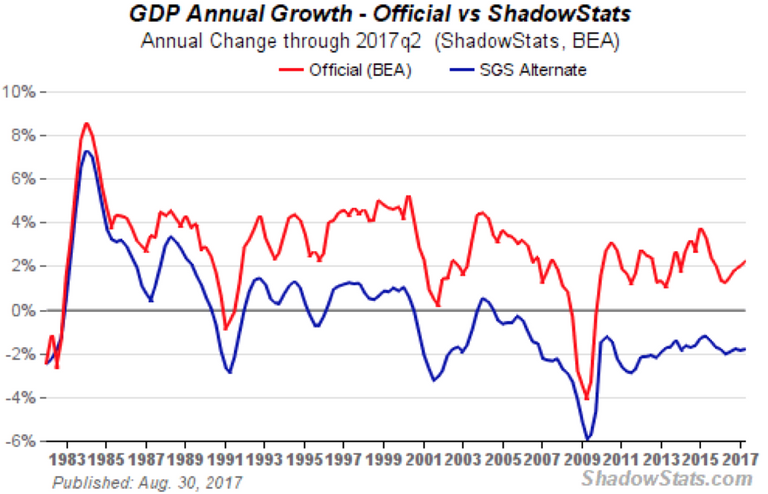

Most governments and their media presstitutes have been painting rosy pictures about robust or even vibrant economic growth. But according to John Williams’ shadowstats.com (which reports the real figures, “net of financial-market and political hype”), the facts speak otherwise.

The Shadow. It’s Dead.

Shadowstats reveals that the US economy has not grown over the past 15+ years. Over that time, GDP growth has been negative, usually hovering around –2%. In fact, there were several times when the GDP grew only 3%–4%, and in 2009 it dropped as low as –6%. (See ShadowStats chart below)

The other figures are just as grim, according to shadowstats. Unemployment is over 20%, well above the reported figure of around 5%. That hardly indicates “vibrant” growth. It seems more like an anemic economy … or a withering corpse. Why, then, do we not see the whole economy crashing right before our eyes? It’s simply because the crash is not happening directly in front of our eyes. Sure, things look bad if we take a close look at the figures, but actually, they do not feel so bad. And the reason they don’t feel bad is, quite simply, deflation.

Deflation is caused by lower demand – that is, by recessions, which we also have now. People are more inclined to sell than to buy (lower demand), so prices drop.

Japan provides an object lesson. After the crash of Japan Inc in the early1990s, the land of the setting sun has suffered through more than two “lost decades” of no growth, decreasing demand, and incurable deflation. A few years back, Prime Minister Shinzo Abe promised to stimulate the economy, foster inflation, and boost growth with his flawed Abenomics plan. His plan failed, miserably. Growth never returned, and the deflationary spiral continued.

It’s Party Time

Of course, consumers love deflation. Prices drop, everything becomes cheaper, and everyone has a reason to celebrate.

Damn. The Party’s Over.

But the problem is that those consumers are also the citizens, the workers, the recent grads looking for jobs. With the aforementioned “no growth” and “decreasing demand,” the economy weakens. Production decreases and unemployment rises.

Even though it seems like the Tanaka and Hashimoto families have more money to spend, they probably don’t. As the economy continues to tank, Mr Tanaka may lose his job, and Mr Hashimoto may not get the annual raise he’s come to expect. So, while all the citizens and residents of Japan are pleased that everything is becoming cheaper and cheaper, they soon began to realize that there’s no reason to celebrate. The party’s long over.

And instead of getting rich slowly, they’re getting rich very slowly … like, NEVER.

(Further Viewing) – Deflation Explained in One Minute …

(Further Reading) – Why You Should Be Prepared for Both Inflation and Deflation … https://dailyreckoning.com/prepared-inflation-deflation/

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!

@royrodgers has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowpond on all your posts, simply FOLLOW @minnowpond. To be Resteemed to 4k+ followers and upvoted heavier send 0.25SBD to @minnowpond with your posts url as the memo

This post recieved an upvote from minnowpond. If you would like to recieve upvotes from minnowpond on all your posts, simply FOLLOW @minnowpond