Since none of the posts being upvoted on this site are relevant to my interests, I decided to try and create the content that I wanted to see. Introduction, content, and analysis below:

I've been all-in on Bitcoin for many years now with every cent. It's a way to absolve yourself from the fraudulent fiat monetary system, while also having some large upside (and downside) potential at the same time. I trade on leverage and have generally been on the right side of the calls that matter, so Bitcoin has been good to me to thus far.

example:

We are now at a point where, extrapolating from past data, Bitcoin's upside potential from current state would be pushing around $4000 max before dumping hard in a shooting star bull run for a +6x if you sold at peak (if the mega bull run bubble actually occurred).

Having said that, after the outages on BitFinex recently, a lot of whales I know said they refused to use the site again, thinking they're just being flat out robbed. This means Bitcoin might have some liquidity problems on the US side of things until a new margin exchange opens for US traders, or Winklevoss ETF approval + Gemini brings in big volume as a catalyst. If Bitcoin wanted to make big moves today, it might need to be almost entirely China motivated until these issues are resolved.

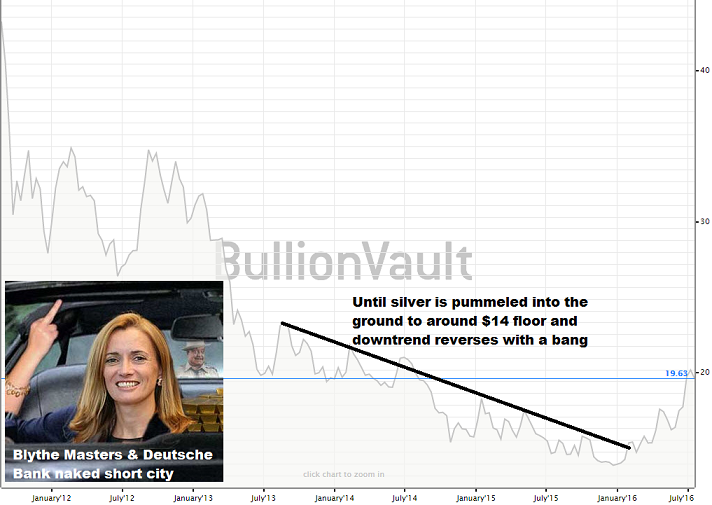

This brings us to silver:

You can see from the above two pictures, silver is just initiating the trend reversal off it's capitulation point, while Bitcoin is somewhat further down the road from it. Worst case, it could retrace to $18.6 or so before continuing to rise, but the post-rise dip might already be over. I'm personally not very worried over the small moves at this stage.

I already covered the best case scenario for Bitcoin upside in the near future, so what about silver? THIS is where it gets interesting. Silver comes out of the ground at around a 10:1 ratio to gold. Gold is not used for a whole lot of things besides monetary purposes, while silver has many industrial uses. It's the best conductor of heat and electricity, and is used a lot in things like solar panels (around 2/3rds an ounce).

For the long term, a lot of eco-fascists believe many of the metals we depend on will mostly be mined out in around 70 years or less from most easy to access areas. Silver is claimed to take less than half that time, maybe even 20 years. As for the much shorter term, we need to look at the historical gold to silver ratio, above ground estimates, and other indicators like Dow to gold ratio. First, let's start with the extremely controversial above ground estimates. There seems to be general consensus of around 4.5-5 billion ounces of gold. Most of this gold is refined bullion and coins sitting in vaults and can easily be brought to market.

For silver, it's a completely different story. The upper, high bound estimates of silver are around 20 billion ounces, but this is a misleading number. The vast majority of this silver (which might actually be far lower) is not in coins or bullion, it's in things like silverware sitting in storage that people don't even know they own, jewelry, decorative statues, art, etc.

There seems to be no consensus on the exact number, but I believe there's somewhere between 2-4 billion ounces of silver in coin and bullion form. As you can see, above ground, refined monetary silver that can easily be brought to market is lower than gold. If someone, for example, owned a $20 silver necklace, the silver price spiking by 500% and giving them a $100 necklace is not exactly a lottery ticket situation for someone. They're not that likely to try and melt it down into a coin, bar, or sell it for scrap unless the price spikes extremely high.

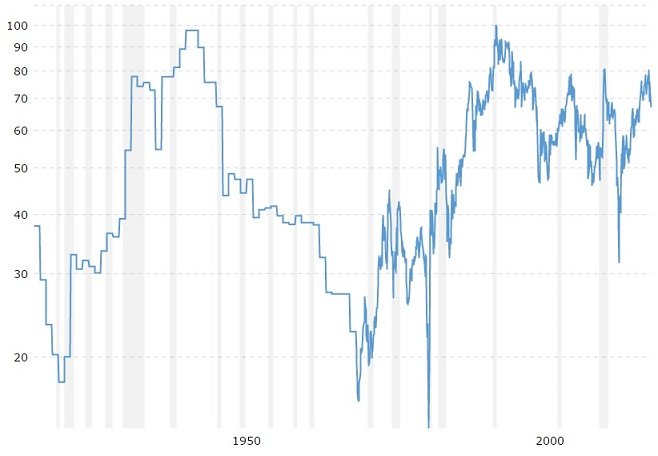

Now we get to historical gold to silver ratios.

One of the first things you notice is, the ratio has been in a suspiciously tight range on the top of the chart that's seen silver on the undervalued side of the gold to silver ratio for a while, likely being locked in place by algorithmic trading bots run by federal reserve proxy banks. It's also suspicious due to the fact that industrial use cases for silver have been exploding lately, and that recent drop to low 30's:1 ratio is likely a sign of things to come - silver getting out of control of the bankers.

Even with this tight range, you can also notice that when the ratio tops out, it usually does a full retrace or more back to where it came from - as in, the ratio appears to be at the top of a peak now with nowhere to go but down to 50:1 or less (current ratio is 67:1). This means that theoretically, the price of silver should move from $20 to around $27 or so in the near future if the price of gold was to just go sideways. The interest in silver for wealth preservation and industry both seem to be increasing, so I wouldn't be surprised to see that ratio blast right past 50:1 into 40:1, 30:1, or even lower in the future. Even though that chart is highly manipulated, my eyes tell me silver resides in a 30-40:1 average range within their manipulated system, with other movements outside of that being outliers. If the manipulation breaks, probably a lot lower ratio.

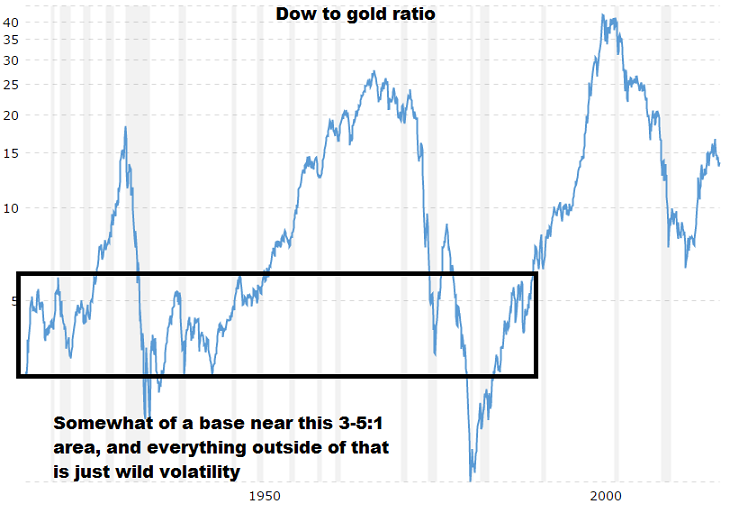

Next, let's look at another interesting number, the Dow to gold ratio:

As you can see, the price of the Dow is currently near the high side in relation to gold, and was obviously manipulated to prevent a crash with that last rise. We're at the top of another peak that appears to have nowhere to go but down, meaning the value of equities should decrease while gold and silver gain value. As I stated on the notes of the chart, I believe the Dow to gold ratio will revist that 3-5:1 range or lower sometime in the near future, probably lower with a real equity meltdown.

I do like seeing what guys like Greg Mannarino have to say from time to time, but gold prices of $10,000 are simply unrealistic to me without things like massive inflation and huge QE/helicopter drops. Price estimates for metals get very messy due to having to take inflation vs deflation into account. If the Dow is melting down to 6000, you're far more likely to be in a deflationary environment, and the most you could probably see gold is the $2000-$5000 range (silver probably $66 to $250) - and that's getting near a 1:1 gold to Dow ratio (it's possible).

Many people believe things like metals are not useful in a deflationary crash. This is completely untrue. What happens is, the first people to panic at the top with inflated prices on their risky or fraudulent assets need a safe haven to transfer all that inflated value to. They instantly pile into the safest assets they can find to try and preserve their ill-gotten gains. When stocks are imploding and banks are going under, plus having bank holidays, fiat 0's and 1's in a computer do not fit the bill. The safest assets get pumped even in the process of deflationary crash unless the deflation is so huge that it risks freezing the system and grinding it to a halt. In that case, you would not want to own any assets tied to that system anyway, because that's right around the point they would unleash hyperinflation to try and stop it.

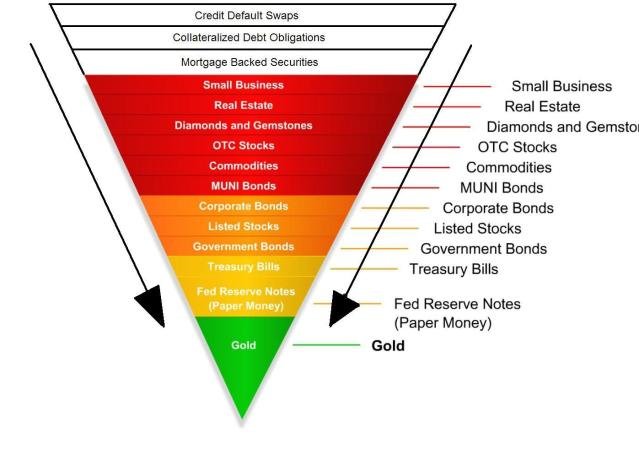

While not the end all solution to your monetary questions, the Exter inverse pyramid is a good example of this:

What's happening here is, people in a deflationary environment are dumping all this fraudulent garbage at the top as fast as their arms can because none of the stuff is liquid, thus worth nothing. The first man to panic wins. The only real disparity is some people will claim federal reserve notes belong at the bottom of the pyramid with metals above it, which is a complete joke to me personally.

The general theme derived from the several charts above is, things like silver can have good upside even in a deflationary crash, because when everything is marked to market, the metals (especially silver) were typically undervalued beforehand, while everything else was overvalued. Bitcoin is more unknown in this regard. The placement of Bitcoin on something like the Exter pyramid is definitely nowhere near the bottom. Most of the population doesn't even know what a Bitcoin is, let alone trust it in a panic situation. The metals market would obviously absorb far more money in mass hysteria.

The one thing Bitcoin has going for it in this situation is, if everyone has cleared out all the local pawn shops of their gold and silver, Bitcoin is definitely one of the biggest alternative low hanging fruits for people to exit the existing fiat system in emergency. They would likely not be doing such a thing without having some big inflation involved, though.

The bottom line is, silver wins big right now no matter if there's deflationary crash or inflation, while Bitcoin is relying more on an inflationary type environment. I still own both assets, but I feel silver currently has the big upside potential Bitcoin is famous for while having less risk. If the price of silver goes to $50-100 in a flash, then we might re-frame that discussion as to what the best bargain is, but it's currently cheap.

Bitcoin would likely see some huge valuations by a 2020 time period, but first you have to get past the equities crashes, wars, and whatever else happens between now and then. This post likely comes off more bearish than it should be, but that's just because it's from the viewpoint of someone who was 100% all in on Bitcoin, and is now hedging some back to silver.

Edit - The 2008 crash

Some people will say, hey, if you try to backtest this against the 2008 crash, it doesn't work out quite like you say. I believe when the 2008 crash occurred, the fed and it's zombie banks monkey hammered metals down to try and prevent them from appearing to be a safe haven asset. When you can print infinite amounts of paper money, these are the type of gravity defying events you can accomplish, but only in an unsustainable short term.

People see things like this occur enough times and think it's an economic law, that things like this will always happen with metals in a crash if it involves even a hint of deflation. The ability to buy everything on the planet with worthless paper or naked short it to zero is an obvious bubble activity that is not going to work out like this every time. The physical and paper markets eventually diverge. It's easily possible, and even probable, that flight from the risky assets to safer assets to try and preserve their bubble gains sends the metals high. The fed just always tries to artificially prevent that from occurring to keep people inside their system.

In the case of the 2008 crash, this was also what I referred to in the article as deflation posing a systemic risk of freezing the system. Even though they temporarily monkey hammered metals down to *appear* to crash a small amount along with equities, they then had to initiate QE right afterwards in order to prevent the system from grinding to a halt, which saw the price of metals jump a lot. Had they not done QE and just let the system collapse, those assets near the top of the Exter pyramid would have been rapidly decreasing in value far more than stuff like metals at the bottom, so you gain in purchasing power regardless.

This is why metals function well in both inflation as well as deflation. The worse the deflation is, the faster sketchy assets lose value in relation to metals, and the more likely they are to respond with hyperinflation to offset that. If they choose to do nothing and let it collapse, or their solution itself causes collapse (hyperinflation), you're far better off owning a piece of gold or silver during a Mad Max event than a Netflix stock or federal reserve note that may have become worth nothing.

Welcome aboard.

The problem with the deflationary crash is the selling pressure from the masses that are scrambling for cash. As your next bill or rent payment approaches, and money becomes ever scarcer to find, you are tempted to start selling your gold - because there is no other option to find easy cash. And as more people do that, there's a pressure from the low-end.

Fortunately, countries like India have a constantly devaluating currency and thus people there are buying PMs in insane quantities to counter the west deflationary issues.

(The west operates a system where the small guy / average person is deflated - making liquidity hard to find - while the big corps, banks, stock markets are swimming in QE liquidity and seeing no deflationary issues)

I added a part going over the 2008 crash, as I believe just glancing at the numbers gives an unrealistic view of what happened there.

"Even though they temporarily monkey hammered metals down to appear to crash a small amount along with equities, they then had to initiate QE right afterwards in order to prevent the system from grinding to a halt, which saw the price of metals jump a lot. Had they not done QE and just let the system collapse, those assets near the top of the Exter pyramid would have been rapidly decreasing in value far more than stuff like metals at the bottom, so you gain in purchasing power regardless."

Excellent point. PMs can win even in scenarios like relevant devaluation compared to other assets.

One of the factors for this is that PMs are global while real estate, stock markets, etc are national. Say there is a large deflationary economic crisis in the US. People start selling their land, cars, stuff, stocks etc dirt chip, due to searching for liquidity. They are also selling (some of them) their metals. But at that same instant, in some other country with inflation or devaluation, this extra supply of metals is a gift from heaven because they can buy PMs on discount. But they can't really buy american land, cars, boats, stocks, etc (which leads to further crushing of their price due to barriers between economies).

I knew that's the reason I wanted to convert cash and time to crypto..

I'm considering selling silver and gold for STEEM and SBD>

https://steemit.com/introduceyourself/@bayareacoins/3stu7f-hi-i-m-bayareacoins-from-bitcointalk-i-m-considering-offering-gold-silver-and-other-rare-items-for-your-steem-sbd-coins-because

I'm thinking you don't own enough silver, but I guess I would be biased. I forgot to mention in my post that I'm sticking entirely with government minted American Eagles, maybe some Canadian Maple leafs or possibly Australian coins, due to the fact that there's SO MUCH counterfeit crap coming out of China now. It tends to be easier to spot fake eagles and maples when they have to match a certain size, weight, and distinct features, etc.

How would you be bias about how much silver I own? How much do you think is "enough silver"?

I'm a platinum member on APMEX, so I tend to only shop with them... no Chinese knock off worries :).

I love Ted :D

Really nice, informative article. Would love to see you discuss some of the best ways to gain exposure to silver. Maybe that will be volume 2.

I also want to say I agree with one of your article's commenters who pointed out that bitcoin's market cap is relatively so small that it wouldn't take much capital flight toward bitcoin to spike the price pretty dramatically.

At the expense of Bitcoins , I fully support .relatively so small

Trying to decide on vol 2 for the future. Mining stocks have a higher upside than the metals themselves, but you also have issues like their location being in unfavorable territory where some type of 3rd world government can just come in and shut them down, kick them out, stop them from mining, whatever. You also have to figure out if all their costs and reserve estimates are legit. There's a lot of due diligence involved.

The information also goes stale faster. If I say some mining company is good now, it might not be a day or two later when someone actually reads this from price changes. There is also another argument, which I'm not sure if I buy or not, that people who make megabucks off mining stocks in an economic crash will have the government come in and take most of it in a windfall tax. Most people who are heavy into mining stocks also own lots of the metal themselves in their house, so that should tell you something.

Well, nice write up but I think that stuff like crypto is going to absorb a lot of these money flows at some point.

Remember that these buying manias seem to flow into sectors. From housing to commodities, to equities... and so on.

We haven't seen the real crypto mania yet. I don't know when it will come (best guess is in about 10-15 years) so better stack what you can and be prepared.

The argument against silver is that a lot of its industrial demand will crash heavily in both a deflationary or inflationary environment. If the system seizes up - there simply won't be any capital flowing to any industry that consumes silver. There is also the argument that silver is no longer monetized and the elite who will hold 95% of global capital aren't interested in silver, only gold. You're safer hedging your bets with the UHNWI, rather than the plebs that carry only debt-based assets (eg. Fiat).

Having said that - silver was demonetized partly to fuck over the chinese, whom stacked it on masse many moons ago and they now love silver again, and this time have a better hand than much of the west with their gold and other hard asseta, including infrastructure.

Look, there are so many confounding inputs and outputs and times are different - so knowing how this plays out is still up for debate. You want all 3 assets with the largest portion in gold because gains are there no matter what. Silver and Bitcoin carry much more risk but will pay immense yield if they win.

The trick is to remember that energy underpins the entire system. Does bitcoin work in a scarce energy environment (oil)? I suppose it will as bitcoin farms are fuelled by other types of energy supplies that will remain plentiful eg. Solar, hydro and coal. Silver as the poor man's gold is relying heavily on the new lower class stuck in poverty to provide the demand for silver when their bank accounts are empty.

You brought up a few points that I wanted to address, but I thought it would make the page too long. One being, it's not all that hard to utilize gold and silver for transactions with random people selling big ticket items. If a guy is selling something like a boat, you can say, I'll take it if you'll accept payment in gold and silver bullion, and usually get some interest.

The key factor here is, it's ingrained in people's minds that gold is extremely valuable, while less people know about silver. American silver eagles are very liquid - the most liquid form of silver, but it's far more easy to get some random person's attention by mentioning gold. If you wanted to keep your current bartering ability as high as possible, while also trying to keep your upside potential high, you'd likely want to go 50/50 gold and silver.

For people who are in it for the potential windfall profits, a 70/30 silver to gold, or even 100% silver allocation makes more sense. Gold also has extreme granularity issues. It's not like Bitcoin where you can just keep dividing it down lower and lower. If the price of gold skyrockets, people don't start trading atoms of gold; that market cap spills over into the silver market.

As for what types to go for, if buying gold you should probably be getting 1 oz government issued coins, as they're the smallest size you can get with low premiums. Anything smaller than that with gold is pointless to me as the premiums go much higher. For silver, the low premiums are in 1 kg or 100 oz bars. You can find low premiums in some non-governmental rounds like 1 oz Sunshine Mint, but people tend to trust government issued coins far more.

Having said that, 1 oz silver coins would probably be the most useful metal and coin size combination possible in a real economic collapse - and you do get the premiums back when you resell them - plus Eagles being the most liquid form of silver, so I lean heavily towards 1 oz silver coins with a few 100 oz bars here and there.

Thanks for the article!! Thanks for backing your opinion up with technical analysis! You make some good cases for silver in deflation scenario and BTC in hyperinflation scenario. We will see, what will happen?? Helicopter money or deflationary panic crash, maybe both over a shorter time than we think? I like where you said, "Most of the population doesn't even know what a Bitcoin is, let alone trust it in a panic situation. The metals market would obviously absorb far more money in mass hysteria. " Probably true, but only needs to be a small percentage into BTC to move the ol price needle quite a bit because of the small market cap of BTC. It's been really fascinating watching BTC getting a piece of the safe assets trade pie as of late! Keep posting!

The inflation vs deflation aspect is the hardest part to tackle. It's worth owning some of both just so you can say, no matter what happens, I have defied the bankers and opted out of their system. Whatever you gain or lose after that point doesn't matter when it's something you know you have to do out of principle. You should probably just make the least risky asset as your base asset so you don't end up living in a cardboard box.

Very thorough write-up, well done r0ach. If you don't mind me asking I'm curious as to what your professional background is, day trader? Finance? Fin-tech? You have a very varied knowledge set between tech and finance, just curious.

I started off in graphics like the Gavinator, got into some programming through MEL, then Python. Decided if I wanted to make some money, it's easier to go straight to the source and get into something benefiting from financialization instead of inadvertently acquiring it through a less efficient path. Went all in on gold at $4xx shortly after. Needless to say, I've liked metals ever since, then I got into Bitcoin after that. I've never liked stocks all that much and far prefer more concrete things like commodities. I figure someday everyone will figure out this is an effective strategy and attempt to make money by shuffling papers around on leverage, then the world collapses and everyone dies.

Cool stuff, you've got a very interesting perspective, I do hope you keep posting.

Great article, I too am big on silver at the moment. Thanks!

Steemit Crypto Mag | Issue #1 | 25 July 2016

https://steemit.com/money/@darknet/steemit-crypto-mag-or-issue-1-or-25-july-2016

YES! content that I can dig... I appreciate you putting this out there. I will have some like this to follow. I was chopping at the bit to buy BTC on that triangle break at 455 but missed the entry and now I want to punch my own nuts.

Dang bro. I like silver to but not that much. I rater go to Area 51.

https://steemit.com/area/@steve-mcclair/area-51-steemit-has-arrived#comments

The Manhattan project used enormous quantities of silver, so you might be able to find some if you jump the fence.

this is a very well written post indeen, will keep an eye on yo're blog

Great 2015 BTC call, and awesome silver analysis. I'm at probably a reverse position as you, silver/gold vs. BTC, ever since discovering the fiat ponzi a couple years ago. So I bought a lot of silver in the low- to mid-$20 range. But I have a long term perspective. I would highly recommend the McAlvany weekly commentary. They are hard money advocates and release a podcast every Wednesday morning. The one today with Richard Duncan made me think... Great post, I'll be following you.

Wow, a very interesting read . :)

Is this r0ach the Eth shill from bitcointalk?

Edit-- you are!