One of the most important things they failed to teach us in school was financial education, how to simply spend money. This is a very essential part of life. We all go to school in order to get a job. After getting the so-called job, a lot still don’t know how to spend money. Hey! I am not here to blab about what we were supposed to be taught in college, but to do some enlightenment on spending money. This might actually be a solution to your going broke. This same information I would give here is still the same information you would see in a book that costs $3000.

Millions of people go to school inorder get a massive pay check but only a few know how to make good use of it. This piece of mine would enlighten you on how to spend less and make more money. Sit back and read this beautiful piece.

Put yourself on a budget: To gain financial freedom, you must be able to live on a budget. To achieve this, you must be disciplined. Put down all your expenses on paper and strike out the irrelevant ones. You don’t need to spend money anyhow, think before you do. You must ensure that you are not spending more than what you have budgeted for in a month. You want to die rich? You have to put yourself on a budget. This is what rich people do a lot. They actually go as far as employing someone very intelligent to manage their finances. spend wisely

Reduce Eating Out: You spend more when you eat out. Making your meals would really go a long way to save you loads of money. It would cost you absolutely nothing to make your meals. You might just need to spare few minutes to make your meals. It’s worth it. Stock your house with foodstuffs and eat good food. Junks won’t make you healthy, good food will. Health is wealth.

Invest in profitable businesses: Have you ever thought of making more money? This is the best way to triple your income. Think of a profitable business and invest in it. Instead of stashing your money somewhere, why not invest with it? This is what makes the rich get richer. You pay no tax and earn more money when you invest in profitable businesses. Doing business is a risk. Make sure you are taking a calculated risk. Work smart.

Put away unimportant liabilities: Why do you need 3 to 4 cars? Well, there is nothing wrong to have 20 cars if you are financially stable and very comfortable. For employees who buy cars just because they love it, they are simply just making a terrible mistake. The more cars you have, the more you spend on maintaining them. Sell irrelevant things consuming your money. Accumulate asset not liabilities. Be smart

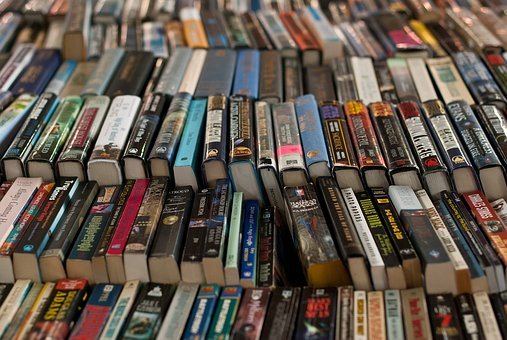

Read books on financial education: You would learn a whole lot by reading books that would enlighten you on how to make 2+2= $4million. Going broke or getting into debts is as a result of lack of financial education. There is a saying that goes thus “the more you read, the more you learn”. Books from authors like Robert Kiyosaki and other financially stable. If you can read books, just like some people would say “reading is hard”. You can listen to podcast. Just find a means to learn.

I hope you learnt from this article. If there are any additions you want to make, kindly use the comment box below.

Thank you

This is great! More people need to read this! Thank you for putting this out there!

You are welcome.

We grow up in a society that encourage us to spend, in 2008 we were suppose to consume yourself out of the financial crisis even.. It's not so strange that we have a hard time making the budget when this message is heard everywhere.

Making a budget isn't hard. You just have to put down your expenses into a paper and follow it strictly. You can give it a try. If it doesnt work out, you can always send me a message or reply this thread.

Very useful information. I recently watched a video explaining that most millennial lack any sort of savings or investments. Hopefully your post helps young people get their finances on track. I wrote a post about a saving app if anyone is interested https://steemit.com/money/@dragonsmoke/a-new-way-i-am-investing-is-the-tanda-app-from-yahoo-finance