I've recently had the distinct pleasure of becoming a father. So far it's been an amazing experience. But one element I keep coming back to that I think all fathers must struggle with at some point or another is,

HOW THE FUCK AM I GONNA PAY FOR THIS CHILD?

It forces you to make some tough decisions. Like chasing the startup dream for innumerable years... Once you have a beautiful daughter staring back at with you big brown eyes and her future life is literally hanging on every action you make, it starts to make you think critically about your existence.

Suddenly, working for free no longer sounds so romantic. I know, I know, WE ARE GOING TO THE MOON! That's what they say in cryptoland. For non-blockchain enthusiasts, the entrepreneurs I know have their eyes set on merely a seaside bungaloo somewhere in Southeast Asia. It's kinda like, "Hey y'all, get get get it! But I gotta hang back here and work overtime (for money!) to pay for the nanny and save up for her ever-ballooning education costs.

And that never hits home harder than when your baby turns into a living, breathing, walking, shitting, babbling nonsense toddler-creature that at times seems like it has come straight from the depths of hell and at other times seems like the world's most perfect calm angel. For me, it was almost like, "Whoa, where did this girl come from? That was fast."

Yeah, before you become a parent, you hear people say all the time - THEY GROW UP FAST - and sure, you're like, of course they do! They're humans. But you don't really know what that means till it actually happens to you.

As a finance professor, of course my little spreadsheet-and-charts oriented mind turns to what comes easiest to me - the calculation of the need for money. I'm hoping mom and grandma can sort out my little monster or at least tell me what I need to do in that regard. But I'm already thinking about how I can instill in my little girl all the financial traits that I would like her to utilize for the rest of her life.

There are four main areas of personal finance that kids need to learn about. The means for teaching kids these four aspects depends on the type of children you have. But let's keep it simple for now. As parents, we need to teach them how to earn, save, budget, and invest.

1. Earning

I strongly believe in kids working part-time jobs when they are young. At first, parents may have to seek these opportunities out for them, but eventually, children will figure out the most suitable activities for themselves. Selling lemonade. Flyering. Lawnmowing. Babysitting. Tutoring. Online entrepreneurialism. Who knows what the future will be like? But I hope to have my girl thinking about her piggy bank from just about the time she starts asking me for money.

2. Saving

For saving, I plan to incentivize her by matching her savings 401-k style. Something like, "I will give you 50% more of what you save, but the money that goes in that account does not come out unless we as a family agree that the purchase is worth your savings." That means that that money is not going to be spent on the latest fad or toy. Or ice cream and sandwiches with her friends. I'ma make her write an essay justifying her purchase every time she wants to pull money out of that account.

3. Budgeting

I really like the idea my mom has about this, even though of course I hated it growing up. Do not bail out your kids! Not for sales taxes. Not for lunch money. Not for bouts of pitifulness. If they don't have enough money, then they can't buy it. If they spent the money on something else, then they can't buy the thing they think they want. Let them learn about the tradeoffs that are associated with purchases of consumer goods. No one needs everything.

4. Investing

I have already opened a Coverdell Education Savings Account (this applies to Americans only), which is basically like a tax-free investing account that can only be spent on education expenses. Every year, I pick one stock and I put the maximum contribution of $2000 towards it. When my girl gets older, I hope that she will get actively involved with that selection. That'll be her stock!

When I was a kid, I was lucky enough to have a dad who let me pick two stocks for myself all by my lonesome. I picked 100 shares of Marvel Comics and 100 shares of Topps Baseball Cards. One did spectacularly well, the other... not so much. By the time Marvel had split three times and gone up a couple hundred percent, I was addicted to checking the ticker page in the business section of the newspaper everyday. At that point, I became an investor. And I have never looked back!

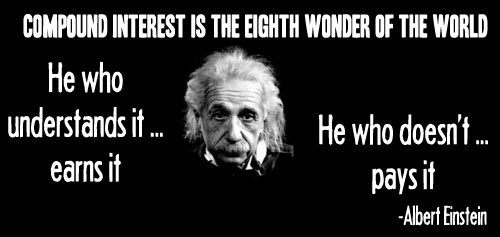

Lastly, when they are old enough (maybe 10, maybe 12, it really depends on their interests) I will establish a Uniform Gift to Minors Account (UGMA). I will stick the money into something safe, like an index fund, balanced mutual fund, or municipal bond fund, something that pays a healthy and regular dividend. I'll show them the statements every month and say, "You see, we didn't do anything at all and look at how our money is increasing every single month. This is called compounding!"

Like Albert Einstein once said, COMPOUND INTEREST IS THE GREATEST INVENTION THE WORLD EVER PRODUCED.

It's never too early to teach your children that lesson.

This post has received a 5.26 % upvote from @kittybot thanks to: @shanghaipreneur.

You got a 3.94% upvote from @bid4joy courtesy of @shanghaipreneur!

You just rose by 10.8696% upvote from @therising courtesy of @shanghaipreneur. Earn 43.8% APR & rise further by delegating SP to therising. For more details visit: https://steemit.com/budget/@therising/auto-daily-payout-of-43-8-apr-for-steem-power-delegations-starting-from-500-sp-only-limited-period-offer.