ICO Basics, To Invest or Not? Cutting Through The Bullshit. There are many terms associated with the cryptocurrency world that has become, more or less, very mainstream over the last 4-5 years. Everyone has an idea about what a “blockchain” is and people definitely know what a “bitcoin” is.

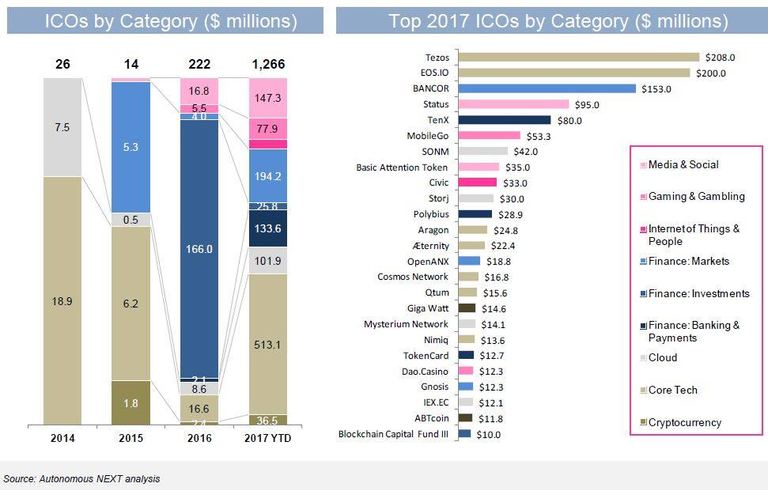

Lately, however, one term has been gaining more and more mainstream attention. That term is “ICO” or Initial Coin Offerings and has raised OVER $1.3 Billion for blockchain based start ups. It has been called everything from “revolutionary” to “a Ponzi scheme. Before we get into the meat of this, we need to understand everything that surrounds this astounding phenomenon.

The origins of ICO

In the real world, companies can always secure funds by approaching angel investors and venture capitalists but by doing that, they would have to give away a share of their equity to them. What companies wanted, was to get a lot of funds without giving away equity and ownership. The only way that they could do that was by going public.

The way companies do this is by holding an IPO aka Initial Public Offering. How does an IPO work?

In an IPO a private company basically decides to put up its private shares up for sale to the general public. Anyone anywhere can buy the shares of the company. Initially, these shares are dirt cheap and if the company hits it big then there is a chance of your shares ballooning up to exorbitant prices. We have all heard stories of the masseuse who became a multi-millionaire after her 500 “useless” stocks in Google matured over time.

So, people started wondering what would happen if we used the same concept and put it on a blockchain based environment. This is what gave birth to the concept of ICOs. ICOs are pretty similar to IPOs but with 3 major differences.

Firstly, the ICO was decentralized with no central authority, secondly, the ICOs lacked the tedious red tape that most IPOs were bogged down by and finally, they were unregulated while IPOs have always under been heavy regulation. Now there was a problem that blockchain based companies were facing when it came to ICOs. In an IPO, the investors got shares in return of their investment. What would a blockchain based company give away in exchange of capital? They had to invent the blockchain equivalent of a share and that was when they came up with the idea of “Tokens”.

What is a Token?

An ICO is a sort of mixture of an IPO and a crowd-sale. When you are interested in a particular project in the blockchain, the way you can gain access to it is by sending the developing team some amount of money, which is usually paid in Bitcoin or Ethereum and getting the equivalent amount of tokens in return.

Tokens have gained even more prominence since the advent of Ethereum. Ethereum provides a platform where you can use the blockchain technology not just for making currency, but to make decentralized applications (DAPPS) as well. If you want to use these DAPPS then you will need the tokens that are native to its respective environment. There are two categories that all tokens fall under:

Usage Tokens.

Work Tokens.

Usage Tokens: These are tokens that act as native currency in their particular environment and can be exchanged for other tokens or FIAT money. Ether is a great example of a usage token. In short, usage token is a currency.

Work Token: Not all tokens, however, act as currency. Some tokens are there to give you various rights within their native environment. Eg. If you were a DAO token holder, then you had the right to vote on whether a particular DAPP could get funding from the DAO or not.

How do you make a token?

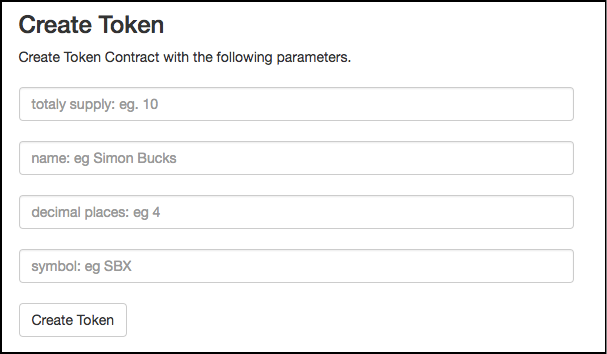

Making a token is deceptively simple. By far the easiest method is to go on Token Factory and fill up the following fields:

Firstly, you will have to determine the total supply. You don’t want a humongous amount of tokens available, that will kill their value.

Then you have the name field. Give your tokens any name you want. Make it sounds professional though if you want a good and profitable ICO.

Determine how many decimals places the value of your tokens will go to.

And finally, decide on a symbol for your token! It is that simple.

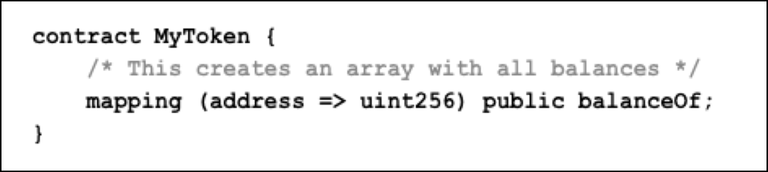

Now., if you are one of those DIY types who would prefer coding their tokens then that is a possibility as well. If you are making a DAPP in Ethereum you can simply use the solidity code to create your own token contract. This is what a simple token contract looks like:

The block of code is divided into 3 parts:

The Mapping.

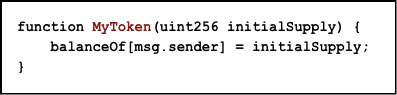

Giving the creator all the tokens.

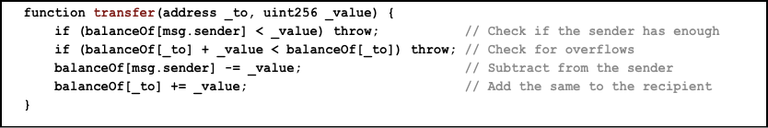

Transfer the sender the requisite amount of tokens for the ether.

Now we will go into the code and understand what is exactly happening and how it is working. It may appear complicated on the surface but once you go deep into it, you will see how simple and easy to understand it is.

The Mapping:

thereum, like all cryptocurrency, is an open ledger. So it makes sense that all token made on an Ethereum contract will be registered on an open database clear for everyone to see. The mapping function makes sure of that.

thereum, like all cryptocurrency, is an open ledger. So it makes sense that all token made on an Ethereum contract will be registered on an open database clear for everyone to see. The mapping function makes sure of that.

The creator getting all the tokens:

When all the tokens are created, the entire supply goes to the contract creator who can then send the tokens to anyone who funds the project with ETH.

The Transfer:

The last part of the code is the transfer.

he requisite amount of tokens. The same number of tokens will cut from your balance and it will be added to the sender’s balance.

As you may have already guessed, there are thousands of tokens out there, and while that’s a good thing, there is also a major flaw that needed to be addressed. Think about this, if everyone designed their own tokens giving it their own unique twist, it will be an absolute horror show to save them in a wallet. Many times you will have to follow elaborate and needlessly complicated steps just to store your tokens in a wallet. That would have been a nightmare. What was needed was a standard or a basic blueprint for all tokens to follow. Fabian Vogelstellar, one of the founders of the Mist Wallet came up with the solution with his ERC20 token standards.

What is the ERC20 Token Standard?

The ERC20 standards have been put in place so that all Ethereum tokens follow a particular rule and standard. While this is not an enforced rule, most DAPP developers are encouraged to follow the standards to ensure that their tokens can undergo interactions with various wallets, exchanges and smart contracts without any issues.

These standards also helped others gain an idea of how future tokens are expected to behave. ERC20 tokens have gotten widespread approval and most of the DAPPS sold on ICO’s have tokens based on the ERC20 standard. So what are these standards?

They are basically a set of 6 functions which, when executed, do the following 4 activities:

Get the total token supply.

Get the account balance.

Transfer the token from one account to another.

Approve the use of the token as a monetary asset.

How does an ICO work?

So now that you have gotten a crash course on what tokens are and how they work, let’s do a deep dive on ICOs and why, for better or for worse, people are calling it the new “Gold Rush”. A number of millionaires that ICOs have made in the last year or so is staggering. Check out this graph:

Check out this graph:

Over the past 12 months, have raised over $600 million as opposed to $140.30 million by established Venture Capitals. That is mind-boggling! So what is it about ICOs that has attracted so many investors? ICO is the rockstar of the investment world, it is the untamed wild genius wearing a torn t-shirt and baggy jeans, living among a group of suit-wearing snooty businessmen. There is something extremely seductive about the concept.

Think about this, anyone, with an idea for a project, can gain massive financial backing from a community without being bogged down by politics or endless red tape. The idea that anyone anywhere can get the financial backing they need in an unregulated manner was a welcome idea for all. No longer will investments be reserved just for the uber-rich, anyone can gain the funds to make their dreams a reality.

The exact procedure behind an ICO can be broken down into the following steps.

Firstly, the developers will announce their intention of making the project to generate hype and interest in the project. This step is very important because first impressions are everything.

Then, the developers will create a white paper. A white paper is a document issued by the developers which highlight their project and the specific features of that project that makes it enticing for the potential investors. While it is true that white papers are supposed to be a sales and marketing tool, it is nowhere near as flashy and over-the-top as a brochure or a sales letter. Whitepapers are written in an academic manner and the specific purpose is to entice the investors by showing its potential and features. They are at least 2500 words long and are meant to be purely informational.

After that, they will run the white paper through prominent members in the blockchain community to get their backing. Getting this backing is critical because this is where they will gain the credibility required to carry forward with the project.

Now, they will need to create the tokens which they are going to exchange for Bitcoin or ETH in the token sale. The process of token creation has already been covered above. Developers will have to decide the limit to the number of tokens and the amount that they want to charge for each token. Usually, the price of these tokens is very low at the start of the ICO. Setting a cap on the number of tokens is necessary because having a limited supply of tokens automatically increases their demand (according to the law of supply and demand).

Along with the cap on the number of tokens issued, developers will have to decide a time at which they want to hold their ICO. Selecting the time, and the amount of time it runs for is CRITICAL and this will be covered in detail later on. Along with that they also need to decide on the cap for the amount of money they will be taking in.

Once all these are decided, the developers choose a platform where they can advertise their ICO. Earlier it used to be tough to do so because developers had to convince people to come to their websites to gain more information about the ICO. But now, there are a number of websites which provide the platform for developers to address this particular need. Some of the best ones are:

Waves.

ICONOMI.

State of DAPPS (for Ethereum Tokens only).

TokenMarket.

Think of these websites as Kickstarter or Indiegogo of the crypto world. Once the ICO has been advertised the developers can then actually do the ICO.

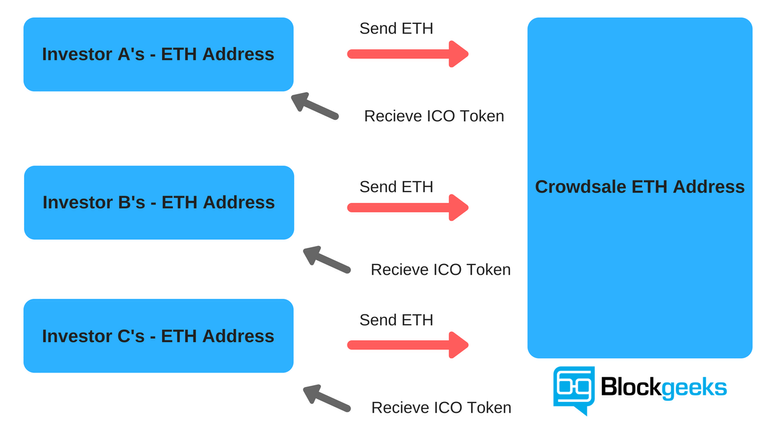

For a visual representation of how an ICO works:

Investors send the coins to the public address of the developers and in exchange, they get tokens in return.

So to summarize:

Firstly, the developers declare their intention of making the project.

Then, the project developers create a white paper which includes the details of their project explained in a descriptive way.

They get the backing and confidence from certain prominent members in the cryptocurrency world who act as “advisors”.

They then create the tokens and decide on various caps such as a token cap, money cap, and time cap.

Advertise the ICO using one of the platforms mentioned above.

Hold the ICO.

In the broad spectrum of things there are two different kinds of ICOs:

Currency ICO.

Project ICO

Currency ICO

A currency ICO is when developers bring in a new currency system. The developers give out tokens which become new cryptocurrencies in exchange of the older more established coins such as Bitcoin and Ethereum. The reason why people are drawn to these ICOs are that of investment opportunities. One of the best examples of these kinds of ICOs is the Ethereum ICO.

In later 2013, a young programmer named Vitalik Buterin was working for Bitcoin as a developer and was getting increasingly frustrated. He realized that the blockchain technology had more potential than being a mere currency system. His vision was to make an alternate form of the internet. This vision was Ethereum, a platform where people not only will have access to a new form of currency (Ether) but they will also be able to create and develop a newer form of DAPPS on the platform itself.

The Ethereum ICO lasted for 42 days and went on from July-August 2014 and raised >$18 million. Back then it was the biggest crowdfunding even in human history. The early birds got a humongous ROI. In the beginning, if you invested just 1 BTC you would get 2000 ether in return. The current valuation of those 2000 ether is ~$420,000. Not bad for a $2500 investment! But more than the ROI the biggest thing that makes this particular ICO so important in crypto history is the concept of the project itself.

If you want an advertisement for why ICOs are so important, just read up on the Ethereum ICO. This was one man with a vision who got a dedicated and talented team around him, got the white paper out, convinced people to invest in his project and then ultimately made one of the most important platforms in crypto history. This is what ICOs should be like.

Project ICO

Along with the currency ICO we have the project ICOs which issue “work tokens”. When you buy these tokens in the crowd sale you gain certain rights and votes inside the environment of the DAPP itself. One of the most famous, and consequently, infamous examples of this kind of ICO is the DAO.

The DAO aka the decentralized autonomous organization was a decentralized venture capital fund which was going to be used to fund future projects made in the Ethereum eco-system. This how it was supposed to work. People invest money in the DAO by giving ether and they get “DAO Tokens” in return. These DAO tokens made the holders part of the DAO community. So, suppose Jill wanted a project to be funded by the DAO, she would introduce the project to the DAO community. The token holders will then hold a vote and if Jill gets the majority vote then she would gain the required funding from the DAO itself.

This was a revolutionary idea and was getting mainstream press exposure as well. The ICO went down in history as one of the biggest ever. The ICO raised $150 million in ether, that was the 14% of the total ether issued at that time and everything was looking up. Unfortunately, that is when the infamous DAO Attack happened and a total of $50 million worth of ether was taken away. This attack had huge repercussions because this was what caused the Ethereum hardfork and resulted in two different Ethereums: Ethereum and Ethereum Classic.

Another great example of the “Project ICO” is Augur, a decentralized market prediction system.

ICOs nowadays are raising a ridiculous amount of money, the Brave ICO, an Ethereum based browser raised in $35 million in 30 seconds. That’s ~$1.2 million per second!! The Tezos ICO recently became one of the largest ICOs of all time by raising more than $200 million. SO the question that you are probably thinking of right now is,

“How do you make sure that the funds that you are investing is going to be used properly by the developers?” What if they just run away with it? Let’s answer that question.

What steps should be taken to ensure the safety of the funds aka how to not get scammed?

Unfortunately, because of the unregulated nature of the ICOs and the sheer amount of money to be made in this space, it does attract a lot of scammers. If you are investing in an ICO then you would want some assurances on your end that all the funds that you are going to invest are going to be used in a right way. So what should you be looking into when you are about to invest to make sure that you are not going to get scammed?

The project developers should be able to clearly define the purpose of their project using simple and short sentences. If they are taking too much time and beating around the bush, then that either means: their agenda is not clear or they are hiding something. Both of which are not that encouraging scenarios.

Make sure that the developers are not anonymous. There should be 100% transparency when it comes to their names, business plans, locations etc. You should be able to contact them regarding any and all information that you need to get from them.

There should be a legal framework between the developers and the contributors including terms and conditions set for the ICO.

Lastly, and most importantly, you need to make sure that the ICO funds are being stored in an escrow wallet. An escrow wallet is basically a multi-sig wallet which needs multiple keys to be opened. One of those keys must be held by a neutral third party.

If you keep these 4 points in mind, then you will be able to spot the scammers with relative ease and invest in projects which have real potential.

So are we in an ICO bubble right now and is it going to pop?

With the sheer amount of money going into ICOs nowadays and everyone and their mothers wanting a piece of that ICO pie, there are legit fears going around of ICO being a bubble much like the dot com bubble and the real estate bubble. To understand how a bubble works, let’s look at one of the most famous examples of the bubble, the dot-com bubble which went from 1997-2002.

Around 1997, the internet became big and tech companies began to emerge everywhere. Investors started putting in their money and flipping their investments into huge sums. Eventually, everyone who saw this started getting major FOMO (fear of missing out) and they began giving away their money to companies without even having any idea as to whether the business had the potential to work or not. Common sense went out of the window and every random internet business was making a killing in the IPOs. Warren Buffet noted that:

“The fact is that a bubble market has allowed the creation of bubble companies, entities designed more with an eye to making money off investors rather than for them. Too often, an IPO, not profits, was the primary goal of a company’s promoters.”.

BOOM! He hit the nail right on the head, most of the companies that got millions from their investors failed and some turned out to be nothing more than scams. Eventually, the bubble burst in 2002.

Companies crashed and lost millions within a year. One of the most infamous examples of this is Pets.Com which lost $300 million in just 268 days! However, while 1 in 2 companies got shut down, the companies that did survive, hung on and changed the way we live today. One of the best examples of that is Amazon. Before the bubble burst, Amazon stocks were at $100/share. After the burst, it went down to $7/share but eventually, it went up to $600/share.

The parallels between the ICO bubble and the dot-com bubble are a bit frightening and as they say “if you don’t learn from history, it is going to repeat itself.” Much like dot-coms, the ICOs have attracted a lot of investors who don’t want to miss out on the gold rush. Much like the dot-coms ALL the investing is done purely from speculation. You have to realize that most of the companies that you are investing in, in ICOs barely have anything ready. Most of them don’t have the alpha version of their end result, it is all based on speculation and the potential of the project.

As with anything, most of these projects will fail to get the end results. The reason why the Ethereum ICO worked so wonderfully was that it had a dedicated and driven team of talented developers who were a day in and day out to make it a success, same with Golem. Another problem plaguing the ICO is the greed of the developers. Some developers are making projects ONLY so that it can look enticing enough for a good ICO. They have no interest in carrying through nor do they have any inclination of turning a profit for their investors.

The parallels are very apparent and it can get real scary thinking about it. But we are not market experts. All we can do is speculate. We don’t know whether we are living in the “ICO bubble” or not, nor do we know whether it is a bubble that is going to pop. What we can tell you to do is to be smart with your money. Don’t get enticed by shiny objects, and have basic common sense. Read the points we have given above to know whether an ICO is a scam or not.

So if I am a developer how should I approach ICOs?

If you are a developer, then first and foremost have a very clear idea and agenda as to what your project is and what do you want to do with it. You must state the purpose of your project and the future that you envision with it. You must also choose the platform that you want to advertise your ICO in (waves, iconomi etc.) and then you must design your tokens.

After you are done creating your white paper and running it through the advisors and getting legal backing, the most important thing that you need to do is to pick a good time and date. Nothing kills an ICO faster than not getting the timing right. So when selecting the time of the ICO to keep the following points in mind:

Do not choose holiday weeks or weeks when important people take off: You need as much hype as possible and the best investors for your ICO. Do not hold your ICO during spring break when most people, including reporters, take off. Similarly, if there is an important event around the week then it’s best to not have your ICO during that time. As Margaux Avedisian says, if your main investors are going to be in The Burning Man, then it is best to not have your ICO during that week,

Day of the week: You must notify the working patterns of your target investors and see which day best suits them. It is best to not choose a weekend for your ICO.

Time Cap: While there are some ICOs that meet their target in 10 mins or even 35 seconds, those are the rarest of the rare scenarios. Even the Ethereum ICO took 42 days, even though that was before ICOs became so popular. So you have to decide on the time cap and the amount of time that you are willing to run your ICO for.

Time Zone: If your target investors are Americans and then it makes little to no sense to have your ICO during midnight EST. Decide where you want your target investors to be from and decide on a time that will be convenient for them.

We cannot overstate the importance of time for your ICOs, the initial period is critical because that will determine how well your ICO will go. If you are a developer, then you will need to decide on the time after doing quite a bit of research. It is worth it in the end.

What are the Pros and Cons of ICOs?

Pros of ICO

Gives opportunities to promising projects: Think of what Ethereum has accomplished in the last year. From becoming the second most powerful cryptocurrency in the world to providing a platform for DAPP creators to create their projects. It is truly becoming the “platform where the future will be built”. All this got started because of an ICO.

Doesn’t require unnecessary paperwork: Many projects don’t get executed because they get caught up in the red tape. For raising funds through IPOs or crowdfunding the project developers need to go through a lot of paperwork and more often than not, they just don’t get the documentation required to collect funds for their project. On the other hand, all that you need to do take part in an ICO is create a “white paper” (The white paper contains all the details of your project.) After that, anyone can read the white paper and choose to invest in the project if it interests them.

Community building: It gives the project creators an opportunity to build a community around their projects. Having a healthy community gives a product immense credibility. Plus, the members of the community can have real say in the direction of the projects and keep the creators accountable.

Exposure for projects: The hype that surrounds an ICO can do wonders for the exposure of the project. The more the exposure, the more the people will know about the project. This increases the number of potential investors.

Early access to potentially valuable tokens: Some tokens have the potential of becoming truly valuable cryptocurrencies. ICOs give investors an opportunity to invest in tokens, with potential, for dirt cheap. Eg. During the Ethereum presale, 1 Ether cost 35-40 cents. Right now, as of writing, 1 Ether costs ~$277.

The incentive for innovation: The roaring success of various ICOs over the last 12 months has given extra incentive to various developers to innovate and develop more exciting projects.

Cons of ICO

Attracts a lot of scammers: Because there is so little paperwork involved in ICOs it attracts many scammers who can simply create a bogus white paper and make off with a lot of money. Some developers also purposefully omit certain important details from their white paper to make their projects look more appealing than they actually are. The biggest consequence of all these scams is the decreased faith of the public in blockchain technology which can potentially spell absolute disaster.

Based on pure speculation: When you are investing in a project in an ICO you are investing in the idea of the project. You read the white paper and if you think that the team is credible and the project has promise than you invest. So, basically, you have no idea whether the project will even be successful or not. Over 90% of the startups fail and blockchain projects are not immune to that as well. Plus, the developers may get lazy and not even bother to finish what they have started. And, let’s not forget, there is always the possibility of a project getting ruined because of hacks and attacks. The DAO is a perfect example of that.

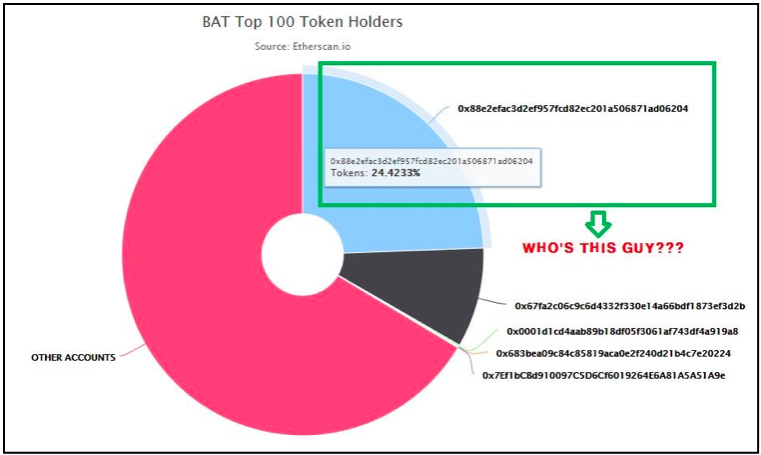

Whaling: Let’s take the example of what happened in the, now infamous, BAT ICO. The ICO got over in just 24 seconds and they were able to raise 35 million USD! The shocking part was, not a lot of people were able to take part in the ICO at all as major chunks of the tokens were bought by certain individuals. In fact, a quarter of the BAT tokens are owned by one person!

These people are called whales. Basically, people who have a lot of money and resources and they rig the ICO game in their favour. The way they do it is by paying extremely high mining fees which help them “cut in line” and get first preference during ICOs. In the case of the BAT ICO, whales paid as much as $2220 in transaction fees to make sure that they take the first bite of the pie. Afterward, they mostly sell these tokens at a premium to turn in a profit.

Network Congestion: The increased amount of activity during ICOs causes a huge strain in the blockchain and may result in a bottleneck. During the Status ICO, when they raised a $100 million, there was so much backlog in the network that many people, who wanted to invest in Status, saw their transactions fail.

Storing the tokens: There is a chance that you will not be able to store some of the tokens in any of your crypto-wallets. You can store any tokens made in Ethereum in your ether wallet but tokens made outside of Ethereum can be very complicated to store.

Government intervention: This is where it gets scary. Because of the increased number of scams and a huge amount of unregulated money, various governments may simply decide to start regulating the ICOs. If this happens then this truly could be the death of cryptocurrency. The whole point of cryptocurrency is the idea of decentralization and being outside of government control.

Conclusion

ICOs are going to continue being a part of cryptocurrency and blockchains. We simply cannot overlook the good that they have done. From giving birth to innovative technologies like Ethereum and Golem to giving DAPP developers, around the world, an incentive to innovate and come up with newer and more exciting technologies, their contribution simply cannot be understated.

Having said that though, there is no doubt that ICOs can be a “necessary evil”. Human tendency is to exploit any loopholes for their selfish benefits and ICOs seem to be the tool of choice for many corrupt individuals. Looking forward, what we can all do is act more responsibly and do our own research. Study the white papers, interview the team involved with the specific projects that are up for ICOs and then invest your money.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://hashgrow.com/