Probability of rising stock prices in the second half of the year is over 93%

The stock markets have a volatile first half year. During the past six months, we were confronted with the necessary mobility for the first time in a long time. Despite the increased uncertainty and instability, most indices managed to do good business. There is even a very good chance that the equity markets will continue to rise.

Despite the wide range of import tariffs that Trump has imposed on countries such as China and Europe, Wall Street has managed to hold its own. Wall Street even managed to do better than Chinese and European indices. And that is not surprising, because the current measures seem to have more effect on the foreign economies than on the American economy itself.

Can we count on further rising share prices?

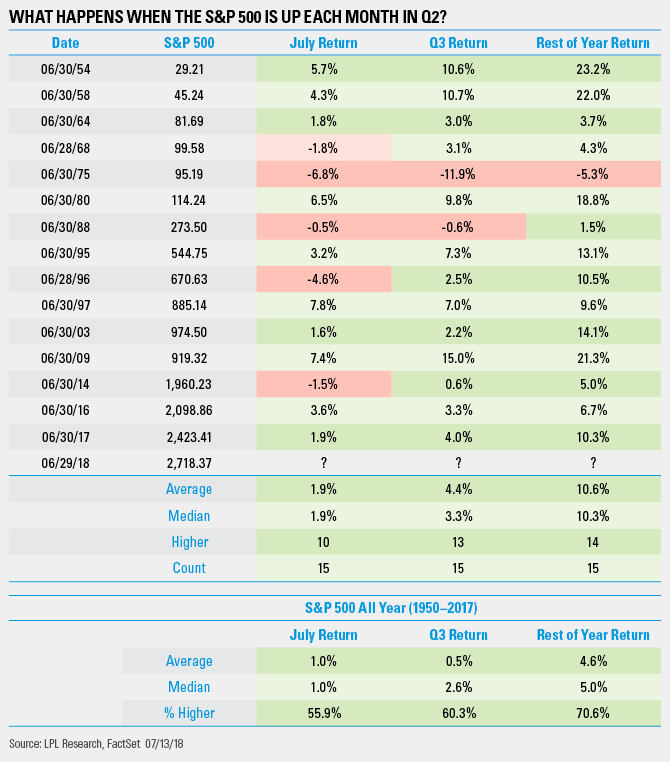

- The S & P 500 index even closed during the second quarter (April to June) in all cases. During no month in the second quarter, the leading American index closed in the red. And according to Ryan Detrick, strategist at LPL Financial, that is a strong 'Bullish' sign.

- The table above from LPL Research shows that the chance of rising share prices is very high. Since 1950, the S & P 500 index has closed green 15 times in all months in the second quarter and in 14 of the 15 cases the S & P 500 index was higher six months later. The average increase over the last 6 months is even more than 10%. And that is a considerable improvement compared to the normal increase in the second part of the year (4.6%).

Interesting chart, thanks for sharing.