OKCoin Quarterly futures are the highest volume instrument in Bitcoin. Its the e-mini of crypto and influences the entire market, so you have to learn how it works even if you don't use it.

These instruments have a few unique quirks and a small learning curve. If you've never traded futures before I recommend getting a lot of practice here before trying Bitmex.

What are Non-Linear Inverse Future Derivatives?

This is a specialized derivative pioneered by ICBIT in 2013, mainly to avoid fiat regulations by making it possible to trade BTC/USD without using any USD. You nerds can read the full paper here.

Derivatives are a broad class of financial tools that lets you bet on changes in the price of an asset without trading the actual asset.

Futures are a family of derivatives. Basically, you buy and sell contracts during the trading period similar to spot trading. Everyone's positions are closed against some calculation of the index price when the contract expires and the losers pay the winners.

Non-linear because your payoff is BTC and the price of BTC in USD is changing.

Inverse because you are using Bitcoin to bet on the contract's price in USD, as opposed to using USD to bet on the price of Bitcoin.

Why Trade Futures Instead of Spot?

Lower Fees: No interest payments since you're not borrowing money. This multiplies the money available for trading by freeing up potential lenders to trade, resulting in significantly higher volume. These factors all synergize to allow the exchange to offer much more competitive fees. For comparison, the typical entry-tier trading fee on most spot exchanges is 0.2% to either buy or sell -- 0.4% overall. But on OKCoin's high volume leveraged futures, the trading fee is a mere 0.03% to open and costs nothing to close.

Higher Liquidity: All that volume attracts big traders, who aren't necessarily interested in trading on leverage. Big traders tend to have issues with slippage -- their positions are so large it tends to move the market, penalizing their average entry price as they increase their position size. They face the same problem again when they exit. With futures, the entire position, no matter how large, can be closed against the index price on the settlement date; no slippage, no fees.

Getting Started with OKCoin Futures

Click on this OKCoin link to start the registration process.

Once you jump through the verification hoops, deposit some Bitcoins (or wire USD) to trade. Click Account → Deposit → BTC deposit, or just use this link if you get lost: https://www.okcoin.com/account/rechargeBtc.do?symbol=0

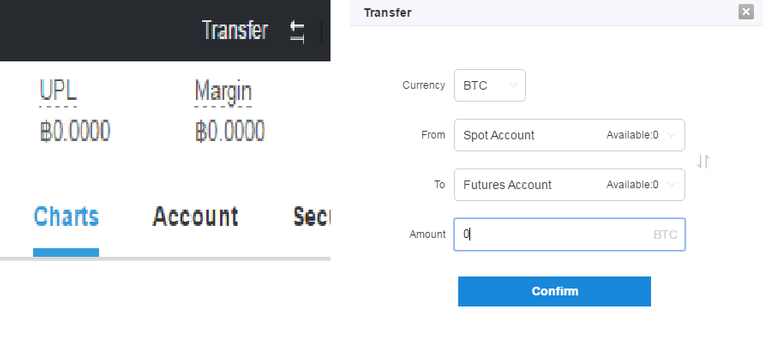

Next, you want to move Bitcoins (can't use USD) from your spot account to your futures account. Click the Transfer button on the top right of the page and transfer your trading budget.

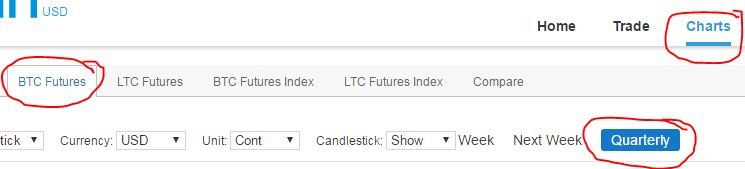

Click on Charts → BTC Futures → Quarterly. This page is your new home now, Quarterly contracts is the entire reason we're using OKCoin. Stay away from Next Week and LTC Futures to save yourself a lot of grief.

This is the complete command center for most traders; you have all the contract and index price data, you can place orders, do some charting, view the orderbook, etc. You can start trading immediately, but lets tweak some settings first. You can use the trade tab instead if you want to try using OKCoin's awful algo orders.

Tweaking the Settings

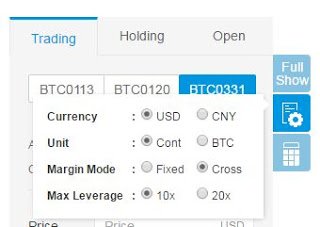

Click on the settings tab on the order form and pick these settings:

Currency and Units should be USD and Cont. Since each contract is worth 100$, its just common sense.

The Margin Mode and Max Leverage settings should be optimal for the vast majority of you guys. However, if you think you know better and want to tweak the settings:

Margin mode depends on your trading style.

Fixed: If you like to break your trades into small bullets, where getting margin called is the equivalent of a stop loss on your overall balance, choose fixed margin. You can only lose a fixed amount on that trade if you get margin called, the rest of your money in your futures wallet are separate. Fixed is an easy way to limit your risk (since the stop loss design on OKCoin is a total joke) and is a must for 20x positions. You can always manually add more margin to your position.

Cross: With cross margin, your entire futures balance is in play (meaning you could lose everything) letting you have a different effective leverage. Since all your positions share their profits and losses, you can do advanced trades like opening a long on weekly and an equivalent short on quarterly -- this allows you to profit if the quarterly premium over weekly narrows without being bull or bear. This is also the only valid reason why you should trade anything other than Quarterly.

I use cross margin because it allows me to have a lower effective leverage than 10x. If I want to have a position with 5x effective leverage, I can use half my available balance to buy 10x leverage contracts. Since the whole futures wallet is in play on cross margin, it factors the other half of my balance into giving me the margin call price of a 5x . Any money I don't want to expose to risk I leave in the spot account.

Max Leverage depends on if you have a gambling problem.

It's important to remember that OKCoin margin calls 10x positions when losses hit -90% and 20x positions at -80%. You forfeit the remaining 10%/20% as a donation to the clawback insurance fund. 20x penalizes you more heavily for liquidation.

10x : The ideal choice for 99% of aspiring traders reading this. Just choose this one. In fact, most people should use cross margin and drive that effective leverage down much lower, like 4x.

20x : Choose this one if you're a degenerate gambler or clairvoyant. Bitcoin tends to swing around 5% before pivoting in short term movements because there are dedicated teams of professional stop hunters whose sole purpose is to margin call swarms of these people for easy profits.

Basic Terms:

- Calculation Period: The 3 hour period before the weekly contract's expiry when the delivery price is calculating from a rolling average of the index price.

- Delivery: The end of the future contract's trading period. All positions are closed are against the index price and the market closes.

- Clawback Every time someone gets margin, called a small portion of that position is donated to the Clawback Insurance Fund If a delivery results in net losses the clawback insurance fund is used to cover it. If thats not enough, those losses are "socialized" i.e. spread among everyone who earned a net profit. A percentage of everyone's profit is "clawbacked" by the system to consolidate those losses.

- Index Price A volume weighted average of Bitcoin's price on major exchanges. Used in calculating the delivery price.

- Premium or Discount The contract trades at a premium when its above the index price and at a discount when its lower. Quarterly prices generally trades at a premium due to normal backwardation, the result of several factors including the phantom interest cost of holding a leverage position for that time.

- Contango or Backwardation Everyone confuses them with premium and discount, which deals with absolute price difference between spot and futures while Contango and Backwardation deals with the shape of the futures curve for all contracts. As delivery nears, the premium or discount narrows because there is more certainty about where the delivery price will be. Contracts that expire later should have larger premiums/discounts than contracts that expire sooner. This forms a futures curve. Backwardation is the futures premium falling to converge with spot on the curve and contago is the discount rising to converge.

- Margin Call/Liquidation/Ashdraked When a trade goes so badly against you that you lose the entire position and the system takes to prevent further losses.

- RPL or Realized Profits and Losses Profits or losses that have passed through the settlement period and can be taken out of the futures account.

- UPL or Unrealized Profits and Losses Profits or losses that can't be withdrawn from the futures account until settlement, but can still be used to trade.

- Woodchipper Slang for teams of professional marauders that try catalyze mass margin calls, typically aiming for people trading at 20x.

OkCoin's Market Mechanics FAQ's:

What are the mechanics of Okcoin's margin call/liquidation process?

- When the price of the contract passes your margin call price and a countertrade happens that fails to push it back to safety, the margin call triggered.

- For Bitcoin, 10x contracts are liquidated at a 90% loss and 20x at 80% (regardless of your effective leverage from cross margin). The position is closed and the trader forfeits the remainder of the position to the clawback fund.

- For Litecoin, 10x positions are liquidated at 80% loss and 20x at 60%, making it completely untradeable and you should never ever trade this scam product.

- Once liquidated, the position is taken over by the system, which will place a limit order at the liquidation price to close the position. These orders are bolded in the orderbook.

- Losses from liquidated orders that remain unfilled by delivery are socialized. First, the clawback insurance fund will be used to cover the losses. If that is not enough, everyone who earned profit that week will split a percentage of the loss.

- Socialized losses are pooled among net profitable investors across all contract types.

- Follow Whalecalls on twitter or check out the Liquidations List for filled and unfilled orders (given the adorable url name "blasting orders" by okcoin's translaters.)

How does delivery and settlement work?

Each contract's name is a code for it's delivery date. The format is [product][month][day], thus the instrument BTC0331 is a bitcoin future that expires on the 31st of May.

Every Friday at 8am UTC the weekly contract expires -- all gains and losses are applied and the market is closed. The other two contracts just have settlement -- gains and losses are applied but positions remain open. The next week's contract becomes the new weekly, and the new next week is either created or rolled over from the quarterly depending on the calendar.

Delivery price is calculated using a rolling price average of last 3 hours of the index price before expiration to discourage the manipulation strategy of "banging the close". This is when a manipulator with a large futures position pushes the spot/index price in their favor during the final calculation period. If you've been watching Okcoin, its clearly not an effective deterrent.

Settlement price is simply calculated from the last traded price when the weekly delivery is complete. Gains and losses are applied/realized and trading resumes as normal. I'm sure someone with deep pockets will figure out how exploit this very design one day.

Around 5-10 minutes after delivery, the new contract is added and trading begins.

What do the statistics in the BTC Futures Index tab mean?

- Price Index shows the constituents and weightings used to determine the price for delivery calculations.

- Open Futures Contracts are the only stats worth watching and show when big traders take positions or exit them.

- Top Trader Setiment Index is totally bullshit, all the stats are calculated according to arbitrary rules that OKCoin doesn't share. Generally misleading information.

Can you teach me some gimmicky tricks?

- If you have a huge (10k+) contract position on cross margin and the market is moving rapidly against you but there's not enough liquidity to close without margin calling yourself, you might still survive. Close as much as you safely can and transfer any available balance to spot before you get totally wiped out.

- During long periods of range-bound sideways, waiting to trade against bolded liquidation orders is generally a very high EV trade.

- OKCoin plugged an old trick to avoid clawbacks by having opposing positions in different contracts; clawbacks are now applied to anyone who is in net profit across all contracts.

Hey guys! Earn POS Mining rewards while trading at btcpop.co!

Great article, I was just looking at OKCoin yesterday, like the idea it is PoS. Any ideas on if it will stake from a raspberry pi or do I need a full system.

I am not much of a trader yet but it kind of sounds like OKCoin is similar to what I heard is trading options with puts and calls. Depending on wether price will go up or down by a future date.

You are thinking of Okcash, which is a cryptocurrency. Okcoin is a chinese exchange.

Puts and calls are options, you pay a fee for the right (but not the obligation) to buy or sell the products on expiration.

Futures are much more basic derivative, it simply trades around like a normal spot market and then shuts down and closes everyone out on delivery.

Cheers!

Ah yes was thinking about the OKCash.

Sounds very interesting, I will have to look at the OKCoin markets. Sounds like it could be beneficial to both large traders and smaller traders.