After I started my first professional career at one of the Fortune 500 Technology Company with $37,000 salary in 2009, it did not take too long to realize that I will not achieve my life-time financial goals with given salary. So, I rapidly changed my mindset– the way I roll my wealth. I am writing this post hoping to share my experience and knowledge to help you achieve your financial goals.

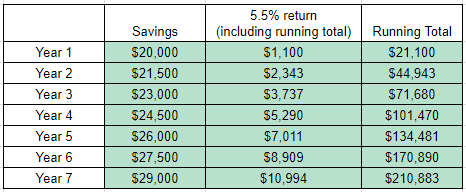

To become a rich, what you have to do is build nest egg and then invest - let it roll - make money work for you. Assuming you don't have nest egg yet, my recommendation is to save as much as possible for 7 years. Let’s assume maximum amount you can possibly save is $20K per year with increment of $1.5K every year and expected return is 5.5% (assume savings are invested). After 7 years, your nest egg will be little more than $200K.

If your nest egg is $200K, your investment will generate more than $10K itself with expected return of 5.5%. Once you reach this point, you can comfortably reduce your savings by half on your 8th year and you will still accumulate more wealth than your 1st year's saving amount. It also means you will have extra spending budget (if you decide to reduce your savings by half) to buy a nice car or nice bag while your nest egg continue to run snowball effect on your net worth.

It does not mean you have to stop aggressive saving after year 7, nor finding a way to earn more money. What it really means how you can change your life forever by sacrificing only 7 years. It is critical for all readers to understand that 7 years of saving starting from TODAY is way more important than 30 years of saving after year 7 from today. This is because of the snowball effect (compound interest rate). Please remember only thing can block your success is you and you can have financial success with ordinary income. (How to become a millionaire with ordinary income?)

Rich is relative term and you should feel you are rich once your nest egg generates significant wealth itself.I truly hope this post was helpful and start the journey to become rich together with me. I welcome readers to leave comments not only asking questions but also providing enhanced advice and experiences to me and to all other readers.

Congratulations @ordinaryrich! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @ordinaryrich! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPGreat post. This is what you came up with for people with income. Are you trying to calculate saving as part of the investment. I didn't get here. You are calculative of your savings only.

I am sorry. Did not mean to confuse readers. I will try to modify my post. or add calculation table.