Bulls strike back

After a long January correction and a crushing decline in the price of bitcoin to $ 6048, the bulls finally managed to seize the initiative within the framework of the already rising correction. Stopping for a short while at the key resistance levels, on Thursday, February 15, the rate of the first crypto currency overcame an important psychological milestone of $ 10,000 and proceeded to $ 11,349 [according to CoinMarketCap].

Currently, bitcoin is trading around $ 10,800. Thus, the weekly gain was 30%.

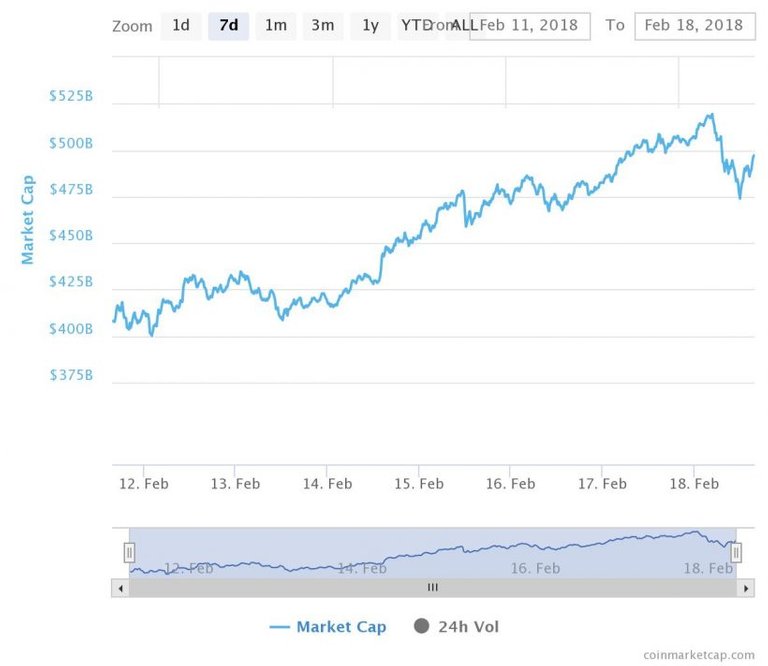

It should be noted that all top altcoyins also appeared in the green zone and showed steady growth, and the total capitalization of the market for over time exceeded $ 500 billion, in the area of which it is now.

Ripple continues expansion

Payment giant UAE Exchange announced partnership with Ripple Labs and joining RippleNet network for instant cross-border payments. The share of this company from the UAE accounts for 6.76% of the global money transfer market (market capitalization - $ 575 billion), and by 2020 it intends to occupy 10%.

In Saudi Arabia, they also decided to keep up with their geographical neighbors. Saudi Arabia's monetary authority, acting as the central bank of the country, has signed a contract with Ripple to use xCurrent technology to improve the efficiency of domestic and cross-border payments, reduce transaction costs and increase transparency in financial transactions.

Simultaneously, one of the world's largest payment systems Western Union said that it is testing the capabilities of Ripple technology for making payments. However, it remains unclear which solution attracted the attention of the company - xCurrent or xRapid. Especially this information is important for XRP-investors, because only the second product uses Ripple tokens.

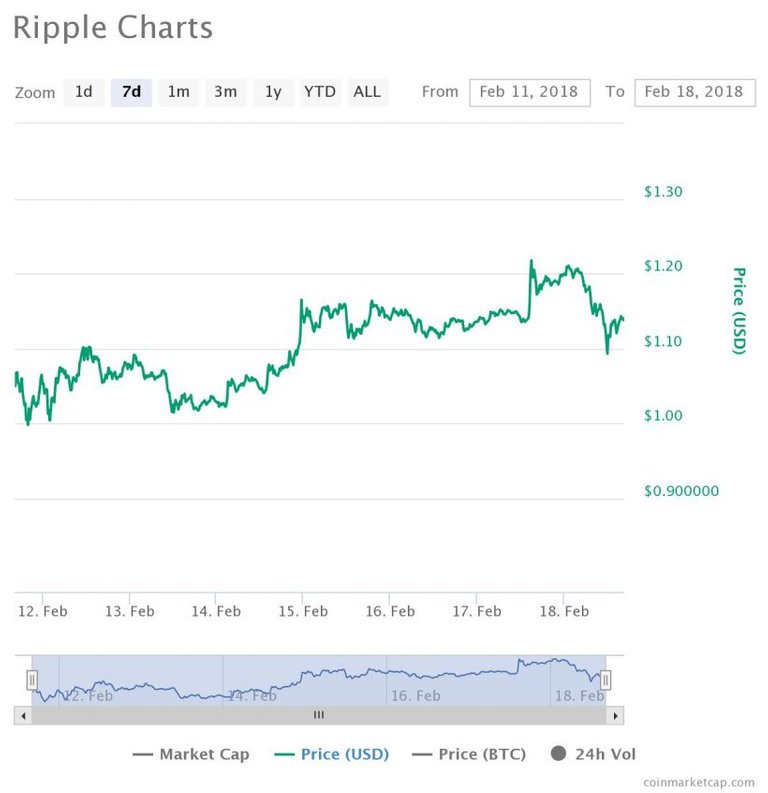

The rate of XRP also showed growth on the weekly segment and even exceeded the mark of $ 1.20 for some time. Now the asset is trading around $ 1.14, which is 14% above the weekly minimum.

Bitfinex will create a new decentralized exchange

One of the leading crypto-exchange exchanges, Bitfinex, uses the EOS.IO lock-protocol to create a "high-performance" decentralized trading exchange EOSfinex.

Representatives of the trading platform are convinced that EOS.IO technology will cope with a significantly increased flow of new users and an increase in the number of transactions through the speed of data processing and horizontal scaling.

The conflict between the developer Bitcoin Core Gregory Maxwell and Vitalik Buterin because of the "life-saving hardcore"

Breaking the Italian BitGrail Exchange and stealing 17,000,000 XRB ($ 159.63 as of 15:00 UTC, February 18), followed by the appeal of Francesco Firano, the founder of the trading platform, to the developers of Nano's blockade, demanding a hardfrock, sparked an active discussion in the community.

Leading developer Bitcoin Core Gregory Maxwell strongly criticized the founder of Ethereum Vitalik Buterin for supporting the so-called "life-saving hail" even in emergency situations, because, in his opinion, no one should have the power to decide whether to branch out or not.

Otherwise, such networks are not decentralized to the full extent and are more like Visa or PayPal, which, according to Maxwell, are much more effective in canceling the implemented transactions and does not need preliminary mining.

Conflict between Coinbase and Visa due to zeroed bank accounts of users

This week, users of Coinbase found that they were writing off their bank accounts tied to accounts on the exchange without warning. As a result, many balances were reset.

In Coinbase, the existence of the problem was confirmed, but they blamed the Visa payment system, arguing that the card issuers and banks had recently requested a number of large credit card networks to change the transit account code (MCC). Visa initially categorically denied its guilt, but then admitted that the problem did not arise from Coinbase.

Worldpay and Coinbase worked together with Visa and its issuing banks to abolish double transactions and return funds to user accounts. The Californian company expects that in most cases the funds must already be credited to the relevant accounts. In case of any misunderstanding, each individual case must be resolved with the issuer of bank cards.

Eleven of the blocking companies entered the Forbes Fintech 50 rating

The financial and economic magazine Forbes published a rating of the top 50 fintech companies and included the following representatives of the blockbuster industry: the New York start-up Chainalysis, specializing in bitcoin-transaction tracking, the start-up Symbiont, The Bitfury Group, the popular bitcoin-purse provider Blockchain.info , Coinbase, Xapo, ShapeShift, Ripple, Chain, Robinhood and Veem.

The IMF decided on the position with respect to bitcoin

The head of the International Monetary Fund (IMF) Christine Lagarde announced the inevitability of the regulation of the crypto-currency industry at the international level. According to her, the organization is actively trying to resist the use of bitcoin and other crypto currency for money laundering and terrorist financing.

A source: forklog.com

Coins mentioned in post: