My bad financial decision is written all over this article. Are you thinking that I will be mentioning it outright? I’ll make it a bit interesting (hopefully). But, to give you a hint: it has something to do with family culture. This is quite a long story, so grab some popcorn.

Our family’s financial status sits below the poverty line set by NEDA (National Economic Development Authority). I discovered it upon seeking a financial assistance. However, we seem to get what we need. We are raised with contentment in mind. We never have our own family computer (a gaming console), television when we were young and other things that other people consider a necessity. I remember harvesting crab on a river with my elder siblings and sell them, sell salted eggs, and I-forget-some.

My parents managed to send me to high school. I also received support from relatives for my school supplies. But most of the time, I recycled the old ones. Since my parents cannot send me to college and that my well-to-do relatives support others, I searched for some financial assistance programs. I was pleased to have some. I was financially independent since then, I even contributed for family expenditures. I was able to buy all the things I need and some things I want.

I was not able to land a regular job right away for the following reasons: I am not so intelligent, not so smart, not so hardworking and not so skillful. Obviously, it did not result to what people call “flying colors” status of success. So, I end up doing part-times: computer-shop attendant; computer personnel of a local center of an international company; and both a private and center tutor. I think I earn too small. But, looking back, I never felt I am lacking. It strengthen my belief that money is not that important. I do not have savings. I do not think about the future. As long as I can buy what I need, then it is okay. Very okay.

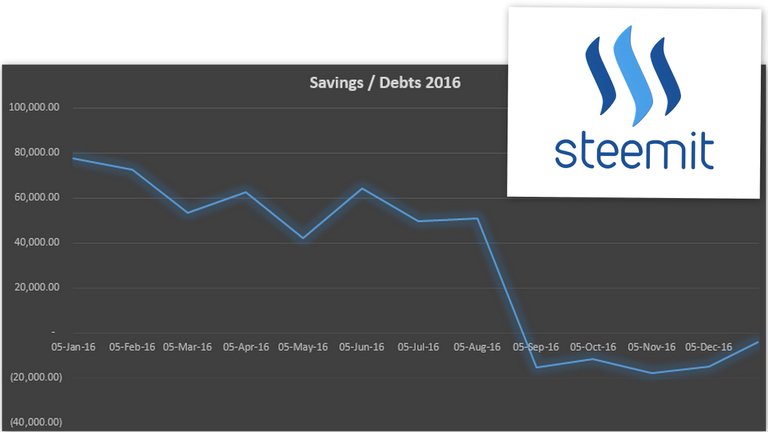

Three years after graduating, I finally land a contractual job in a state university. It was quite a tough decision since I have to reject an offer from a bank to be a roving teller. The easier part was just an assumption – work for only 40 hours a week, no work on summer, and better benefits. Setting aside other noise, I felt accomplished financially. I earn more, and yes I spend more. I still have the family culture, so I really don’t spend much on what I want. I cannot avoid saving, since I have more than what I can spend. You might guess it – regular savings account is what I meant by saving. Along the way, I read about concepts of investment… and then business finance… bonds… stocks. But, I never read ahead, I never really seriously think about it.

I already did the bad financial decision. Can you spot which one?

My next article might give you the idea if you still have none. This is Sep and this is my financial Chronicles.

You might want to check these steemers, as well. @atongis @dunkman @el-dee-are-es @franbel @iyanpol12 @shula14 @sn0white

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://sepchronicles.blogspot.com/

Welcome back kuya Sep!

This comment was made from https://ulogs.org

:D salamat. anggapo ni balo. aralen ko ni may technical analysis na trend ompano mas labay dan basaen man. MACD, CCI, RSI. pigara labat tan ed indicator no kapigan onatagey so trend odino onabeba. applicable tan ed commodities, stocks, futures, index, currencies, anggano ed bitcoin.

Thanks everyone! It's my first time to reach those upvotes! @surpassinggoogle is in the haws. :D