Dilute your Sunday leisure with keep-up on the major developments happening in the crypto world right, as presented to you by fee-free exchanges with one of the most competitive exchange rates in the market, VHCEx

SEC Chief confirms ETH and the like are not securities

Recently, Coincenter reports the latest confirmation from SEC Chief, Jay Clayton. The story starts few months ago when Coincenter worked with SEC representative, Ted Budd to send a letter to Jay to confirm his point of view on crypto. After a few months, Jay replied:

“I agree that the analysis of whether a digital asset is offered or sold as security is not static and does not strictly inhere to the instrument. A digital asset may be offered and sold initially as security because it meets the definition of an investment contract, but that designation may change over time if the digital asset later is offered and sold in such a way that it will no longer meet that definition.”

It’s good to see that Mr.Jay is considering to change the definition of digital assets. If the definition of digital assets is changed, this will open a new path for ICO.

CBOE will not add new BTC futures contract this month

In the latest announcement, CBOE has temporarily stopped providing new Bitcoin futures contracts to assessing their approach to digital assets. However, listed XBT futures contracts still available for trading.

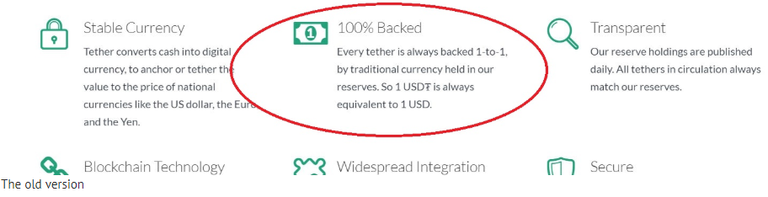

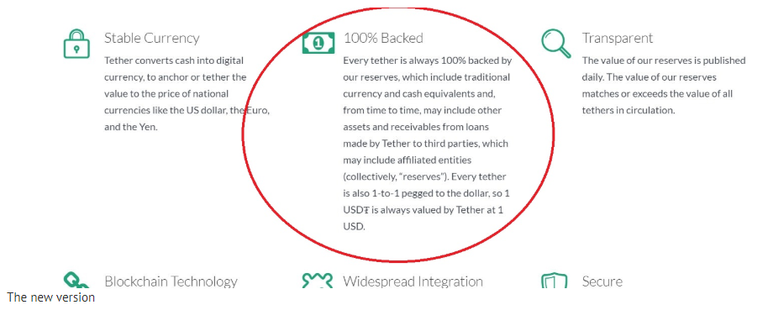

Tether silently changed its claim

A Reddit user has recently noticed the change about Tether claim. In the old time, Tether claimed that every USDT was backed by real US Dollar. However, that has changed. According to Tether website, USDT is no longer backed by US Dollar but currency, cash equivalents, and other assets.

On a side note, as we have mentioned several times, Tether reserve accounts cannot be audited. Therefore, it’s better for you to move to more regulated stablecoins such as TUSD, GUSD, and USDC.

LTC founder, Charlie Lee revealed Lisk’s partnership

A YouTube livestream with TokenPay CEO Derek Capo and Litecoin founder Charlie Lee has yielded some significant news for the Lisk project. At around 48:00 of the video, Capo revealed the partnership between Lisk and WEG Bank, a specialized credit institution providing banking products to the housing industry.

Thai SEC has approved the first ICO portal

On March 13rd, the local news, Bangkok Post reported the first approval of the Thai ICO portal. Through this portal, SEC can observe ICOs, conduct due diligence, verify KYC and check the smart contract source code. However, the director of Thai sec Fintech departments declined to disclose the name of the company.

The Central Bank of Russia wants to limit crypto funding for “unqualified investors"

According to the documents obtained by RBC, the Central Bank of Russia wants to equate investors limit on crowdfunding. The threshold is estimated to be approx. ~$9,100 per year. On a side note, the document considers those who have less than 1-year experience in investing will be considered as unqualified investors.

That’s it for today, folks.

Happy trading and stay safe,

VHCEx team!

I thought, major top crypto were approved for being non-security long ago, haven't they?

An investor is considered “unqualified” if he/she has not more than 12 months minimum of investment experience. To be regarded by the central bank of Russia as a “qualified investor”, you need to get a qualification certification since it meets the set min individual investment time requisites, or else, possess at least 24 months (2 years) of full-time work experience in a firm which is deemed as a qualified investor by the government.

This is really onerous, why implement that, Russia?

Thailand is slowly becoming a highly tempting crypto jurisdiction