.

Federal Reserve Chairwoman Janet Yellen, when asked yesterday about federal reserve monetary policy, was unable to explain why despite month after month, year after year, The Federal Reserve continues to miss it's 2% inflation target.

The fact of the matter is since last December the US dollar has been in A downward trajectory, losing purchasing power virtually week after week.

What Janet Yellen will not speak of is a topic which I bring up almost on a constant basis, and that is the money velocity.

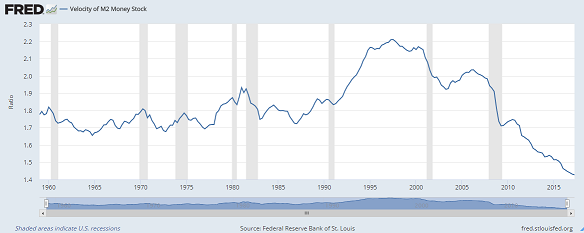

Have a look at the chart below.

.

.

You will notice that the money velocity, that is the rate at which cash is moving to our economy, is near historic lows.

Now, what Janet will not say, although she is well aware of this fact, is if cash is not moving through our economy no matter how hard she tries, no matter how much cash she prints out of thin air, no matter how many digital dollars she wants to introduce into the money supply, without the cash moving through our economy she will not be able to create inflation.

Here is another nice fact for you which Janet Yellen does not want you to know.

In times of economic recession's and stagnation, the money velocity does not move, just like we are seeing now.

Conversely, In times of economic prosperity the cash moves rapidly through the economy and thus money velocity is high.

Despite what we are being told by the mainstream financial outlets, Janet Yellen, and our politicians, the proof is right in front of our face that the US economy is dead in the water, and that is why the money velocity is near an historic low.

The illusion of the stock market reaching record high after record high allows people like Janet Yellen to perpetuate the lie that we are in some type of economic recovery, A complete falsehood. The stock market is hyper-inflated on the back of the largest bubble the world has ever known-the debt bubble, and has nothing to do with economic growth in this fake environment (created by the Federal Reserve's interest rate suppression scheme now going on for nearly a decade....)

Gregory Mannarino

.FRIENDS, LIONS, TIGERS AND BEARS. TAKE ADVANTAGE OF THIS! 100% FREE eBook, Downloads, Chat Room, Commentary, ALL ON MY WEBSITE. Have a look! Click HERE: https://www.traderschoice.net/

2 days ago, just before yesterday's little Janet induced dumpf, Greg was saying we should be long stocks. He wreck-o-mended we look at AAPL ....and did it convincingly enough that I'll even let him bullshit around it by saying it don't mind if Greg's excuse is that he really actually just meant he wanted you to watch it. Similar to Jim Cramer's claim that he actually meant your money in your checking account at Bear Stearns was safe. :-) Now Greg says the economy doesn't match up with stock prices? Did Greg spew an idea of how to get us out of the mess he just put us into yet? Should I add to my hard asset longs? Whata you think? ...besides the fact that you think anything Greg says is >>>> "neat?"

All you do it bitch about who is losing you money. Look in the mirror.

The only person that loses me money is me. I was actually spewing as one of Greg's kittens. They have either gone "silent" because I was over here warning them about how wrong Greg was about "hoarding hard assets and bitcoin!" at recent highs....or they are silent because Greg is silent about it now. I just "advised" the kittens to panic one more time in their gold and silver holdings. I can save the skeeerd bastages...wtf are you gonna do?

No more beitchin from me. Greg stepped up and made a "buy the pullback!" call in both precious metals and bitcoin via his new video blog. He actually said something instead of going completely silent. :-)

Just invest in cryptocurrensies :)

As Greg asked yesterday...if you "knew" price was going to drop in the asset you were exploring for a new buy entry...wouldn't you wait for the drop first? Greg actually was saying that BTC recovered "nicely" to $4000..as if to insinuate that his buy calls from levels 10% higher really weren't that big of a mistake. This steemian here is your best bitcoin technical analyst at steemit. I know as I have been tracking him. He's good...that why he's on my followed list. At least be "prepared" for all the possibilities. You should "explore" his. I said the exact same thing two days ago...it'd be better if you just panic'd out of your bitcoin and other crypto shit right now. :-)

https://steemit.com/bitcoin/@ew-and-patterns/important-btc-update-21-09-17-why-you-should-hope-for-a-fast-freefall

excellent economic information, thanks for sharing ,, @marketreport

Follow back @mutiaariani

Some bubble we got here. Maybe if I'm lucky the bubble will outlast me.

Estamos muy cerca de una recesión económica MUNDIAL y la FED lo sabes, lo que no quiere es decirnos la verdad...

Buen post @marketreport

You are so right. I can see the lack of money movement just in my local area. Of course, there are people spending money...but...it has slowed. More and more companies are struggling.

Thank you.

If only the sheeple could be woke from their slumber. Thanks.

You slept through a second consecutive move down of 5% in the precious metals stocks? I'd check your pulse...might not be lack of sleep. Tell me how you feel on the next gapdown move. No wait...only "physical" for you right? OK,youuuuu asked for it.

Thanks for the update

Logically this stock market price rise cannot go on forever, but it already seems to have gone on much longer than most of us would have guessed. The shenanigans seem endless. Could it be simply that fundamentals don't matter in markets as long as the majority of people aren't paying attention? The fed just needs to come out once in awhile and speak half truths and make vague statements. If market realities are simply nothing more than the perception of our collective consciousness, then as long as people stay uninformed perhaps we can indefinitely maintain the illusion of growth, regardless of factors such as dollar velocity. lol. Furthermore, I wonder how much "black market", unreported cash, unmeasured economic activity there is and how that would factor in to monetary velocity measurements.

The only money velocity is in the volumes of dollars moving in and out of various speculative assets. Bitcoin is thin air and how much is it worth? Uber doesn't even own a single taxi cab and how much is it worth? The only thing that is really "logical" is the fact that the gold and silver advocates keep gettting their asses beaten down any time they get anywhere close to the prices of the Aug 2016 price frenzy in gold and silver. Deeeeflation coming golden silver losers...that means prices of precious metals come down. You can call it "manipulation"...I just say you are all a bunch of dummshits chasing deflation via precious metals. Go ahead and panic one more time dummshits. Did "Maalox" Mannarino say anything new about gold or silver today yet? :O

The windup on my whole spiel as far as bitcoin goes is that the same clowns driving the price of Uber and any other Silly Con Valley pipedream are "likely' driving the price of bitcoin. Lame stream media won't tell you that, Maalox mannarino can't even come close to figgering that out...so he can't report it. The irony of it then is that the bitcoin advocates need to pray that the "manipulation" of price created by the moneyrunners shows favor to bitcoin. GOOGLuck with that. I'd "probly" rather own GOOGL but just the drop in the quality of Utube tells me they's running out of cash to waste. :-)

interesting that every single dip is bot and the retail investor has zero fear.

I haven't really been paying attention lately..... come back and seems things are just like I left them. Who'da thunk it........

This post has been ranked within the top 80 most undervalued posts in the second half of Sep 21. We estimate that this post is undervalued by $19.19 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Sep 21 - Part II. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

How about checking out some of my Expired Posts and get back to me with their true Value...

@pocketechange

... ...$7.77 ... ...1 vote ... ... .... Reset

Great Post Greg, your right the money is only passing through the higher levels of finance. The Central Banks are creating money then purchasing bonds and now stocks directly. The Central Banks loan the money to the Big Banks. The Bid Banks loan to the Corporations. The Corporations spend this money on Stock Buy Backs instead of investing in their Businesses.

Thank you for shining the light on the elephant in the room.

Correct Gregory;

The illusion of the stock market is reaching record high after record high allowing people like Janet Yellen to perpetuate the lie that we are in some type of economic recovery, complete bullshit!

The stock market is hyper-inflated on the back of the largest bubble the world has ever known-the debt bubble($1.3 QuadTrillion), and has nothing to do with economic growth of this fake environment created by the Federal Reserve's interest rate suppression scheme for nearly a decade.