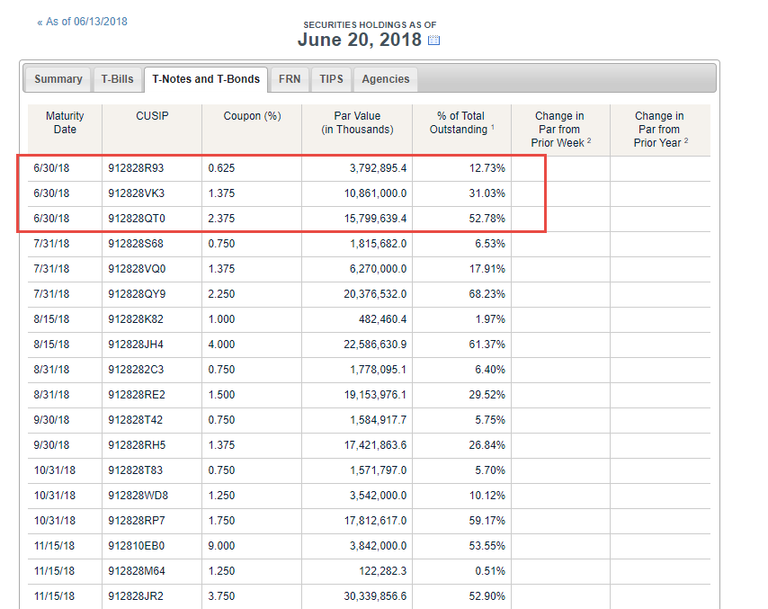

The Fed owns over $4 trillion worth of U.S. garbage paper and it needs to unload it without collapsing the global financial system. Not an easy task. Every time the debt matures and the Fed doesn’t buy an equivalent amount, stocks drop. Therefore, Quantitative Tightening is directly correlated with stocks falling. Are you ready for the rollercoaster to begin?

^DJI 24,475.50 259.45 1.07% : DOW - Yahoo Finance

https://ca.finance.yahoo.com/quote/%5EDJI/

All Federal Reserve Banks: Total Assets | FRED | St. Louis Fed

https://fred.stlouisfed.org/series/WALCL

20180627-spx.png (1748×1271)

20180627-fedbs.png (854×677)

20180627-qtdays.png (421×337)

▶️ DTube

▶️ IPFS

How does a drop in stock value of this scale influence currency value? Will money be worth less? There is talk of a currency collapse - how realistic is this scenario?

Sheeple won’t understand until they have to take a wheel barrel full of useless notes to buy milk and bread . Venezuela 🇻🇪 will be nothing compared to USA 🇺🇸 corporation collapse .