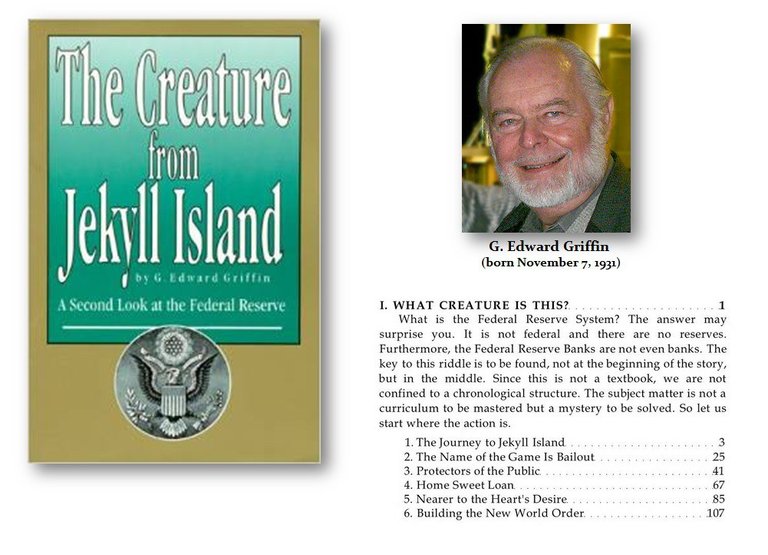

Hey guys I'm back with another breakdown post. This breakdown is Chapter 2 of The Creature from Jekyll Island by G. Edward Griffin. The name of this chapter is The Name of the Game is Bailout. I hope you enjoy and learn something from this post. Lets get to it...

This chapter starts by stating that the Federal Reserve has similarities to a professional football team:

First, there are certain plays that are repeated over and over again with only minor variations to suit the special circumstances.

Second, there are definite rules which the players follow with great precision.

Third, there is a clear objective to the game which is uppermost in the minds of the players.

And Fourth, if the spectators are not familiar with the objectives and if they do not understand the rules, they will never comprehend what is going on (this is the vast majority of Americans today).

The name of the game is BAILOUT.

The game begins when the Federal Reserve System allows commercial banks to create checkbook money out of nothing. The banks derive profit from this easy money, not by spending it, but by lending it to others and collecting interest. When a loan is placed on the bank's books it's shown as an asset because it's earning interest and, presumably, someday will be paid back. At the same time an equal entry is made on the liability side of the ledger. That is because the newly created checkbook money now is in circulation, and most of it will end up in other banks which will return the canceled checks to the issuing bank for payment. Individuals may also bring some of this checkbook money back to the bank and request cash. The issuing bank, therefore, has a potential money payout liability equal to the amount of the loan interest. When a borrower cannot repay and there are no assets which can be taken to compensate, the bank must write off that loan as a loss.

However, since most of the money originally was created out of nothing and cost the bank nothing except bookkeeping overhead, there is little of tangible value that is actually lost. It's primarily a bookkeeping entry. The loan asset is removed, however, the money liability remains. The original checkbook money is still circulating out there even though the borrower cannot repay, and the issuing bank still has the obligation to redeem those checks. The only way to do this and balance the books once again is to draw upon the capital which was invested by the bank's stockholders or to deduct the loss from the bank's current profits. This would cause the bank to lose an amount equal to the value of the defaulted loan, making the loss very real. If the amount of bad loans exceeds the entire value of the owner's equity, the bank becomes insolvent.

This concern would be sufficient to motivate most bankers to be very conservative in their loan policy. But the Federal Reserve System, The Federal Deposit Insurance Corporation (FDIC), and the Federal Deposit Loan Corporation now guarantee that massive loans made to large corporations and to other governments will NOT be allowed to fall entirely upon the bank's owners should those loans go into default. This is done under the argument that, it these corporations or banks are allowed to fail, the nation would suffer from vast unemployment and economic disruption. The end result of this policy is that the banks have little motive to be cautious and are protected against the effect of their own folly.

A single loan to a 3rd world country netting hundreds of millions of dollars in annual interest is just as easy to process, if not easier, than a loan for $50,000 to a local merchant on the shopping mall. If the interest is paid, all is well. If the loan defaults, the Federal Government will "protect the public" and make sure that the banks continue to receive their interest. The individual and small businessman find it increasingly difficult to borrow money at reasonable rates, because the banks can make more money on loans to the corporate giants and to foreign governments. The public will not swallow the line that bailing out the little guy is necessary to save the system. The dollar amounts are too small. Only when the figures become mind-boggling does the ploy become plausible.

It's important to remember that banks do not really want to have their loans repaid. They make a profit from interest on the loan, not the repayment of the loan. If a loan is paid off, the bank merely has to find another borrower. It's much better to have the existing borrower pay only the interest and NEVER make payments on the loan itself. One of the reasons banks prefer to lend to governments is that they do not expect those loans ever to be repaid. There are few recorded instances in history of governments actually getting out of debt. No one lending money to our Government by buying a Treasury Bill expects that it will be paid at maturity in any way except by our Government's selling a new bill of like amount.

Eventually the borrower comes to the point where he can no longer pay even the interest. Now the play becomes more complex. The bank does not want to lose the interest, but it cannot afford to allow the borrower to go into default either, because that would require a write-off which could wipe out the owner's equity and put the bank out of business. So the bank's next move is to create additional money out of nothing and lend that money to the borrower so he will have enough to continue paying the interest, which by now must be paid on the original loan plus the additional loan as well. A disaster is converted into a brilliant play and major score. This not only maintains the old loan on the books as an asset, it actually increases the apparent size of that asset and also results in higher interest payments, thus, greater profit to the bank.

A second method used by the banks is rescheduling. Rescheduling usually means a combination of a lower interest rate and a longer period for repayment. It reduces the monthly payment but extends the period further into the future. it postpones the day of reckoning, but in the meantime, the loan remains as an asset and the interest payment continues.

Once the borrower realizes he can NEVER repay the capital and flatly refuses to pay interest on it, then it is time for the Final Maneuver. Request that the game is extended...the reason is that this is in the interest of the public. Members of the banks and defaulting corporations will join together and approach Congress. They will explain that without assistance from the federal government, there will be dire consequences for the American people. There will be unemployment, hardship, and massive disruptions in the world markets. Congress must provide money to the borrower, either directly or indirectly, to allow him to continue paying interest on the loan and to initiate spending programs which which will be so profitable he will soon be able to pay everyone back. The borrower will agree to accept the direction of a 3rd party referee in adopting an austerity program to make sure that none of the new money is wasted. The bank will also agree to write off a small part of the loan as a gesture of its willingness to share the burden. A small step backward to achieve a GIANT stride forward. After all, the amount to be lost through the write-off was created out of nothing in the 1st place and without this Final Maneuver, the entirety would be written off. Furthermore, this modest write down is dwarfed by the amount to be gained through restoration of the income stream.

One critical part of the Final Maneuver is for the government to provide the credit for the funds. That means to guarantee future payments should the borrower again default. Once Congress agrees to this, the government becomes a co-signer to the loan, and the inevitable losses are finally lifted from the ledger of the bank and placed onto the backs of the American taxpayer. Money now begins to move into the banks via a complex system of federal agencies, international agencies, foreign aid, and direct subsidies. All of these mechanisms extract payment from the American people and channel them to the deadbeat borrowers who then send them to the banks to service their loans. Very little of the money actually comes from taxes. Almost all of it is generated by the Federal Reserve System. When this newly created money returns to the banks, it quickly moves out again into the economy where it mingles with and dilutes the value of the money already there. The result is the appearance of rising prices, but which, in reality is a lowering of the value of the dollar. The American people have no idea they are paying the bill.

The FDIC guarantees that every insured deposit will be paid back regardless of the financial conditions of the bank. The money to do this comes out of a special fund which is derived from assessments against participating banks. The banks, of course, do NOT pay this. As with all other expenses, the bulk of the cost ultimately is passed on to their customers in the form of higher service fees and lower interest rates on deposits.

Depositors are told their insured accounts are protected in the event their bank should become insolvent. To pay for this protection, each bank is assessed a specified percentage of its total deposits. That percentage is the same for all banks regardless of their previous record or how risky their loans. Under such circumstances, it does not pay to be cautious. The banks making reckless loans earn a higher rate of interest than those making conservative ones. They are far more likely to collect from the fund, yet they pay not one cent more. Conservative banks are penalized and gradually become motivated to make more risky loans to get their "fair share" of the fund's protection. The FDIC is not a solution to the problem, it is part of the problem.

The FDIC "protection" is not insurance in any sense of the word. It is merely part of a political scheme to bail out the most influential members of the banking cartel when they get into financial difficulty. This is a last resort. If the bank is rescued in this fashion, management is fired and what is left of the business usually is absorbed by another bank. The people who create the problem seldom suffer the economic consequences of their actions. The FDIC runs similar to banks...their financial exposure is much larger than the safety net which is supposed to catch it. When the funds run out, the Federal Reserve provides the balance in the form of freshly created new money. This floods through the economy causing the appearance of rising prices and the lowering value of the dollar. The final cost of the bailout therefore, is passed to the public in the form of a hidden tax called INFLATION.

Well there you have it...a breakdown of chapter 2. If you made it this far, then you are a trooper. Thanks for reading and if you enjoyed please leave an upvote and feel free to resteem and share with the community. Moral of the story...keep buying Bitcoin and cryptos and take the power away from the Federal Reserve and all Central Bankers. Thanks for everyone's support.

Take care and stay safe out there,

Pete

Nice post with great and useful article by @pbgreenpoint

Content is very important to new crypto users like me...

Wel done my dear friend...

Thank you so much sharing your valuble knowledge with us...

Cheers!.....

Glad I could help. Thanks for reading, commenting, and for your support!

that was wonderful to read glad to find your post :)

good to see your content

Thanks for the support. Glad you enjoyed!

After i found crypto my perception was completely changes towards bank. Before i didn't saw any thing wrong with bank but after i got to know about crypto i was wrong.

You're ahead of the game. Great time to be in cryptos. Bitcoin is on fire right now. Lets hope it can take the power away from the central bankers.

Yeah its a great time. sure crypto will take power away from the centralized banks

Hi....................Dear @pbgreenpoint

Nice location.

Valuable article.

Voted, resteemed and followed.

Cheers!

That's Awesome! Thanks for the support. Bitcoin just soared past $3200. Things are looking good!

The bank guy started to feel worry now as the blockchain technology emerges!

In the future, people will have control over their money :D

I hope so!

problem is public needs loan for a better life shown in movies or tv

Ha! Can't argue with that...

Another great review. Here is a short clip on banks, war and debt from the movie; The International.

Great vid! War is Racket. Very profitable for the few, but extremely profitable for the central bankers. Great share.

Wow I thought chapter one was great, it seems like it's just getting better and better :D

Society now understand that banks are not an option, and those who work online do not use them. Or use them in the best way

The problem is that most of society is clueless when it comes to banking. Hopefully people will begin to see what is really going on...

The decentralized era has arrived!

folow me

No thanks.

PS you spelled "follow" wrong