Facebook Surges After Sending Upbeat Message to Wall Street

- Social network says it’s investing in building new products

- Sales top estimates, proving resilient in face of data scandal

Facebook opposition.’s message for investors is clear: the business is healthy and growing.

In its first-quarter operating statement, the social network aforementioned revenue jumped forty-nine p.c, beating analysts’ estimates, because the digital-advertising business charged ahead. whereas Facebook is outlay to mend huge issues like election manipulation and privacy -- problems that have dealt blows to the company’s image -- “we’re progressing to invest even a lot of in building the experiences that bring folks along on Facebook within the initial place,” Chief military officer Mark Zuckerberg aforementioned on a fall weekday.

Shares in Facebook were up half-dozen.3 p.c to $169.83 at 5:25 a.m. premarket on Thursday. The stock has born regarding fourteen p.c since the new reports regarding data-privacy lapses emerged in March.

On the decision, executives used the word "proud" 5 times. “We’re pleased with the ads model we tend to designed,” Chief operative Officer Sheryl Sandberg aforementioned. By pursuit user activity, the company’s promoting business will dish out relevant promotions and certify Facebook remains free for its users. And their area unit lots a lot of ways that for Facebook’s advertising business to expend additional, like through the photo-sharing app Instagram.

After a month of turmoil and scrutiny from lawmakers, throughout that the corporate has smitten a contrite tone regarding lapses in knowledge protection, executives required to reassure investors regarding Facebook’s quality and therefore the strength of its advertising powerhouse. The numbers did most of the work. Quarterly sales rose to nearly $12 billion, and monthly user growth conjointly lidded estimates. Facebook aforementioned it currently has one.45 billion daily users, matching estimates on this key live of engagement. Shares surged over five p.c in extended commerce.

The results were “a relief,” aforementioned Daniel Ives, associate analyst at GBH Insights.

Facebook has spent the past month explaining, apologizing associated tweaking its rules once an app developer passed on personal data on as several as eighty-seven million users to Cambridge Analytica, a political consulting company, which can have didn't delete it. That crisis, that resulted in a very #deleteFacebook campaign and a general assembly inquiry for Zuckerberg, hit toward the top of the quarter -- thus its implications have had very little visible impact thus far.

“Facebook continues to possess an extended revenue runway sooner than it,” Mark Mahaney, associate analyst at RBC Capital Markets, aforementioned in a very note to investors. “Marketers continuing to pay on the platform at record highs. and that we believe actions that cause revenues speak louder than words.”

The company’s main social network side users in North America, reversing the decline that happened for the primary time ever within the fourth quarter. Monthly active users within the U.S. and North American nation rose to 241 million, whereas daily active users climbed to 185 million within the half-moon.

Net income within the half-moon climbed sixty-three p.c to $4.99 billion, or $1.69 a share, topping the $1.35 per share analysts foretold. Capital expenditures reached $2.81 billion within the quarter as Menlo Park, California-based Facebook will increase its outlay on security, video content and new technologies. the corporate conjointly aforementioned it boosted its stock-buyback program by $9 billion.

Facebook still holds a dominant position in mobile advertising, aboard Alphabet opposition.’s Google. That has let the corporate increase the value of ads -- Facebook aforementioned mobile created up ninety-one p.c of ad revenue within the recent amount, compared with regarding eighty-five p.c a year earlier. the corporate conjointly has many properties wherever it’s commencing to create more cash on the far side the most social network, like Instagram, that is predicted to succeed in a billion users this year, and well-liked chat apps WhatsApp and courier.

Still, the corporate has been rocked internally by the information crisis, that has caused Facebook to launch a review of all of its product and judge what quantity data it ought to share with app developers, researchers and advertisers. Meanwhile, it’s operating to handle new privacy rules in Europe, referred to as the final knowledge Protection Regulation, that Facebook has aforementioned might scale back the quantity of monthly and daily users from that region.

Facebook created the argument that as a result of GDPR in Europe affects the whole ad trade, it’s tough to forecast the repercussions -- together with on users outside Europe, wherever Facebook says it’s progressing to roll out an equivalent protections.

“While we tend to don’t expect these changes can considerably impact advertising revenue, there’s definitely potential for a few impacts,” Chief money handler David Wehner aforementioned.

The company could not be able to build merchandise quickly and roll them out without fear for his or her potential negative impact. Zuckerberg has aforesaid that the corporation did not take a broad enough read of its responsibility to users. Facebook is staffing up this year to review doubtless damaging content a lot of quick and higher perceive potential security threats. And it places a hold on introducing some merchandise, together with a home speaker device, whereas it will a deeper counterintelligence.

Facebook in Gregorian calendar month proclaimed that it absolutely was tweaking its news feed algorithmic program to place a stress on posts from friends and family, at the expense of infectious agent news and video. that would cut back the number of your time folks pay on the positioning, the corporate has aforesaid.

Wehner declined to relinquish updated numbers for that live, oral communication they were not as vital.

“We’re not extremely optimizing the business on time spent, however rather the type of quality of conversations and connections,” he said.

Facebook Sales Top Estimates, Fueled by Ads; Shares Jump

- Social network added users in North America after Q4 decline

- Mobile now accounts for 91 percent of overall ad revenue

Facebook opposition. has been entangled in one contestation when another. however, ad sales ar close to records and users keep flocking to the social network.

First-quarter revenue rose forty-nine p.c to $11.97 billion, beating the $11.4 billion average analyst projection, in step with information compiled by Bloomberg. in an exceeding statement Wednesday, Facebook aforementioned it currently has one.45 billion daily users, matching estimates on this key live of engagement. Shares surged quite five p.c in extended mercantilism.

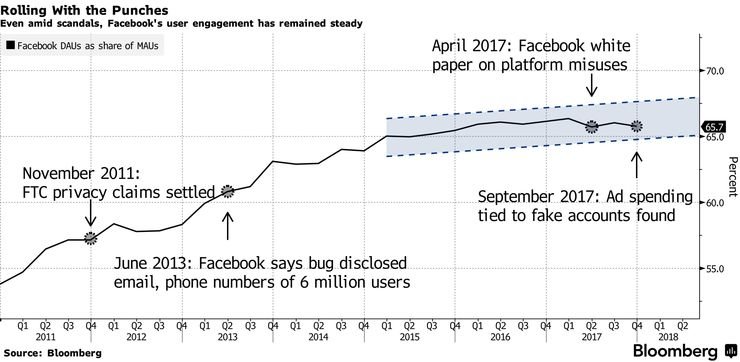

Facebook has spent the past month explaining, apologizing Associate in Nursing tweaking its rules when an app developer passed on personal data on as several as eighty-seven million users to Cambridge Analytica, a political business firm, which can have didn't delete it. That crisis, that resulted in a very #deleteFacebook campaign and a general assembly inquiry for Chief officer Mark Zuckerberg, hit toward the tip of the quarter -- therefore its implications could have had a very little visible impact up to now. Still, the company’s persistent growth points to the strength of its digital-ad business, despite growing considerations from advertisers, users and lawmakers within the past year.

“Facebook continues to possess an extended revenue runway before it,” Mark Mahaney, Associate in Nursing analyst at corpuscle Capital Markets, aforesaid in a very note to investors. “Marketers continued to pay on the platform at record highs. and that we believe actions that result in revenues speak louder than words.”

The company’s main social network another user in North America, reversing the decline that happened for the primary time ever within the fourth quarter. Monthly active users within the U.S. and North American country rose to 241 million, whereas daily active users climbed to 185 million within the half-moon.

Facebook shares jumped as high as $168.20 when closing unchanged at $159.69 in regular commercialism. The stock has born concerning fourteen p.c since the new reports concerning data-privacy lapses emerged in March.

Net income within the half-moon climbed sixty-three p.c to $4.99 billion, or $1.69 a share, topping the $1.35 per share analysts foreseen. Capital expenditures reached $2.81 billion within the quarter as Menlo Park, California-based Facebook will increase its disbursement on security, video content and new technologies. the corporate additionally aforesaid it boosted its stock-buyback program by $9 billion.

Facebook still holds a dominant position in mobile advertising, aboard Alphabet Iraqi National Congress.’s Google. That has let the corporate increase the value of ads -- Facebook aforesaid mobile created up ninety-one p.c of ad revenue within the recent amount, compared with concerning eighty-five p.c a year earlier. the corporate additionally has many properties wherever it’s commencing to build extra money on the far side the most social network, just like the fashionable chat apps WhatsApp and traveller and also the photo-sharing app Instagram, that is predicted to succeed in a billion users this year.

Still, the corporate has been rocked internally by the info crisis, that has caused Facebook to launch a review of all of its merchandise and value what quantity data it ought to share with app developers, researchers and advertisers. Meanwhile, it’s operating to deal with new privacy regulation from Europe, that Facebook has aforesaid might scale back the number of daily users from that region.

The company might now not be able to build merchandise quickly and roll them out without fear for his or her potential negative impact. Zuckerberg has aforementioned that the corporation didn't take a broad enough read of its responsibility to users. Facebook is staffing up this year to review probably damaging content additional quickly and higher perceive attainable security threats. And it places a hold on launching some merchandise, as well as a home speaker device, whereas it will a deeper censorship.

Facebook in January declared that it absolutely was tweaking its news feed rule to place a stress on posts from friends and family, at the expense of infectious agent news and video. that might scale back the number of your time folks pay on the positioning, the corporate has aforementioned.

Facebook Investors on Alert for Any Evidence of User Defections

Facebook Iraqi National Congress. is on a faucet to report first-quarter results once the shut of mercantilism on Wednesday, and Wall Street can scour the numbers for any signs of user losses or a drop-off in advertizer outlay.

The company’s shares have tumbled ten % this year, with abundant of the decline associated with revelations in March that Facebook didn't safeguard the info of a lot of users. Political-consulting firm Cambridge Analytica obtained info on as several as eighty-seven million Facebook users in 2014 so song regarding deleting the info, Facebook has aforementioned. Chief officer Mark Zuckerberg has spoken regarding the social network’s efforts to enhance privacy protection to users, journalists and U.S. Congress. currently he’ll ought to address Wall Street.

Here’s a glance at a number of the numbers investors can monitor most closely:

User Growth

Zuckerberg has aforementioned the corporate has seen no substantive impact from a social-media hashtag campaign aimed at encouraging users to delete their accounts.

The company is projected to report daily active users of one.45 billion, the common of analyst estimates, compared with one.4 billion within the fourth quarter. Monthly active users in all probability rose to two.19 billion, analysts foreseen. That’s up from two.13 billion within the preceding amount.

Facebook suffered its first-ever decline in North yank users and aforementioned that point spent on its social network declined five % within the Gregorian calendar month quarter. Investors are on the lookout for whether or not the trends continuing within the 1st 3 months of the year. Menlo Park, California-based Facebook attributed the call in time spent to changes in however it surfaces data within the News Feed. the concept was to cut back time-wasting muddle and supply additional "meaningful" social interaction, Facebook aforementioned. The question for analysts, though, are whether or not the declines area unit really Facebook’s own style or a mirrored image of user preference.

Revenue

Another concern coping with Facebook is whether or not firms can look to market their brands and merchandise elsewhere. Chief of operation Officer Sheryl Sandberg told Bloomberg News earlier this month that some advertisers -- "a few" -- had if truth be told paused payment. Even so, analysts area unit foretelling a forty two % increase in sales, to $11.4 billion. Heather Bellini, of syndicalist Sachs, aforementioned she expects “little to no impact” on advertising payment from the Cambridge Analytica scandal.

Facebook’s profits seemingly inflated to $1.38 a share, in step with estimates compiled by Bloomberg.

Expenses

Facebook has additionally returned under attack for its failure to staunch the unfold of hate speech and false or dishonest news. In response, the corporate has aforementioned it'll increase payment on the employees required to observe what gets denote and unfold around the social network. prices associated with inflated staffing threaten to crimp profit margins. Analysts at MKM aforementioned that Facebook management can in all probability speak up aggressive efforts to spot and curtail the misuse of information by third parties. "While we expect that existing expense steering offers lots of space to support such efforts, we expect that comment to appease regulators and users may be a higher priority for management than near-term comfort to investors,” the analysts wrote during a recent report.

There area unit lots of different, doubtless costlier reasons Facebook is boosting payment, other than its efforts to regain the public’s trust. the corporate is distributing cash for content deals for its new video section, Facebook Watch, and finance in analysis and development in computing and its hardware businesses.

-*-*-*-*-*- WORK TOGETHER -*-*-*-*-*-

{ FOLLOW ME AND UPVOTE ME }

Don't forget to - RESTEEM