Introduction

Since the launch of Bitcoin in 2009, over 4,000 altcoins (alternative coins) have been created, although as of May 2018, only 1,800 cryptocurrency specifications existed. More than 200 exchanges currently exists, with an average volume of over 18 billion US dollars being traded daily.

Therefore, it is appropriate to say that digital assets are experiencing a rapid growth rate when compared to the initial numbers it experienced at its inception, this is why experts believe that by 2033 the total estimated market cap for blockchain may exceed 10 trillion US dollars – that for sure is a whooping sum! Although, the current estimated market cap is over 325 billion US dollars—that is no small amount too..

The Challenges in Crypto Market

Due to the various complexities for the digital asset space, fragmentation of tokens and exchanges is one of its reoccurring feature.

- Fragmentation of exchanges and the low trading volume when compared to traditional market leads to liquidity and slippage problems. This further leads to high trading cost for traders.

- In addition, Crypto exchanges are not buoyant enough to accommodate large order volumes, this leads to delays in the execution of trading strategies, and a delay in the cryto market could potentially lead to losses.

- There are no rebalancing tools available for utilisation, in order to maintain a certain allocation target or monitor capital deployment for a single portfolio in multiple exchanges.

- Existing exchanges lack the adequate customer support system and risk management capabilities offered by traditional market trading platforms, and this is imperial to market participants.

- Fragmentation in exchanges also creates complications in compliance procedures. This have resulted in significant risk of errors as various market participants lean on varying individual solutions such as Excel spreadsheets, python scripts, multiple web interfaces and others which is unable to track their positions efficiently.

- Current exchange fragmentation make it difficult for institutional entities to keep and provide detailed audit records for internal use, to external users and for regulatory purposes.

- It is also impossible for investors in institutional entities to monitor all digital investments in a consolidated system.

Clearly stated above is a list of challenges that plagues the cryto space, hence, there is a need to develop tools that would tackle these problems.

What is Caspian?

Caspian is a joint venture between two firms (Tora and Kenetic) with successful track records and professional experience in asset investment and management. One of these firms (Tora) have clients in Asia, Australia, Europe and North America, with a monthly volume of notional equity averaging over 100 billion US dollars in an OEMS.

How Caspian Provides a Solution

Caspian is a suit of tools, built to support digital asset instruments and adequately equip users with sophisticated Portfolio, Order Execution and Risk Management Systems, with exceptional reporting capabilities, to provide compliance, reliability, liquidity, volume, and dynamism.

The benefits of Caspian can be categorized into three aspects:

- Execution

- Position and Risk Management

- Compliance and Reporting

Execution

In this category Order Execution Management System (OEMS), Smart Order Router (SOR), Algorithms, User-build Strategies and Alerts are the available packages.

Position and Risk Management

This category offers the PMS, RMS, Reconciliation, Rebalancing, Allocation and Engine.

Compliance and Reporting

Compliance Engine, Reporting Engine, Importation of Data and Online Dashboards are the features of this category.

The Impact and Advantage of Having Access to all Portfolios in one Place

Having an access to all portfolios in one place would make less burdensome to track or monitor all digital investments in a consolidated system.

It also makes provides an investor with detailed historical data and auditing of records at any time, for internal use, to external users and for regulatory purposes. Therefore, with the help of Caspian users can maintain a complete book of records for any trading entity.

When compared to other method of maintaining a compliance procedure, Caspian exhibits a zero significant risk of errors, hence, it is able to proficiently users positions.

Caspian helps maintain a certain allocation target or monitor capital deployment for a single portfolio in multiple exchanges.

Benefit of Setting Limits and Alerts?

Setting limits and receiving alerts are an essential ingredients in successful platforms. Caspian is designed with a built-in mechanism that gives users access to configure alerts, these alerts appears in a pop-up window or can be sent as a mail. Users have the freedom to determine under what circumstances such alerts will be triggered. The benefits include;

- Being able to set a rule that should not be broken. A warning will pop up when this rule is about to be broken.

- A user can decide to cancel a compliance alert. This requires a supervisor to insert a password to complete the action.

- A maximum or absolute limit can be set. This type of limit cannot be exceeded and any infraction is recorded.

- Conclusively, being able to set limits and receive alerts serve as a protection to users.

Effect of Caspian On Adoption of Crytocurrency

Some of numerous barriers hindering most individuals and institutions from getting integrated into the blockchain world are as a result of unreliable trade execution, lack of security, lack of compliance and reporting of digital assets. Caspian comes to the rescue in these regards. Some of the effects of Caspian on the adoption of crytocurrency can be found below;

For Individuals

Caspian possesses a skilled and experienced support team that provide a level of support that is unparalleled in the Crypto space, are swift in response. Crypto trading, investing and managing becomes way easier than before with the help of Caspian. These and many more are the benefits enjoy by individuals utilising the Caspian platform.

For Institutions

Caspian can help institutions track and keep well informed records for internal use, to external users and for regulatory purposes. Significant risk of errors are also reduced with the use of Caspian, to track their positions efficiently.

Institutions can maintain a certain allocation target or monitor capital deployment for a single portfolio in multiple exchanges, as this is one of the features Caspian provides.

Institutions can rely on the adequate customer support system provided by Caspian.

Conclusion

In simple terms, Caspian is a single, user-friendly interface, designed to adequately assist digital market participants to track their positions efficiently. Hence, surmounting numerous challenges in the Crytocurrency market.

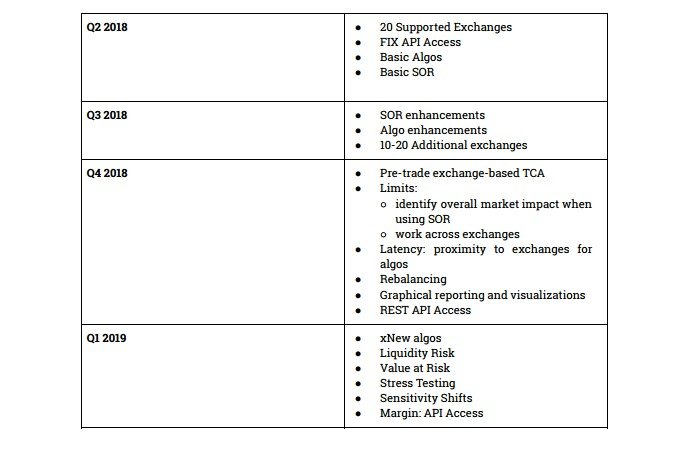

Technical Summary and Video

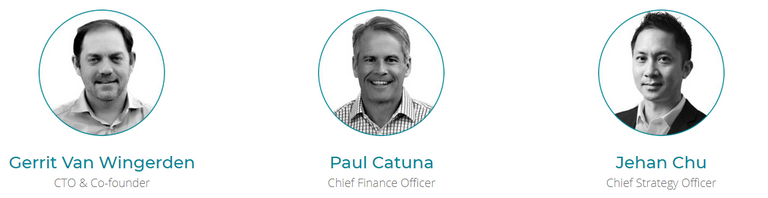

The Team

For any project to be successful, there is a need for an experienced group of intellectuals. Below is a team of individuals with professional experience in asset management and Crypto investment.

Advisors

Strategic Partners

Powered By

For More Information Visit

- Caspian LinkedIn

- Caspian News

- Caspian Events

- Caspian Blog

- Caspian Website

- Caspian Steemit

- Caspian YouTube

- Caspian Whitepaper

- Caspian Videos

- Caspian Management

caspiantwitter

Here is a link to my tweet on Twitter.

here to participate.

This is my entry for the @originalworks contest. Click

caspian2018

Sponsored Writing Contest!

This post has been submitted for the @OriginalWorks You can also follow @contestbot to be notified of future contests!

Hello! Thanks for your honest comments in the Partiko review post!

Posted using Partiko Messaging