Netflix came up well short of subscriber-growth targets for the second quarter of 2018 — sending the streamer’s stock down more than 14% in after-hours trading Monday on fears its pace of expansion is slowing down.

The company reported 670,000 streaming net adds domestically and 4.47 million internationally. Wall Street analysts expected 1.23 million net adds in the U.S. and 5.11 million overseas for the period (slightly higher that Netflix’s prior guidance).

“We had a strong but not stellar Q2,” Netflix execs wrote in their quarterly letter to shareholders. “This Q2, we over-forecasted global net additions… as acquisition growth was slightly lower than we projected.”

Netflix also provided third quarter guidance that was below analyst forecasts. For Q3, it projects 650,000 net adds in the U.S. and 4.35 million overseas. That’s compared with analyst estimates that Netflix would have Q3 net adds of 947,000 in the U.S. and 5.05 million internationally.

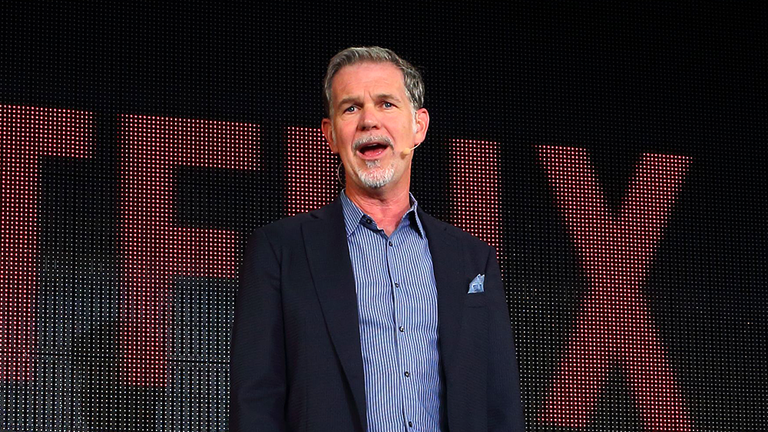

In a post-announcement interview hosted by Netflix, company execs essentially said they didn’t know why subscriber growth in the quarter was lighter than expected. “We’ve seen this movie of Q2 [subscriber net adds] shortfall before, about two years ago in 2016 — and we never did find the explanation to that, other than there’s some lumpiness in the business,” CEO Reed Hastings said, adding that Netflix “continued to perform after that.”

The miss on subscribers for the second quarter “isn’t entirely surprising,” according to eMarketer principal analyst Paul Verna, as rivals including Amazon, Hulu, and HBO are gaining share of the subscription-video market at Netflix’s expense.

Despite the “near-term gut punch,” Netflix is still well-positioned for future growth, GBH Insights analyst Daniel Ives wrote in a note. “As we head into the rest of 2018, we believe Netflix has a number of growth levers which should fuel the company’s next phase of strategic penetration among both U.S. and especially international consumers despite some softness seen in 2Q,” he wrote.

Netflix reported Q2 revenue of $3.91 billion, up 40% year over year, and earnings per share of 85 cents (versus 15 cents in the year-ago quarter). Wall Street consensus Q2 2018 estimates were for $3.94 billion in revenue and EPS of 79 cents.

The results broke Netflix’s two-year streak of over-delivering on subscriber growth. Over the previous eight quarters, the company has on average topped its total net subscriber addition guidance by about 1 million, with three-quarters of that coming from international markets, according to Wedbush Securities analyst Michael Pachter.

Still, Netflix ended Q2 with 130.1 million global subs, up 25% year over year, with 56 million in the U.S. and 72.8 million elsewhere. For the first time, Netflix generated more revenue outside the U.S.: International revenue totaled $1.92 billion and U.S. revenue was $1.89 billion for Q2.

In announcing earnings, Netflix also touted its historic 112 nominations for this year’s Primetime Emmy Awards, announced last week, stealing HBO’s 17-year streak as the top-nominated network or service.

Netflix cited an array of competitors, starting with YouTube. The company also said “HBO and Disney are evolving to focus on internet entertainment services,” while Amazon and Apple are investing in content as part of larger “ecosystem subscriptions.”

Going forward, “We anticipate more competition from the combined AT&T/WarnerMedia, from the combined Fox/Disney or Fox/Comcast as well as from international players like Germany’s ProSieben and Salto in France,” the company said in the investor letter. “Our strategy is to simply keep improving, as we’ve been doing every year in the past.”

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://variety.com/2018/digital/news/netflix-q2-2018-subscriber-misses-expectations-1202874317/