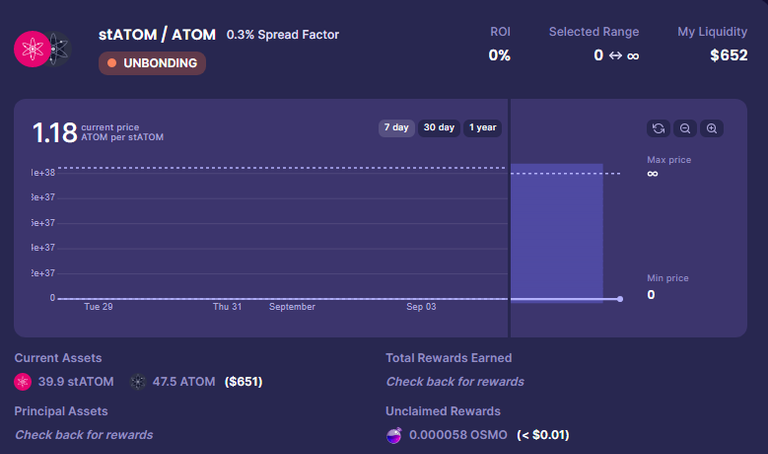

For now I have unbounded my my LP in stATOM/ATOM pool; it would take 14 days of the liquidity to arrive and then only I could move to the Supercharged liquidity model. I definitely would want to try it out and see if I can make the maximum returns from this Next-Generation Liquidity. I missed this opportunity during the initial launch of Supercharged Liquidity, where there was a migration bonus of 5% to encourage users to transition to the new system. Anyways better late then never and I look forward to further enhance my stake in these pools. The best part that I like about Supercharged liquidity is that it allows users to take charge of the strategy that they would like to leverage from moderate to passive or aggressive as your risk appetite the users can select their strategy accordingly. You earn less, based on strategy you select; less risk aversive means less return and high risk means higher the returns/profits.

There is also a point to note here is that users who provide liquidity to the new pool will be eligible to receive internal OSMO incentives, but only users in the old pool will receive external incentives like stATOM and other tokens. So please do your research before you plan to move to the Supercharged liquidity pool #1136. The @STRIDE also stated in one of their tweets that within the next couple of months, the stATOM oracle price source will switch from the old pool to the new pool; therefore more rewards planned for the Supercharged liquidity pool in near future... cheers

Have Your Say on Supercharged liquidity

Did you notice #Supercharged liquidity on Osmosis change? Which mode did you selelct - Passive Vs Aggressive? Let me know your views in the comment box below...

#osmosis #atom #defi #blockchain #decentralization #dex #supercharged #liquidity #superchargedliquidity

Best Regards

ImageCourtesy: leofinance, peakd, procanva, coingecko

PS:- None of the above is a FINANCIAL Advice. Please DYOR; Do your own research. I've an interest in BlockChain & Cryptos and have been investing in many emerging projects..cheers

Congratulations @gungunkrishu! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited..

This post received an extra 12.47% vote for delegating HP / holding IUC tokens.

I believe it is Uniswap V3 that has introduced the concept of providing liquidity at a specific range. Generally, if you go out of your range, you are not receiving the reward.

Does this happen under Osmosis?