Economic bubbles... We all remember the American housing bubble that triggered the credit crisis in the USA in 2007. Seven years earlier, investors lost a lot of money when the Dot-com bubble burst. Investors never seem to learn from previous bubbles, because spotting a bubble is not always easy. Of course it's easy afterwards, but even while a market is in a bubble it can always go higher. Even much higher!

The Everything Bubble

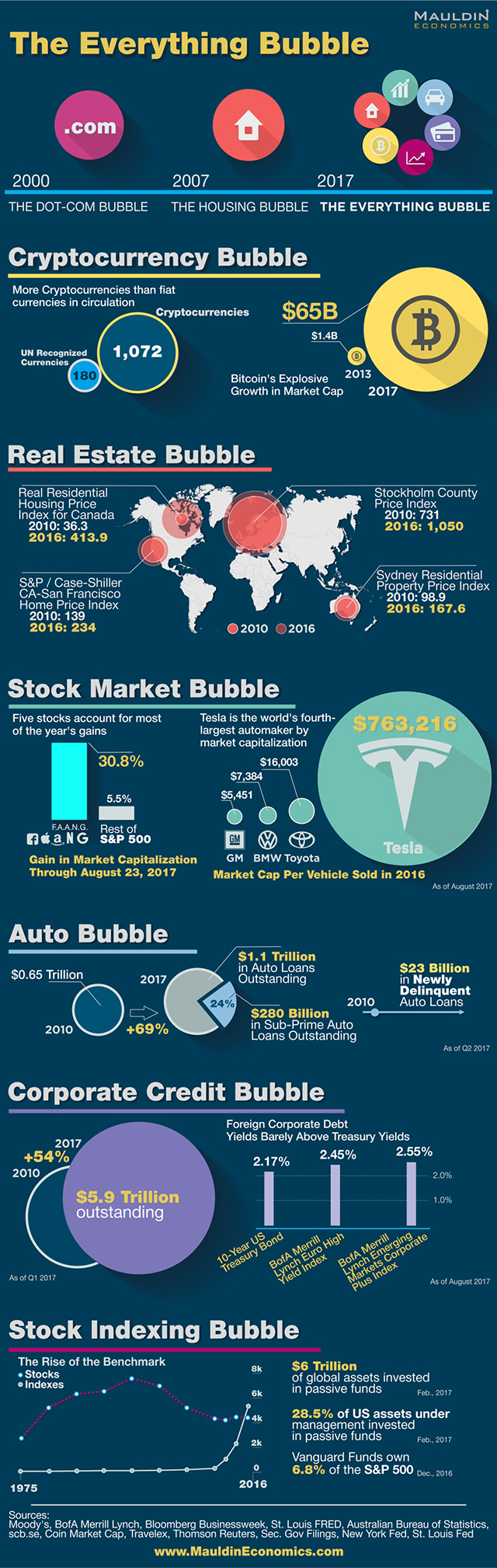

According to Jared Dillian, economist at Mauldin Economics, everything is a bubble at the moment. Together with his colleagues at Mauldin Economics he created the infographic below to show us all the bubbles he believes we are currently dealing with.

In 2000, we had the dot-com bubble.

In 2007, we had the housing bubble.

In 2017, we have the everything bubble.

S&P 500 Stock Index

Is the stock market in a bubble right now? Below is a chart of the S&P 500 Stock Index. How can one argue this is not a huge bubble? Can the index go higher? Sure, but corrections and crashes will always come one day. No asset goes straight to the top without corrections and crashes. The last correction was in January 2016 and the last stock market crash was during the crisis of 2008. We haven't seen a correction in almost 2 years. This is not normal! Look how overbought this market is on the RSI indicator in the chart below. A correction will surely come, you just don't know exactly when.

Cryptocurrencies

Do you remember when the Bitcoin bubble burst when Bitcoin Exchange Mt. Gox collapsed in 2013? Below is a chart of the total market capitalization of all cryptocurrencies. As you can see the bubble of 2013 was nothing compared to today's prices. The question remains if cryptocurrencies are in a bubble right now? Only the future knows.

To put things in perspective...

| Asset | Value |

|---|---|

| Value of all gold in the world | $7,823 billion |

| Value of all companies on the NASDAQ in March 2000 | $6,710 billion |

| Value of all Apple stocks | $805 billion |

| Value of all Google stocks | $679 billion |

| Value of all Facebook stocks | $498 billion |

| Value of all cryptocurrencies combined | $154 billion |

| Value of all Bitcoins | $80 billion |

| Value of all STEEM | $243 million |

As you see... If the cryptocurrency market is currently a bubble then it is a relative small one.

Which bubble do you think is going to burst first?

What was the source of your numbers above, especially for gold? It would be interesting to look at today’s stock market cap. I would also add the bond market which more obviously in bubble territory

Here is the source for the value of all gold: http://onlygold.com/Info/All-The-Gold-In-The-World.asp

For the market capitalization of a company you can just google 'stock company name'. Stock Apple for example.

The biggest one is the debt bubble. Treasuries and Co.

This is a very old topic, I agree with you, if there is bubble in things like bitcoin, the bubble is too small to burst so far.

Thanks for sharing

Upvoted for great content

Regarding Bitcoin :

If bubble is defined quantitatively as an exponential increase in price over a short period of time.

Than yes, it is a bubble.

From a qualitative perspective I do not think it is though.

I fucking love this article, and that infographic is pure gold!

It's like a multibubbleverse

Regarding the infographic: comparing the number of cryptocurrencies to the number of UN recognized Fiat currencies doesn't give it much credibility. There are no UN recognized cryptocurrencies, they're not really comparable entities anyway.

Great post! I always have a hard time explaining to people that the crypto bubble is still relatively small.

Still think we're barely even reached bubble stage, if this was the dot-com bubble, we'd be in 1996/1997 (as an analyst predicted recently), so I think it'll be a few years before it pops. There's still the need for some real institutional/hedge investment to pump up the prices from Goldman Sachs & co, more widespread adoption of crypto. Only when we delude ourselves into thinking we don't need fiat, because 5-20% of the population use crypto, when the price of Bitcoin is 50,000/100,000+, then it'll be a the bubble will pop.

The situation we're in now is beyond insanity. A correction is much needed across the board. It would be very painful, but is much needed. The runaway money printing by central bankers has created an environment of utter chaos. How long can it go on? Who knows. When you can simply print your way out of every problem it could last for some time. I wonder if we'll see helicopter money in it's true form, ala a living wage to keep the wheel turning.

Nice man, I have been reading Mauldin's letters for years. Met him in person way back in 2002. Jared's stuff is good as its short and to the point.

I think the bubble term is thrown around a lot just because its a trigger word. Your last chart shows some really important numbers. All of the crypto universe isnt even worth a quarter of Apples stock. there will definitely be some peaks and valleys but I think it is way too early for a bubble (then again, what do I know). Once crypto hits the one trillion mark then we can start talking haha

I'm missing the fiat bubble or debt bubble, it's real and I think it certainly will burst at some point. Currencies based on property instead of debt are so much better, from both a technical and ideological viewpoint.

True, most assets are in a bubble nowadays. And there's another major bubble that has been called the "money bubble." The Fed, the Bank of Japan, and the European Central Bank have all printed truckloads of money in their QE programs.

Soon, the chickens will come home to roost and the SHTF. All overvalued assets will come crashing to their actual worth -- including stocks, bonds, property, and fiat currencies. And since they've been printing so much of the latter (and will likely continue to do so), we'll get inflation and quite possibly hyperinflation. It's almost inevitable.

As for cryptocurrencies being in a bubble, I think that is a moot question. A bubble means that something is far overvalued. One can argue that bitcoin, steem, and other cryptocurrencies have not yet reached their actual value, and are in fact still UNDER-valued.

The other sole assets that remain undervalued are the precious metals. After 5 years of a precious-metals bear market and price suppression, gold and silver in particular are insanely cheap.

As an uneducated guess I think it will be Facebook. Its too trendy now, but lacks consistency and is bloated with adds. It will happen just like MySpace

We have been waiting for the bubble to burst for 10 years.. I think it’s just MOOR of Japan style now. Gravity doesn’t seem to exist with constant printing.. just slow death by food inflation :(

If one asset class was in a bubble, I'd totally agree. However, its not one asset class, its everything. And thats due to the fact that we have an enormous global debt problem and extremely low interest rates. There is no incentive in government to fix it so the only way this gets resolved is through creation of money which pushes prices higher, which promotes people to take money out of savings and invest in these assets. People will not sell assets until they get rewarded for saving.

Even if we started a deflationary cycle, it wouldn't take long for the Fed to come in and prop it up. I honestly believe its more likely that we get faster inflation before we get any kind of deflationary sell off. And thats the thing about bubbles. They can get huge before they pop. Would need a paradigm shift or black swan before this changes.

Just because prices seem to be going up does not mean we are in a bubble. I think the real issue is not over-valuations, but rather the rush to get out of cash into literally anything. The lone voices calling for the end of currencies have turned into a crescendo of sirens. If you were in Zimbabwe when the currency collapsed, you wouldn't have said that prices are in a bubble. If you are in Venezuela today, you would do anything you can to turn your Bolivars into something tangible like gold, bitcoin, or American dollars. You wouldn't call it a bubble. You'd see it as falling value of the currency.

One of the first signs that currency is about to fail is rising prices. people see opportunities for profit everywhere.

In pre-war Germany, its citizens didn't wake up one night saying "all my money is worthless. I'd better put it in a wheelbarrow and light the fire with it." The end of the currency started with opportunities for profit. You could buy land, buildings, food, animals shares of businesses, commodities, gold or, foreign currency and the prices would rise. There were profits to be made in everything. It wasn't a bubble. It was a currency decline. The great German empire had spent too much fighting wars and paying reparations, and could no longer service its debt. so it resorted to printing the difference.

In my opinion these is not a bubble yet to explode... but no one knows. As long as people keep on adopting it there is no bubble to be called like fiat money.

The bubble term keeps pop up and yet no "KABOOM", that's why top dollar is paid to those tiny few that keeps scaring the shit out of us and still make more money in/after the bubble.

Much of this feels whimsical in the way the ebbs and flows happen to the valuations and price levels. People have a blind trust to the system and don't seem to be protecting themselves in the larger scope. Just because the system has been plodding along in this fashion for years doesn't mean it can't suddenly stop. It really only takes a single domino to fall to take out the ENTIRE design, as we have seen in other "popping events".

Here is something I just found on Sciencedaily.com that relates to this very subject of price bubbles.

Raging Bull: First study to find link between testosterone and stock market instability

Remember your own charts here: "Be careful what you call a top"

Prices are controlled, markets are rigged, and "nothing happens by happens so".

Thanks for sharing , I think the housing bubble is continually spiralling - well here in the uk the problem has now elavated the rental market which is unsustainable due to the amount of people not affording to first get on the housing market. It's almost like a landlord bubble which governments are trying to cap , everyone needs a home and needs to make money to secure that home but the opportunity to break in is becoming ever harder and further away for first time buyers.

In contrast the crypto currency - Lot of people are now priced out of the bitcoin due to the escalating costs and risks involved , it's very volatile but at least people can still get a piece of the pie being a fraction of a bit coin, but the rich - celebrities alike are getting a piece of the action which only helps inflate the bubble, they can also afford potential crashes depending on how much they initially invested of course.

Certainly the Value of all companies would be the one affected most :)

That was very enjoyable and informative . A sincere thank you for sharing this .

Some they, bitcoin is bubble 😃

Maybe one day Bommm

and very lass currency

thank you for shared

Facebook!

Thanks for sharing.

Good perspective. Thanks for sharing it.

I genuinely think Bitcoin is a bubble, but it won't cause a complete collapse. The price will be stabilized on a reasonable price.

But I may be wrong, all I care are coins backed by value, like Steem, LBC and Gridcoin. And Ether, to an extent.

The silver bubble goes first... I hope it takes JP down with it.

bitcoin can be in bubble. It is us who has to handle our profit or loss. Dont put all the eggs in one basket.

nice job putting things in perspective.