Introduction

The global market had grown to be so busy and interesting and as such to remain relevant in this community, an operator has to device good, efficient and effective ways to be a participant or be knocked out of the game and over the years we have seen so many fluctuations on the economy both from individual and institutional level in most cases thus comes as a result of the operators not understanding what I would in my own words call, "hints to success" let me dig deep into what I mean

Unreliable trade execution

Most crypto-traders are not able to handle voluminous transactions for instance it's recorded of numerous occasions of user being blocked out of transactions and at times this block may be for days due to technical difficulties, other traders just lack customer support andvthis is not in a bit a good one

Lack of adequate security measures

Good crypto-traders trade should have the understanding and equally be poses the awareness of the security risk associated with purchasing and trading with digital asset that includeSwipe left or right to deletes hacks and so on and record has shown that the industry has lost over 4 billion USD equivalent since 2011

Reporting and compliance

Dye to the instability in economy a success conscious trader should be one who kept track of various investments, transaction in short developing it own reference list in order to determine it current transaction rates but in other way some make errors while manually computing this records, this includes :a record of returns, currency exchange rate etc. This I a work that requires a lot dedication and efficiency up to minute monitor in order to address short comings and also build up a strong economic stand in the crypto currency ecosystem.

What if I proposed that there is a solution to this misconception, yes there is andvthe solution is Caspian ,

Caspian is a bombardment of many financial tools that allows users to had a concised interaction with the crypto-space Caspian is an ecosystem designed to solve the problems facing crypto investors using a single ,user-friendly interface.It achieves this by providing sophisticated connectivity and inter-operability across various digital asset exchanges.

Caspian Website plans to strategies other pre-trade transactions cost analysis as a way to improve the way people interact with their cryptocurrency;

reconciliation

Remanagement

allocation management

Caspian position and risk management;

Seeing that one of the problems crypto traders have not been able to deal with the problem of being able to maintain a steady growth but hear seeing this problem, Caspian take it on them to offer crypto-traders the compiled and concised historical records

Using the PMS and RMS technology allow the user to maintain their positions, using this, the trader are now able to make review on their Historical record and master the operation this ensuring against future risk of any form

A major part of running investor money is to be able to analyze the trading and exposure of your position and to successfully do that you run accurate reports and be consistent

Caspian has in stall freshly prepared compliance features which allows that users can set various rules and limits into their transaction strategies these Compliance are of three limit types:

Warning Limit

The warning limits suggests that a rule is about to be broken.

Approval Limit

The approval limit suggest for a supervisor such as a password to assess records override .

Absolute Limit

The absolute limit is a limit that cannot be overridden by any means.

- For more information on reporting and compliance

[compliance engine ](The compliance engine is based on Tora’s proprietary technology, which offers extremely low latency and extensive functionality ,as well as a robust framework that allows Caspianto implement newlimits and compliance rules quickly and efficiently.The compliance engine provides multiple levelsof functionality to address user defined limits and rules covering both pre-tradeand post-trade workflows. ●Pre-trade limits, which include simple limits as well as more complex portfolio or, trading parameters such as exposure limits.These limits can delay order execution untilcompliance checks are complete.They can be triggered at various stages of a trade, including staging, sending,or amending an order.There arethree 12 levels to the limits: warning limits, which can be overridden by the user; approval limits,which require a supervis or to approve the order before it can be sent to market; and absolute limits, which cannot be overridden. ●Post-trade=compliance includes alerts, monitoring ,and reporting.Alerts and reports can be delivered to users via email or other mechanisms ,either on a schedule or as they occur.Souced directly from Caspian white paper)

[Report engine]( From day one, Caspian will feature robust reporting capabilities, consisting of simple “flatfile” reports such as tradefiles, snap shot reports, position data, audit reports, and compliance reports. These options offer flexibility in preparing graphical reports and other external-facing materials. As part of our roadmap,we are also working on a solution that incorporates Tora’s proprietary reporting engine to allow users to design report templates including graphs, editable tables,and filtering.Users can then schedule and receive graphical reports directly in PDF ,in Excel format, orin.Souced directly from Caspian white paper )

[Online dash board]( Once Caspian integrates the Tora Reporting engine ,it will beable to harness a number of associated dashboarding functionalities.In particular,it will enable customizable web dashboards, enabling users to: ●Viewweb-based visualizations on an ad-hocbasis ,including exposure breakdown graphs,marginreports,and order fill status. ●Amend visualization in realtime by adding formula column stotables or changing chart types. ●Save their amended visualizations as both a new report that can be scheduled and sent as a file ,and as a new dashboard that can be viewed online.Souced directly from Caspian white paper)

[Importation of data]( Caspian’svarious modules import the data provided by each exchange via its protocols and APIs, focusing the information into a single portal which users can use as a“one-stopshop.” This includes execution data, instrument information and instrumentprices(both real-timeandmark-to-market=, marginand account information, and volumes and liquidity information Souced directly from Caspian white paper )

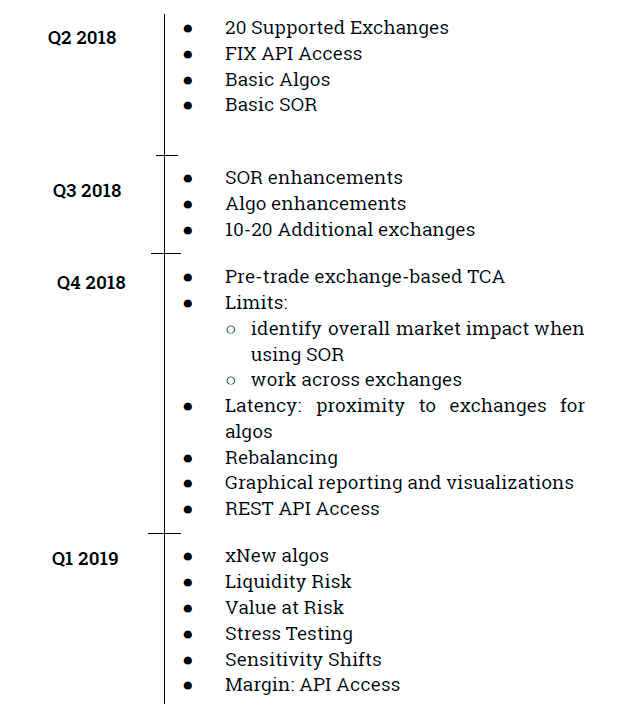

Roadmap

Source Caspian whitepaper

Source Caspian whitepaper

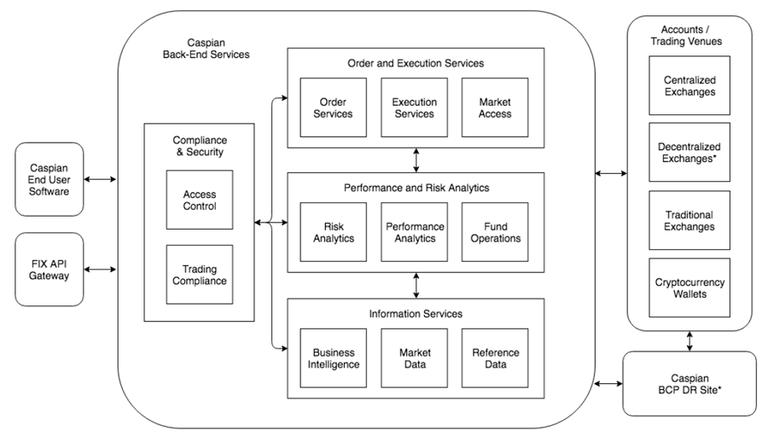

Summarised technology

Sourced from Caspian whitepaper

Watch this video for visual info https://m.youtube.com/watch?v=7euk5Mfccm0

for reference and more information >>>

- Caspian Website

- Caspian WhitePaper

- Caspian Steemit

- Caspian YouTube

- Caspian Telegram

- Caspian Videos

- Caspian Blog

- Caspian Events

- Caspian News

- Caspian Linkedin

- Caspian Management

This is my submission for @originalworks sponsored writing contest for participation and sponsoreship follow the link below >>>>>>>https://steemit.com/crypto/@originalworks/910-steem-sponsored-writing-contest-caspian

Caspian2018