If you are like most investors you are probably buying the latest hot stock pick.

Long term compounding of wealth is much easier by focusing on the best businesses in the world and avoid the volatility that hot stock picks experience. Hot stock picks are more of a gamble or at the very least a trading instrument.

The most successful investors look for dominant businesses with big profits.

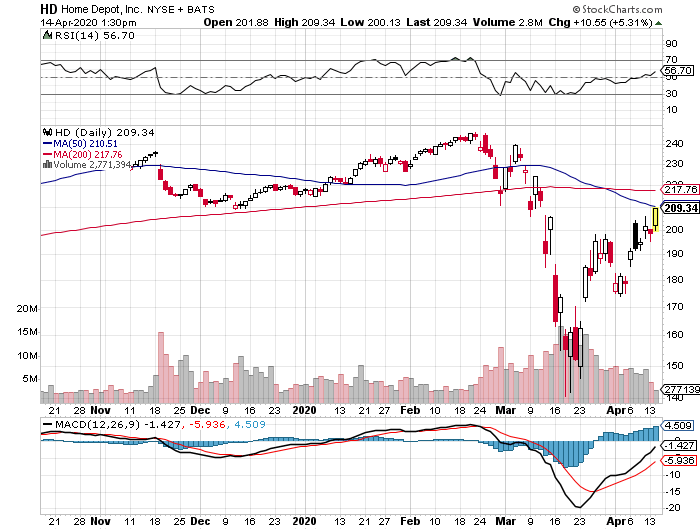

Home Depot (HD) is the greatest business in the home-improvement sector. It does $110 billion in annual sales about double that of its biggest competitor Lowe's. The success of Home Depot is shown through the profits that company generates. The giant size of the company has not hurt profit margins where they are still earning between 29 and 31%.

The safer way to invest is buying quality businesses with strong profits and solid return on equity characteristics. COVID1-19 provides a great entry point to buy a wonderful business. Make the smart choice and have most of your money in companies like HD.

Disclosure: I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article. The information provided should NOT be considered advice. The topics discussed are risky and have the potential to lose a substantial amount. I am not an investment professional and therefore do not offer individual financial advice. Please do your own research before investing.