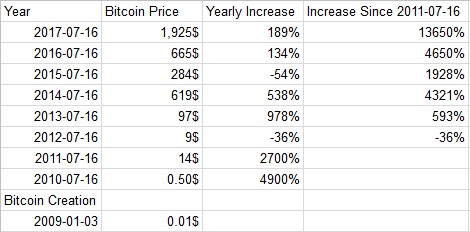

The price of Bitcoin has gone up 567% in the last 365 days. 10,000$ of Bitcoin exatly 1 year ago is now worth 66,700$.

My Latest Series

The current post is part of a series of post listed below but can also be read on it's own.

- #1 "What Truly Matters!"

- #2 "How National Currencies Are Created And Who They Profit"

- #3 "Cryptocurrencies: The Best Investments Of All Time"

- #4 "Understanding Bitcoin"

- #5 "Understanding Bitcoin Cash"

- #6 "How To Buy And Secure Your First Bitcoin"

- #7 "Empower Everyone, Decentralize Everything!"

- #8 "Doing Away With Governments: How And Why"

The Opportunity Of A Life-Time

In many of my previous posts I've talked about cryptocurrencies, why they are a better form of money than national currencies, why they pose a challenge to the existence of countries as we know them today and I've also shown the fact Bitcoin is the best financial investment of all time.

In this post, I will treat of altcoins which are cryptocurrencies derived from Bitcoin. Many altcoins have out-perfomed Bitcoin in the last years. This post will show some of those stats and some strategies for investing in those altcoins. It will be much more about the fundamentals than any prediction as this make a lot more sense when investing.

I first learn about Bitcoin in June 2011 possibly even sooner and I began to read about cryptocurrencies daily in February 2013.

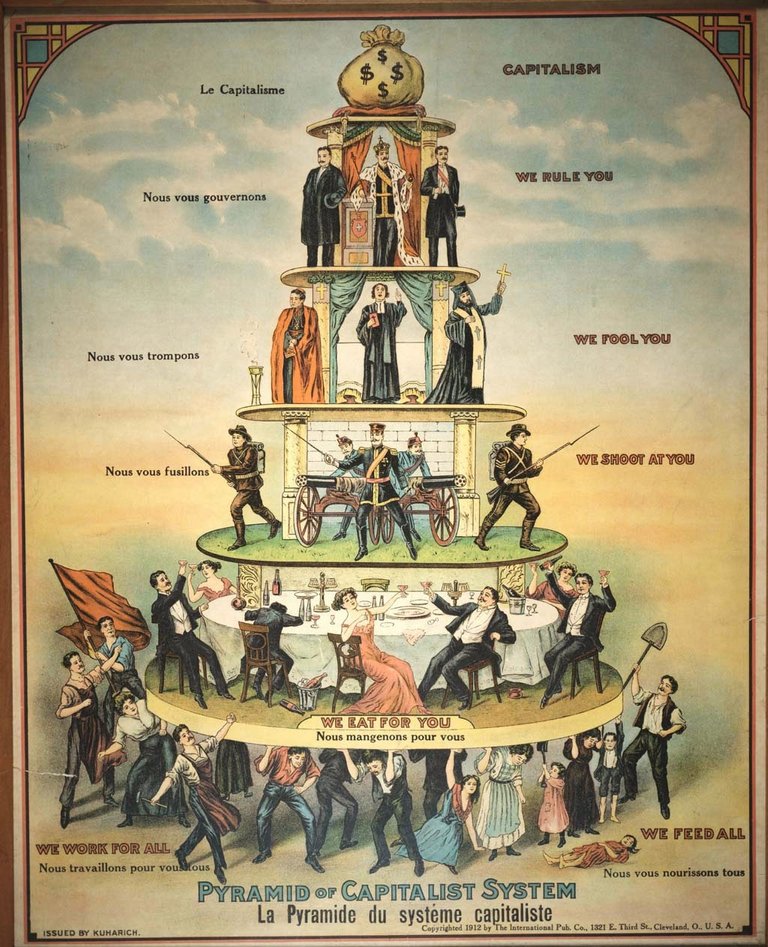

Governments Are Masters Of Deception

They can't exist without war and war is based on deception. Those who engage in wars are always looking to gather more power to themselves at the expense of everyone else and that's exactly what we are observing from governments.

Countries run the show and create money out of nothing, until this changes, it's their will that will be realized and the suffering of the masses will go on increasing.

Everything that redirect power away from governments and give this power back to people is a good thing.

This is the first book I ever bought. I was still a teenager. It's a French version of "The Art Of War". It turn it to be my favorite book ever yet I don't necessarily recommend it.

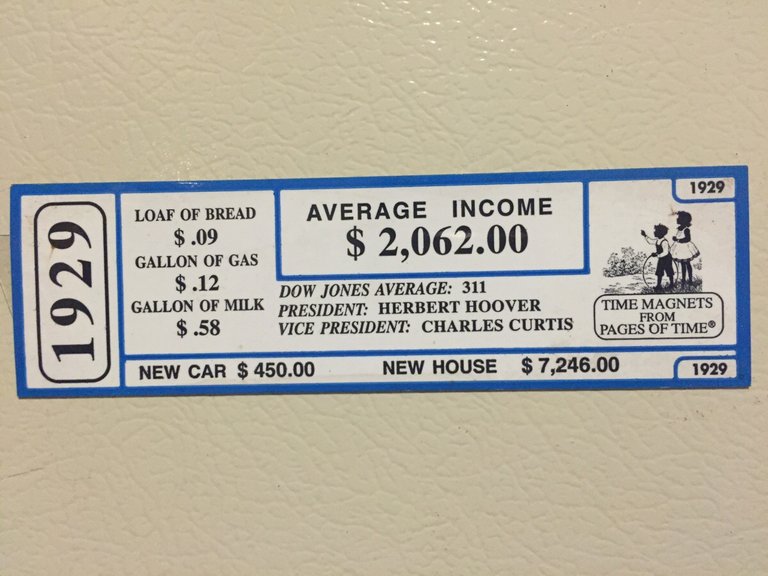

National Currencies Are Inflationary And Losing Value

One of the greatest example of this is Zimbabwe where inflation reach 231,150,888% in less than a year. [Wikipedia]

All countries create or issue new currencies every year. They are issuing a lot. When they do so they are debasing the value of their currencies. The people receiving the newly created money couldn't care less about it losing some value but for everyone else this lost in value has very real consequences.

I live in Canada. Here, prices in 2017 are 63.2% higher than prices in 1990. This is because the Canadian Dollar lost 63% of it's purchasing power during that time. [Source]

This purchasing power have been taken away from those who hold Canadian Dollars and given away to those who created it out of nothing through multiple schemes like fractional reserve banking and other scheme, all of which comes down to creating money of or nothing, benefiting some unknown people at the expense of everyone else.

Many countries don't have a national currency and use the national currency of another country or use a multi-national currency. Here's a very interesting article on the subject.

I've talked a lot about how money is created and who it profit in my post: "How National Currencies Are Created And Who They Profit". I've also given a lot of sources for anyone interested about investigating the subject further. It's a subject of capital importance, pun intended.

@jockey also wrote a very good post on money creation here.

National Currencies Are Inevitably Losing Value

This is the case for all national currencies. I hear a lot of people saying they are buying houses because the prices of houses go up over time. Though it's true that the price of some houses go up in value, in those case most of the time it's the land on which those house are built that is going up in value, the rest of the time it's simply that the money with which the house are bought that is going down.

In other word most of the time it's not that houses are going up in value but it's the value of the currencies they are bought with that is going down.

National currencies are created out of nothing at the expense of everyone who hold them. This is in great need to be exposed. This is in great need to be repeated.

Holding national currencies when someone somewhere create them out of nothing is very foolish.

I've talked about this in more details and why cryptocurrencies are a much better form a money in the post I just mentioned.

There's more US debt than there exist US money.

Cryptocurrencies Recap

Cryptocurrencies have given a lot of financial freedom to many people but even more importantly they are taking away from governments by making national currencies, less desirable.

Obviously the poorest of the poorest can't invest in Bitcoin but because cryptocurrencies are taking power away from governments and redistributing those power to the individuals, this is a good thing for everyone. In the long run even the poorest will benefit greatly.

Countries can still issue more of their national currencies but if there's an ever diminishing demand for them, their value will inevitably go down and the power behind countries will also go on decreasing.

I've talked about cryptocurrnencies in much more details in my previous post of this series. They have been the best way to make money for the last couple of years. Make the smart choice by learning about cryptocurrencies.

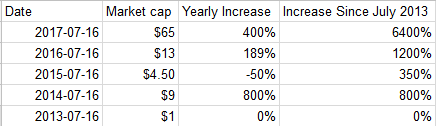

Cryptocurrencies Are A Huge Market And Growing Fast

Cryptocurrencies' market cap or the total value of all cryptocurrencies is $127B and currently rank them as the 53th largest company (by market cap) in the world and the 52th biggest economy (M3) in the world right between Algeria and Pakistan. At the current rate, cryptocurrencies will become the company with the biggest market cap in less than a year and the biggest economy in less than 3 years.

The company with the biggest market cap is APPLE with $827B and the biggest M3 is China with $22T has of December 31 2016. [source: 1, 2]

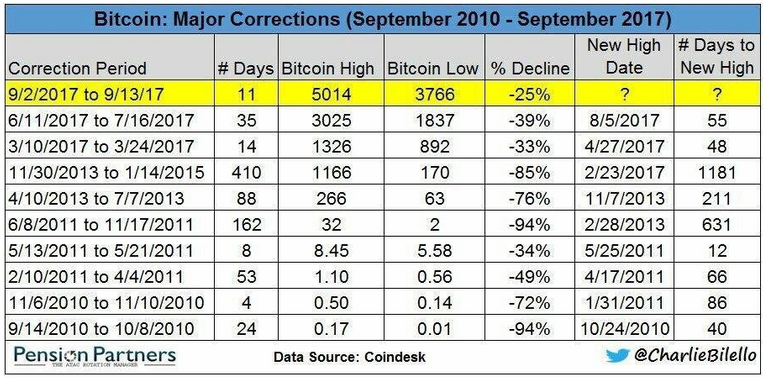

Bitcoin Lastest Price Correction Put Into Perspective

A Primer On Altcoins

Altcoins comes from the contraction of the words alternative and coin. Altcoins are cryptocurrencies like Bitcoin but an alternative to it.

There exist now more than 1,000 altcoins. [Source]

Hundreds of those coins come directly from the source code of Bitcoin. We can see what are those coins here and when did they split as well as what other altcoins those splits generated.

Some other altcoins have a totally new source code. Some of those altcoins which don't share the Bitcoin source code can be seen here from the very same website I just mentioned.

Cryptocurrrency Market Overview

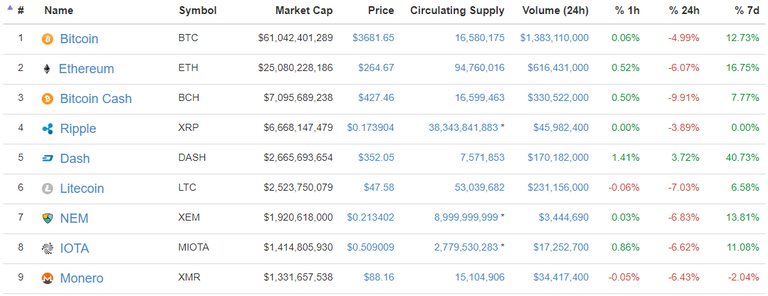

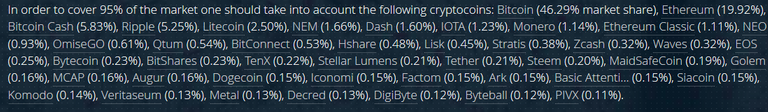

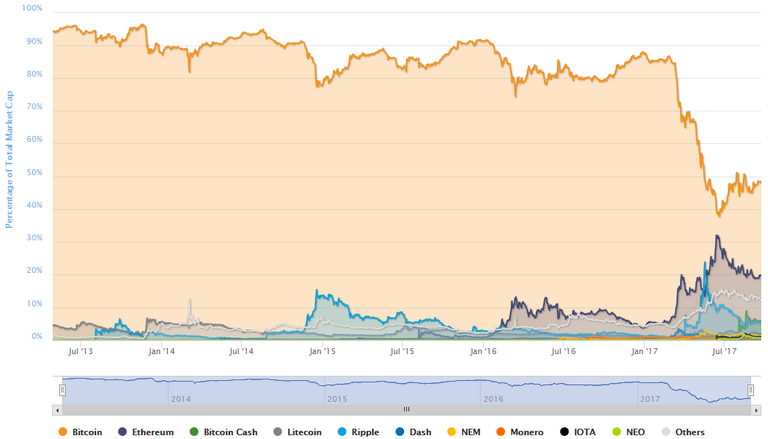

Comparing the market cap of cryptocurrencies separately to the total market cap of all cryptocurrencies give a good overview of the cryptocurrency space. The stats above aren't quite up-to-date. They are a bit less than a month old and comes from this website. It used to be up-to-date.

Up-to-date graph of the top 10 crypcurrencies market cap dominance can be found here.

Much of the value of cryptocurrencies are highly concentrated at the top.

The Initial Investment Hold The Most Potential

There's no amount of re-investment that can make up for the lost of potential gain from the initial investment. Let's take Bitcoin for example, it's price has gone up 567% in the last 365 days. If someone invested 1,000$ back then, they now have 6,670$. No amount of re-investment can make up in potential gain that initial investment hold. I've talked about this in some previous post and why I max out my credit card 2 years ago to buy Bitcoin.

I can't blindly recommend people to do the same. The future is not 100% predictable. At that time, this move made sense to me and it turned out to be a very good one. Losing all my investments would have been pretty bad but not catastrophic.

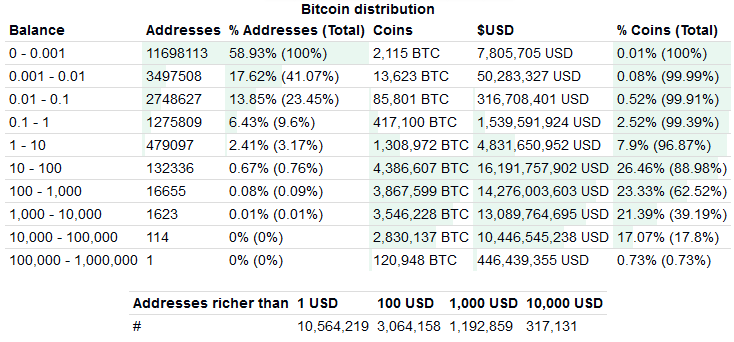

The Importance Of Coin Distribution

If one person held all the Bitcoin that currently exist, then it would be more sense for miners (owners of hardware) to start a new Bitcoin blockchain from scratch. The value of the Bitcoin blockchain which would entirely held by one person would be close to 0$.

For this reason, the incentive for someone to diversify from holding a cryptocurrency increase proportionally with how much % of this cryptocurrencies they own compare to the total market cap. If someone owns 1% of all Ethereum for example they wouldn't have as much incentive to diversify away from Ethereum than someone who owned 99% of all Ethereum.

Stats on the distribution of most cryptocurrency can be found here and more detailed one here.

The Logic Behind Diversifying Your Crypto Investment

If someone only hold one type of cryptocurrency and there's a bug found in this cryptocurrency causing its price to crash then this person would lose most of their crypto investment. This is in a sense the most risky, least diversified portfolio but if this one cryptocurrency goes up more than any other then it's the most profitable option. This is now what I'm looking for and thus not how I invested.

The opposite strategy would be to have a portfolio investment reflecting more perfectly the market cap of all cryptocurrencies and how much of the total market cap they represent. So for example, above Bitcoin represent 46% of all the cryptocurrency then their cryptocurrency portfolio would hold 46%. Ethereum represent 20% then someone would hold 20% of their cryptocurrency as Ethereum, etc.

Note: The image is about an app which keep track of someone's crypto investments called blockfolio.

A Portfolio Representative Of The Crypto Space

This is in part the strategy I use but I mostly concentrate on the top 10 cryptocurrencies. This doesn't mean I hold every top 10 cryptocurrencies and in direct proportion to the market and this doesn't mean I don't hold any of cryptocurrencies which smaller market cap. Steem is one good example.

Cryptocurrencies with bigger market cap are usually more scrutinize by a greater number of coders and hackers. There is more to gain or to lose from finding bugs and from the success or failure of the coin. I'm not talking about bugs in the protocol itself but sometimes the wallet accessing the cryptocurrencies and other related application can have bugs. The price of cryptocurrencies with larger market cap are also most of the time more stable.

Cryptocurrencies with larger market cap are traded on more exchanges and are paired with more cryptocurrencies. More pairing mean they influence the price of a greater number of cryptocurrencies. For example, when the price of Bitcoin goes up compare to the USD the price of all cryptocurrencies will go up compare to the USD if there's no order book filled between Bitcoin and those altcoins.

There's many dynamics at play here and trying to keep track of them all is pretty much impossible.

Proof-Of-Work Vs Proof-Of-Stake

There's 2 mains ways cryptocurrencies are created and thus distributed. There's proof-of-work (POW) often reffered to as mining and which I explained here in detail with a full explanation of Bitcoin and there's proof-of-stake (POS). There are other type of distribution and there are also hybrid like POW/POS. Steem is DPOS or delegated proof-of-stake.

POS have been criticized and could possibly be insecure. Because of those criticisms and also because POS have a tentency to concentrate the distribution of newly created coin, I avoid investing in POS coin. DPOS coin aren't at risk to the attack described below.

"Some authors argue that proof-of-stake is not an ideal option for a distributed consensus protocol. One problem is usually called the "nothing at stake" problem, where (in the case of a consensus failure) block-generators have nothing to lose by voting for multiple blockchain-histories, which prevents the consensus from ever resolving. Because there is little cost in working on several chains (unlike in proof-of-work systems), anyone can abuse this problem to attempt to double-spend (in case of blockchain reorganization) "for free"."

Statistical simulations have shown that simultaneous forging on several chains is possible, even profitable. But Proof of Stake advocates believe most described attack scenarios are impossible or so unpredictable that they are only theoretical." [Wikipedia]

Initial Coin Offering (ICO)

"Initial coin offering (ICO) is an unregulated means of crowdfunding via use of cryptocurrency, which can be a source of capital for startup companies. In an ICO a percentage of the newly issued cryptocurrency is sold to investors in exchange for legal tender or other cryptocurrencies such as Bitcoin. The term may be analogous with 'token sale' or crowdsale, which refers to a method of selling participation in an economy, giving investors access to the features of a particular project starting at a later date. ICOs may sell a right of ownership or royalties to a project.` [Wikipedia]

I advice to be cautious with ICOs. They can easily be scams created solely to enrich their creators. I use caution and I've rarely invest in them. Still some of them have turned out to be really good investments yet the vast majority haven't done as good as Bitcoin.

Proof-Of-Work Mining Algorithm

There are many proof-of-work mining algorithms. Some mining hardware like those mining Bitcoin can only mine coin which use the SHA-256 algorithm. These hardware are based on chips called ASICS. A list of many cryptocurrencies with many different algorithm mined by ASICS as well as their mining profitability can be found here.

"An application-specific integrated circuit (ASIC), is an integrated circuit (IC) customized for a particular use, rather than intended for general-purpose use." [Wikipedia]

There are some coin which have mining algorithm that can't be mined with ASICS these coin can only be mined with GPU and CPU. A list of many cryptocurrencies with many different algorithm mined by GPU and CPU as well as their mining profitability can be found here.

Mining Profitability And Cryptocurreny Prices

I tend to think there's a certain correlation between the price of cryptocurrencies and their mining profitability. Miners won't sell the coin they mine at a lost or else the miner with the smallest mining profitability will stop mining, driving up the profitability margins of remaining miners. There are somewhat opposite incentives when mining profitability margins are too high.

The Cost Of Mining 1 Bitcoin

The cost of mining 1 Bitcoin at the relative price of 3619$ with the most efficient hardware miner, the Antminer S9 and the price of electricity at 0.10$/kWH is roughly 1030$. This doesn't take into account the cost of the miner itself. Cryptocurrencies can also be mine with a pencil and a paper.

Mining Difficulty

Difficulty is a measure of how difficult it is to find a hash below a given target which translate into the difficulty to find or mine a given cryptocurrency. The cost of mining a given cryptocurrency goes up proportionally with the increase in difficulty.

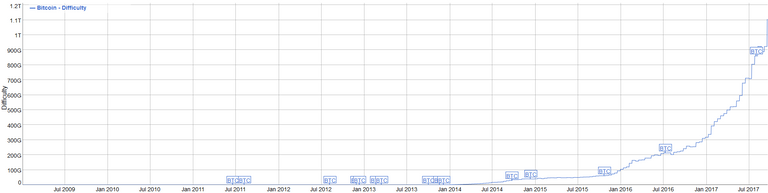

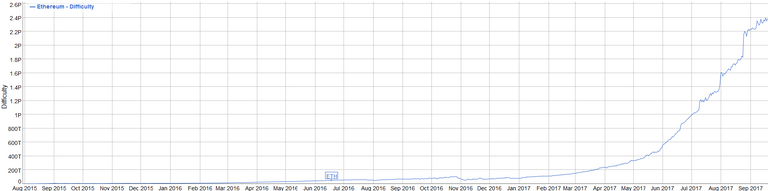

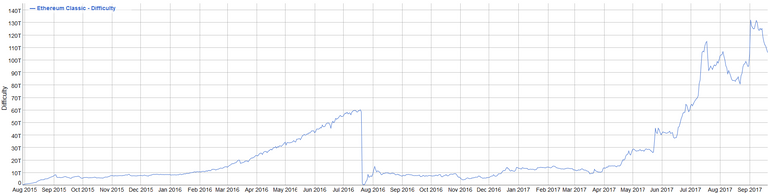

Below the difficulty chart of the 7 POW cryptocurrencies with the biggest market cap.

Bitcoin

- More precise number here with prediction for future difficulty increament.

Ethereum

Bitcoin Cash

Litecoin

- More precise number here with prediction for future difficulty increament.

Dash

Monero

Ethereum Classic

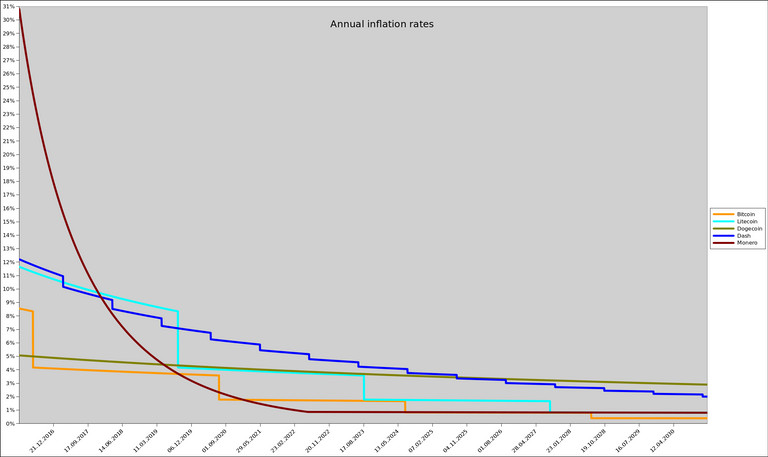

Inflation Rate Of Major Cryptocurrencies

The inflation rate of the different coin also influence the mining profitability. Some inflation rate decrease slowly with every blocks while some happen abruptly at some precise block.

Bitcoin, Litecoin, Dash & Monero

- Click on the chart above for more information.

Ethereum

- Click on the chart above for more information. Ethereum is suppose to switch to a new type of POS at some point.

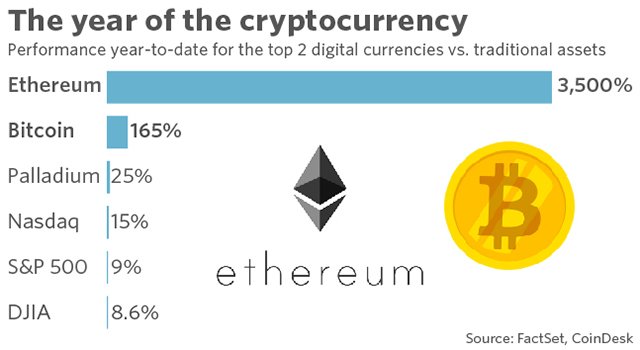

Best Performing Financial Assets Of 2017

Cryptocurrencies have out-performed pretty much all other financial assets for the first half of 2017.

"Cryptocurrencies have become so prominent that major semiconductor stocks have started to move based on how readily their chips are used by “miners,” who use high-powered computers in a race to solve complex puzzles. Those who solve these problems are rewarded with the digital gold of bitcoin and other digital currencies." [Marketwatch]

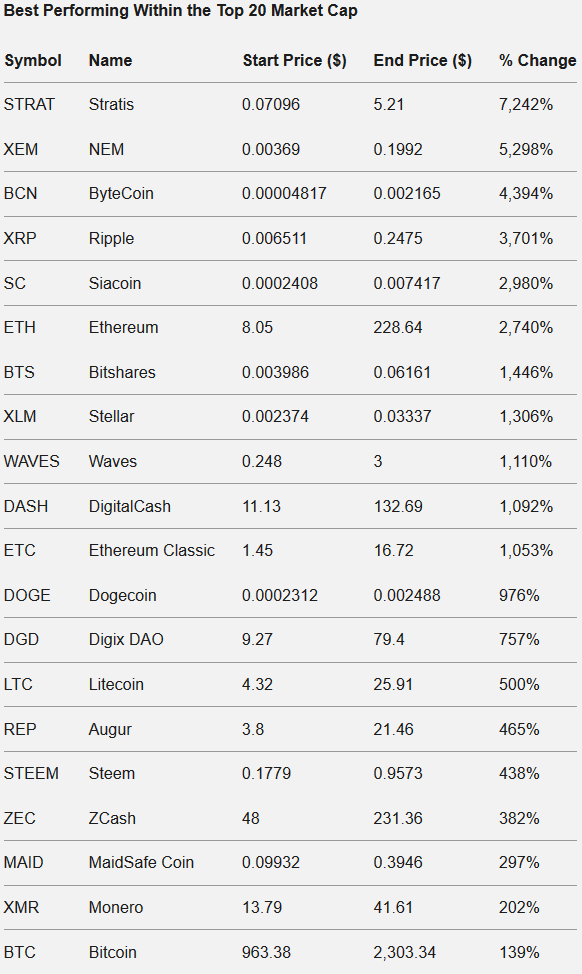

Best Performing Altcoin Of 2017

These are the best performing cryptocurrencies from December 31 to May 31 2017.

"While Monero took the crown in 2016 with growth of 2,760%, 2017 has seen even more explosive – crazy? insane? bubbly? – growth of the cryptocurrency market. I’ll leave word choice and analysis up to others for now." [Source]

More information can be found at the source.

A much more better place to find information on the best performing altcoins of the last past months can be found here.

Cryptocurrencies From Top 10 Which I Don't Know Much About

Ripple, NEM, IOTA are 3 coins from the top 10 which I've investigated for less than 5 hours and thus I don't consider knowing much about them. Here's one enlightening discussion I had with Ripple CTO @joelkatz here on Steemit.

Best Investment Advice

"I am up almost 50% from two weeks ago because I always have pre set orders ranging from -10% market value all the way down to -%75. These recent dips have been incredible to my ROI."

"If you analyze an order book of a given coin, you will see that I am not alone. There is a reason you see a ton of orders for ridiculously low prices, these are the smart investors, waiting for the price to come to them, we are not chasing the prices ourselves. That would be stupid yet i'd argue MOST of you do just that." [Reddit]

With Every Price Movements

"When this happens, that bitcoin (money) is travelling from hands of people with very large holdings in bitcoin, and weaker hands than those buying it up usually. Therefore, these large movers are divesting. In divesting, the money is put into more peoples' hands. When it is put into more peoples' hands, liquidity increases, and volatility necessarily must decrease."

"Think of it this way: maybe Roger Ver sells 25-50% of his bitcoin, and sometimes idiotically, people will do that in one fell-swoop. When that happens, the price drops significantly, but then others (undoubtedly multiple people) buy it up. Thus, next time, those price variations must be consigned by multiple people, all who have independent will."

"See every single swing in bitcoin's price as a hardening in it, ups and downs alike." [Reddit]

In Conclusion

Bitcoin and other top 10 cryptocurrencies have had price increases that are very satisfying to me. Because cryptocurrencies are fundamentally better than national currencies, I think the current trends observed over the last years will continue pretty much as they have for most of them with their usual roadblocks and hiccups.

When I invest in coin with much smaller market cap than the top 10, I avoid investing more than 2% of my portfolio. There are some exception to this. Steem is one. EOS is another one. @eosio There are others. If I invest in a coin that I think as some potential, I try to invest as soon as I can.

There are many good opportunies out of the top 10 market cap but they aren't so obvious to spot. I've read on at least 50% of the top 100 cryptocurrencies and on so many others, of which quite a fair amount are now dead coins, with no dev anymore or they aren't traded on any exchanges anymore.

Money is just a tool and I have enough to achieve my current life objectives and thus I keep my trading at a minimum. As with everything there's a trade-off. The more someone spend time trading and looking at the charts the more opportunities they will be able to size.

Do what you love in life. Trying to accumulate as much money for the sake of owning as much as possible is foolish.

Music Time

One of my very best song from one of my very best album (2015).

Approving My Witness!

Witness #53

Would you consider voting for my witness to help us Steeming the world we all long for? https://steemit.com/~witnesses

Thank you for reading and for commenting! I read all comments!

Steem's Growth Is Unmatched!

Its Popularity Is Rocketing!

Share the fun by inviting your friends!

Good To Know

I used @jerrybanfield's strategy for this post title. See Jerry explain all about it here. We'll see how it does.

I use Markdown Pad (free version) to create my posts and I recommend it to everyone.

How to align pictures.

Get On The Chats!

Not the private messages but in the chat rooms. These are some of the best places to makes some Steem friends.

- Official Steemit.chat

- SteemSpeak.com @fyrstikken @fyrst-witness (24h/7 Voice chat)

- Peace, Abundance, Liberty @aggroed @ausbitbank @teamsteem & More (Minnow Support Project)

Find Out More!

Useful Links

- https://steemd.com/@teamsteem

- https://steemdb.com/@teamsteem

- https://steemit.chat/

- http://www.steemreports.com/

- http://steemvp.com/

- https://steemvoter.com/

- https://coinmarketcap.com/currencies/steem/#charts

- https://coinmarketcap.com/currencies/steem/#markets

- https://steemdata.com/charts

- https://www.steemnow.com/

- http://steem.supply/@teamsteem

My Most Useful Posts

- "Stand for What Feels Best!" (Money in the world today is created out of thin air by a small elite group at the expense of everyone else.)

- "Creating The World We Long For!" (My last post from my previous series, listing my 16 previous posts.)

- "Thank you Dan Larimer! You are a great mentor!" (Dan is the Ex-CTO of Steemit)

- "Steemit.com Set To Become The World's Most Popular Website" (Part of The Ultimate Steembook)

- "The 911 False Flag Tragedy"

- "Geoengineering: Its Documented History"

- "The most beautiful thing I’ve ever heard" (My best paid post at 8,000$)

Steem 101

- "Steem: An In-Depth Overview!" (The most in-depth and clearest guide to understand what Steem is and what it can do for you!) (Reached top #1)

- "The Ultimate Steem Guide!" (How to Use Steem: The revamped edition.) (Reached top #1)

- "What Are Steem Witnesses And Why You Should Support Them!" (Your 30 most important Steem vote.)

- "Some Steem Stats!" (Empowering Cryptocurrencies Stats, Steem In Particular.)

- "Some Steem Tips For Some Steem Success!" (Who to follow and many more Steem fundamentals every serious Steemians should know!)

- "Hello Steemit! - Coinmarketcap.com Introduced Me!" (Template people can follow for their own introduction post. It list my most favorite short video and documentaries.)

Shared On

- Facebook Profile: (760)

- Facebook Page: (236 followers)

- Twitter: (1,425)

Good stuff! Must have taken you a few hours at the minimum to put all this information together.

I must admit that I just scanned this article, but I plan to read it over later. What I did learn from the article is not to let FUD & FOMA influence my decisions and actions when it comes to cryptocurrencies.

I appreciate the links you provide with assistance in learning more about SteemIt and how to do well. As I am new to SteemIt, I am constantly learning new things. I also follow @jerrybanfield as he has been in the Online Money Making niche for some time now.

Hey, have a great week! Keep on STEEMING!

Better use the Original :)

Did I do something wrong? If so, please let me know. Thank you for making this one. I figured with so many people requesting these badges, I would save you some time. It was not my intent to steal your thunder.

No worry its all fine :) Was nice to see a copy :) Hope you like it :)

I love it! Better than mine for sure. Thank you so much!

How do I get one like this badge? It's lovely.

Nice one

I nor have a better view on cryptocurrencies

You did a good job

Thanks

So....did I miss the memo? Is being a member of steemspeak prestigious? I don't know much about it.

No, not so much prestigious, but a great place to learn a great deal about all things SteemIt. It is on a Discord Server. The badge just helps me with my low self-esteem issues. LOL

This article is way behind talk about all the fake news going around right now. There is a long road to 10000 bud.

Such a good use of this info...

Very well thought and exposed ...engurages me how much effort you put into a post.Well done and thank you

https://steemit.com/bitshares/@lenabryant/bitshares-based-sec-compliant-tokens-and-exchange

That manual SHA-256 hashing video blew my mind. Loved it. Thanks a bunch for posting it, and everything else.

Good advice about setting limit buy orders well below the market, too. I'm always telling people that...

Great post! Shared on my Twitter since I don't have much of a Steem presence -

Disclaimer: I am just a bot trying to be helpful.

We live in exciting times. The blockchain ecosystem now reaches far beyond bitcoin. The technology enables us as a community to fund all that brings value to the space in the short and long term. That not only includes content creators and developers. The projects we fund through ICOs are employing countless of people that are now all entangled within the blockchain economy.

We can only imagine what the future will look like. But this is just the beginning of "open source", self governed systems that may very well take over the world and the way we work with it.

buckle your seat belts!

YES! You get it!

good article to read @teamsteem

the topics you make the analysis are very good and very clear.

are you working on this team? :-D

The Art Of War seems a good read. I will read it. I read somewhere that wars are the most profitable businesses. If it's true, there can never be peace in the world. This tells why most of the things in the real world are upside down including money. This also proves that controlling of money is bad for the masses. China banned Bitcoin, no problem. Now, Japan replaced it because it was inevitable and blockchain is going to stay. Another great and insightful article by my most favorite Steemit author. Loved reading it. Thank you @teamsteem.

Steem On!

This list of quotes from The art of war are more than enough. The book is a lot about out-dated military strategies.

Suffice to say that even 2,500 years ago they use multiple type of spies and these were a lot more powerful and important than regular soldiers. I think they where "worth" something like 10 soldiers.

Even the list of quote could be slim down to less than 10.

http://www.military-quotes.com/Sun-Tzu.htm

You're right and thanks for sharing the link. I saw an online photo that tells a lot how our society works but is never taught in our books most of the times. I think this is pretty much the case with the warlords/the people who are controlling the money system of the world. Actually, they are controlling the world:

You wrote a post about how was created National Currencies and who benefits, but who create Bitcoin and who benefits the most? May people who on the top of hierarchy make this new instrument of investment? Or they are too stupid for this trick?

It is very difficult to do, because bitcoin does not possess the basic properties of money: money must be secured by the value of goods and services, be a measure of prices, predictable and low inflation, free credit for business and consumer in an unlimited amount. Only modern fiat money can be considered as money in monetary theory.

Bitcoin is very similar to gold, and gold has shown its complete failure as money for the modern economy during the great depression. Let us remember how Roosevelt confiscated gold in order to somehow restart the economy, ROFL.

It's a very real possibility.

Bu dünyada yapay olarak üretilen herşeyin muhakkak ki bir sahibi vardır. Bu noktaya kadar geldiyse basit bir güç olduğunu da sanmıyorum. Esas sorulması gereken bu gücün planladığı duruma biz hazır mıyız?

Thanks for the article. The information is presented is very accessible for all. For example, I don't really understand the economy, but I quite understand the point. It turns out my viewpoint. Coincide with yours. The fact that bitcoin is a step towards the abandonment of war and global poverty. I want to believe that States will not be able to kill the cryptocurrency. The usual inflation of money is really huge. In Russia the prices go up almost every day. Many people were still a couple of years ago in the middle class are now forced to save even on food. The wage remains the same while the prices increase. It only gets worse, I think. Therefore, I lay great hopes on cryptocurrencies. This is a real chance to stop the arrogant power of the state over the people. A chance to live the life we deserve.

Your posts make other people's posts on cryptos look like they were written by 5 year olds, good job

Haha!

If you can't handle my 20% drops.....just much yes :)

I hope that Bitcoin will rise up so that I can invest again a little with bitcoin..tnx a lot @teamsteem for your continue support :)

Your work is very interesting to read. Your posts are very informative. You always reinforce your reasoning with detailed analytics. How do you manage to conduct a detailed analysis of your topics in a short time? Do you have any assistants?

No. Most of this is accumulated knowledge.

I thought for your posts there is a team of specialists. I'm afraid to imagine how long I'll have to learn to understand all the algorithms of the "crypto world".

Thank you for another informative post :)

And war cannot exist without them. And fiat.

I think so too. That's the most important aspect in all of this.

Very good article...Particularly liked your price correction bitcoin table...Thanks

wow - that was a lot to read. I guess you just wanted to bring everything on point but it was a lot ...

Must have taken him a while

Good post! It is sad that almost nobody knows what inflation does to their wealth. It looks like people are finally learning about it, hope this learning proces goes parabolic like cryptocurrrencies too. They will fuel each other!

This is a great piece of state-of-the-art work on cryptocurrecny in general, we need a long, detailed, similar article of STEEM and Bitshares (price prediction) from @teamsteem :)

This is truly the best time to be involved in bitcoin and its never to late to start. There is an upcoming fork coming in November which will see you score a few extra coins if you own bitcoin. Yes governments are trying hard to stop bit coin through regulation but they wont succeed. I for one am so excited for being part of this crypto space great opportunity for great future wealth.

Great article i must say again it makes me excited when i read it and im glad im a part of something great.

Only not money, but credits! And this is the greatest invention of mankind, without which we would now be living as in the 15th century)))

hmmmmm... Countries don't create money at all. All the "new money" available only in the form of a credit issue, they can only borrow them to banks, which then lend to real businesses and people, and as the economy grows and the average business makes a profit, every dollar issued is 100% guaranteed by goods and services.

I don't agree and reality don't agree with you either. More seriously you should read the number 2 post of this series to get my opinion slash facts on the matter.

But if you want to argue your point that goods and services back dollar you're always welcome to do so.

I don't know how to argue with very popular myth that states print money out of thin air ...

The government does not really "print money". Most of the money used in the monetary system appears through the process of issuing bank loans. The government is responsible for the physical appearance of banknotes and coins. This form of money exists to facilitate the use of bank accounts. They are distributed through the banking system, as bank customers need this form of money.

Perhaps the argument for you may be the fact that the US for example has a huge debt of 20 trillion dollars. If they can just print money "Out Of Nothing", where could the debt come from?

It's government that delegated most of their money or more precisely currency issuance power to many entities some of them banks through many schemes like fractional reserve banking and quantitive easing just to name those 2. At the base of which money really is created out of nothing, not my word but the exact words of Maurice Allais Nobel Prize in Economics just to name this one person. You can look at the second post of this series if you're interested to learn more.

Well, let's ask ourselves a question. What is the main function of modern fiat money and monetary policy in the economy? In my opinion, this is the stimulation of economic growth. The whole system is built for this: it is lending to businesses and consumers. So:

And this is absolutely fair! In any complex system, the division of labor is inevitable. Banks - experts of the highest level in lending, this is their main function, everything else is secondary. For this reason, the higher the rating of a bank, the cheaper it can get money on credit. The best banks receive loans at a key interest rate from the central bank (CB). Further, loans are distributed throughout the economic system, and the rate of course is growing. I, too, can take a loan, but I will not be given it at the rate of the central bank. This is fair, because there is always a risk of non-repayment of the loan. And I'm not such a reliable borrower as the best banks.

this is an excellent invention in the financial system! The best banks issue loans so well that they have a very low percentage of non-repayment, they can give out 10 times more credits and finance 10 times more businesses than they have their own funds with minimal risk of bankruptcy. This is the acceleration of progress and speed of development. Have you ever wondered why Europe has overtaken other countries for economic and technological development for centuries?))

It is absolutely robbery of the population in its pure form((( The states turned bad loans of private banks into national debt by purchasing toxic bonds, which was justified by the threat of collapse of the whole banking system, but it is very very unfair! All citizens paid for bankers' mistakes ...

yes and it's not a secret, and it's excellent!)) I do not want to pay for making money out of anything expensive, money is only a parameter in the economy, only goods and services are of real value.

Аnd of course fiat money is not for holding, they are for lending, so if you need to keep their purchasing power, they should be given to someone in debt, i.e. buy reliable bonds.

This is late but had to say you make some strong arguments for your case but honestly I think you should of just stopped at "...in my opinion"

every move now is the best, just move.

hold bitcoin? good move?

old some crypto? good move.

just buy somethin and wait, it will be a good move.

Wow!!! Thank you so much! A veritable treasure trove of information.

✨✨✨🤘😎✨✨✨

Upvoted & Resteemed

I know a lot of people who keep national currencies, here in Brazil we are in crisis, and I always talk about investing in crypto-coins and who does not own houses to buy, because the government may want to take all the money out of the accounts, and let it go. And if it were to invest in crypto-coins as they are secure forms, there would be no such fear. In 1990 President Fernando Collor formulated a plan with a radical package of economic measures, including the confiscation of bank deposits and until then untouchable savings accounts of Brazilians were confiscated, and Brazil plunged into hyperinflation.

1990 is 27 years over, let's hope it won't happen again! If you now trust Brazilian Central Bank, you can store Brazilian reals in the national government bonds. Crypto currencies are a financial pyramid scheme, so to keep money in them would not recommend more than 10% of the savings (IMO).

Thank you!

hey bro great blog

Wow, that's the best post explaining cryptos I've ever read...and I read a lot of them. Bookmarked for future reference! Thanks.

Thanks! I really appreciate!

That was a great and informative read. Thank you :) Too much FUD coming out of China currently but your post puts it in perspective for me and many.

This is an intelligent analysis. I can see the light.

Thank you.

Very good pridictions in this we can get success in cryptocurriency.

This is a very good post and well written with lots of infomations ...good point on POW and POS plus DPOS am sure that minning with our minds is far more better for our world than POW use of electricity

Awesome post I took the list and considered how I would diversify my portfolio with it. @cleverbot this is a very good post on crypto-currency.

Great results! Thanks for sharing

Come on. I'm all for blockchain-based technologies, but some defences of bitcoin is just too senseless and it's hurting cryptocurrencies as a whole.

"Canadian Dollar lost 63% of it's purchasing power during that time. This purchasing power have been taken away from those who hold Canadian Dollars and given away to those who created it out of nothing"

"Many countries don't have a national currency and use the national currency of another country or use a multi-national currency."

"Holding national currencies when someone somewhere create them out of nothing is very foolish"

"cryptocurrencies are taking power away from governments and redistributing those power to the individuals"

There's this lack of knowledge in crypto-community who's been only subject to American-style liberal economy bias (mostly Austrian school nutjob libertarianism). They've never picked up a book on sociology, statistics, human history, mathematics. They've read all these online articles praising how libertarianism is freedom, it's power to individuals! Oh, at best, they've read some chapters from Hayek or Friedman.

But back to the point, this lack of knowledge causes them to limit the government's definition to a corrupt evil entity, that just tries to take power from oh-so-poor-and-free individuals.

What government really is, is a contract between many individuals to increase collaboration, create synergy and result in overall improvement. 1+1=3. It's good old Game Theory. If you can establish trust, everyone wins. But there are some individualists who ruin this game for everyone of course.

Never underestimate the game theory. It exists for a reason. That's why libertarianism is just a nutjob distopia.

Sorry to disagree on so many levels but bitcoin community needs to wake up. Bitcoin itself is dangerous for humanity. I'm not saying the same for other cryptocurrencies, though there are plenty that are also dangerous and plenty that are beneficial.

Hi @algons - I have spent half a lifetime attempting to resolve the discrepancy dilemma - just proposed a method for obtaining a blockchain currency with a value stable relative to cost of production of necessities at a basic level, with the object of protecting the purchasing power / power of survival of the man in the street. Would love to hear your opinion. Regards

This is exactly what I think will eventually be the future of digital currencies! An automated blockchain-based currency where the value gets automatically updated to the cost of production of necessities! Thanks for explaining it so clearly! There would be a lot of discussions probably on those necessities (I guess). A question though: How do you think this would be maintained? On a global level or more regional? Regards.

Hi @algons - it is inspiring to find someone that cottons on - thank you for that! It could be regional and it could be universal. I think a coin with this attribute will find its own way in the market in terms of beneficial effects. If it can function better regionally, then derivatives of it can be created with parameters suited to specific environments added. Making like minded souls aware of its potential might help a lot getting the ball rolling. You may find my reply to @teamsteem interesting too. Regards

I never said this was a good thing. Obviously it's a bad thing.

People can't enter in a contract where one party does threaten the other party if they don't agree with the contract they proposed.

I'm not even going to comment. I'm inviting you to read the whole series.

Thanks for the response. I will try to read the series as well.

How is it threatening the other party? In essence, you're free to leave the government (contract) that you dislike. The threat happens when the abuse of the contract happens, but that doesn't change the definition and theory of the government. And there are many countries that have governments in practice close to the theory.

You have a lot of awesome posts, but this is by far one of your best ones man. I needed this one today! Thanks.

The Art Of War appears a decent read. I will read it. I read some place that wars are the most productive organizations. In the event that it's valid, there can never be peace on the planet. This explains why the greater part of the things in reality are topsy turvy including cash. This additionally demonstrates controlling of cash is awful for the majority. China prohibited Bitcoin, no issue. Presently, Japan supplanted it since it was inescapable and blockchain will remain. Another awesome and savvy article by my most loved Steemit writer. Adored understanding it. Much obliged to you @teamsteem.

Hey thank you very much for this nice compliment!

Well done! More likely than not taken you a couple of hours at the base to assemble this data.

I should concede that I just examined this article, yet I intend to peruse it over later. What I learned from the article is not to let FUD and FOMA impact my choices and activities with regards to digital forms of money.

I welcome the connections you give help with adapting more about SteemIt and how to do well. As I am new to SteemIt, I am always adapting new things. I likewise take after @jerrybanfield as he has been in the Online Money Making specialty for quite a while.

Hello, have an awesome week! Continue STEEMING!

great post.

a very good post @teamsteem very deserving of accurate voting. we like your postigan. always success . I am @muhammadrazikon like your post

Its a well documented and written article,

Its true about the value of bitcoin has increased

The Secret of Cryptocurrency success is to buy and hold them

nice turn on "the best time to plant a tree is 20 years ago and the next best time is now"

How can bitcoin be the currency of the future?It is fluctuating so rapidly.I believe it will crash some day because trading cannot be done with something which is not constant.The government some day will take it down.I am bit skeptical to trade with digital currencies because i do not trust them.

Blockchain is not only about currency. Besides, fluctuation of fiat money is also visible. Try to do forex, and let one of those fundamental elements to get involved and you are going to see how easy you lose control of the money.

Very good post. It's interesting what you mentioned about not just owning money to simply own it. Seems like many in the crypto-world get caught up in that mindset. Nice job!

I upvote you as my witness, but this post did me feel very sad 2010 bitcoin price was $ 0.17 and me not buy anything

Thank you very much. We all wish we would have bought some or more.

Hi @teamsteem - as a newcomer to the block I could not help but notice your work - knowledgeable, well researched and put together in a way that makes the material accessible for a broad audience - well done. I would love to hear your commentary on the stable valued coin I propose. Should it work, it will of course not offer profit in the speculation market, but could generate a 'bookkeeping fee' type income serving as a keeper of value not only for pensioners etc, but also in the same fashion as bitUSD be a holding position in a volatile market. Thanks! @clicketyclick

You haven't link to it or given any information.

It's in his/her Steemit blog page

For some reason I had missed it the first time. I looked at the wrong tab.

Thanks, @teamsteem for the in sight, i myself do not really know much about cryptos but with this hopefully i will a make sound decisions. This is very helpful.

10 top cryptos are a must if you in to blockchain technology trick is to find another coins which will outperform some of those from top 10 when mass adoption comes. THATS WHERE THE BIGGEST PROFITS ARE MADE on the start before first few pump and dumps

The article covers a number of aspects in very informative manner, It is really helpful for person with limited knowledge of crypto-currencies and block-chain system. You sir, Have my upvote !

Also I'd like to say people always hesitate and take long to adapt to the new trend or system, If any of you believe that crypto-currencies do not hold any potential or are a scam (pretty harsh word) then you're completely wrong. It has been proven over and over again that crypto-currencies are the best method of transactions and they'll only grow in the future, the exchange prices will keep rising for almost a decade or so due to national currencies falling in value (as explained very well in the article). My suggestion is that just buy or earn as many crypto-currencies as you can hold, they're a better investment than purchasing land or anything else in that matter.

lo importante es que a nivel mundial se esta viendo una nueva moneda virtual que esta revolucionando al mundo moderno y con buenas ganacias asi que aproveche ahora mismo

This is such an outstanding post on bitcoin and crypto currencies, full of facts, charts, links and statistics. Am gonna have to read and refer to it again.I agree with you that cryptos are gonna change the world by taking power from banks and governments back to the people. In the coming years its gonna change everything , some countries may cease to exist as we know them. The ramifications are profound . That fiat currency they print has been continually eroded by inflation, even here in Kenya the prices are up upto 70% of what they were 20 years ago. Its insane.Lets keep holding and growing our cryptos, the future is bright :) I love the song at the end, listening to it as I type this :) Upvoted and resteemed :)

The rich control the production of money and its value on the market. In this way, paper money is devalued with the aim of replacing it for electronic money. People invest in crypts, hoping to earn big sums of money in a short time. For now, this is indeed true, many have enriched themselves. I also believe that now is the moment to invest, it will take several more years, where people with little money can earn a lot of wealth. Now everyone lives in dreams of success, that now it is possible. It's only important to know how to invest. It is very important to monitor the flows of money, people and jobs. Money - people and jobs are an indicator of where to invest.. If you invest it's best to do it in the markets where people come from and not the markets from which people are leaving.

Just imagine that states ban crypts overnight, or to happen the same as with China? This means that everything you own in crypts is no longer worth anything. That's why it's good to invest in things that have real value, such as gold, silver, diamonds, land, real estate ... Of course, not every investment is good and you need to learn how to invest. It is best to devote one way of investing, if these are real estate, then become a professional for them. Never buy a property in the place where people leave. Because that means that people are losing jobs there and going to work places. Buy a property where people come, because where there are people there is money.

Value is always relative. If no one has anything to eat no amount of precious metal will be worth anything. I agree though diversifying is always smart.

You probably didn't read or fully understand the context of this article. I'm sorry but this is completely unrelated as the data provided in the article is very credible and should i say self explanatory.

EXCELLENT INFORMATIVE POST! I truly loved this post puts the puzzle together for me. Keep these type posts coming.

As long as STEEM on that top 10 list I'm cool!

Dop€

-MikQuote