In this video, I talk with author and economic analyst John Sneisen about the crumbling economy in Suriname as an update to a previous report we at WAM did in early 2016.

Suriname saw one of the highest inflation rate in the world, breaking into hyperinflation. While the inflation rate dropped dramatically from at one point 80% to about 10.8%, food inflation continues to hang around 145% which dramatically affects individuals living in the South American nation.

There's a lack of communication when it comes to why the inflation rate went down. While some celebrate the drop in the inflation rate, it's sure to return at a much worse scale than it was previously. Interest rates were risen 25% this year which is incredibly high. It was enough to manipulate the inflation rate down, but it creates a vast bubble which is building much more pressure than was seen in the past. Unemployment is still high. Government spending is still high and the people of Suriname are victimized further by an out of control big government, central banking system and of course the international IMF.

This video is for the people of Suriname who are being left in the dust with no proper information on what's currently happening there. It also gives several solutions.

Let's continue to call out the fiat central banking system and the quantitative easing programs. If you're shoved down a bottomless pit of debt, you are forced to ask for a ladder from the government and banking system putting you the individual in perfect servitude.

See the FULL video report here:

Stay tuned as we continue to break down these important issues! Don't forget to Upvote & Follow!

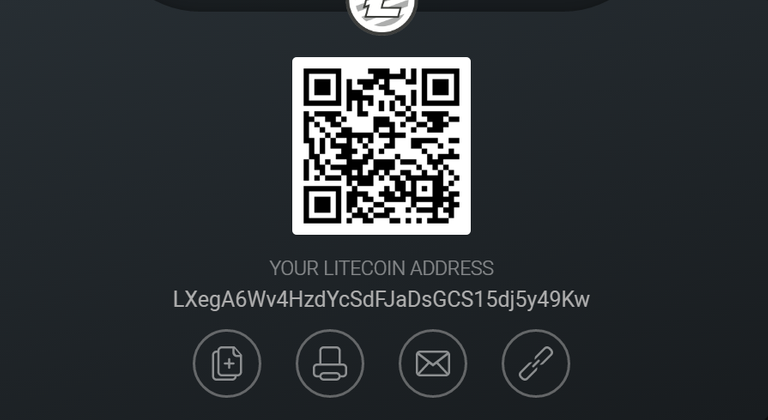

If you like what I do, you can donate to my Bitcoin, Dash or Litecoin addresses below!

Bitcoin:

Dash:

Litecoin:

Wow, I had no idea this was going on. Thanks for the post.

Happy to do it! Probably the most overlooked hyperinflationary event in history!

nice post

Good post.

Thanks

Showing statistical data is great and you are probaly right about what you say but what would be interesting to know is why that happened in the first place. I mean what caused this small country to derail its economics?

the currency devaluation is bad if you are an importing economy but if you can boost your exports it could not be so bad... So what has happened in 2016 that caused all this troubling financial indicators?

Racial tension might not be the cause of these financial issues, but I don't think it should be completely written off. We see more and more racial tension here in the United States, and it is tearing communities, businesses, and cities apart. One only has to look at Detroit, Chicago, Baltimore, Seattle, D.C., and other "diverse" cities to see the damage that racial tension can cause. In any case, great video as always.

perfect sharing thank you for the continuation of sharing my dilemim follow

Un superbe article comme d'habitude et qui est très passionnant, mais je trouve cela dommage que tu n'as pas assez de popularité tu mérites 100 fois mieux mon ami, j'attends avec impatiente ton prochain article porte toi bien ;)

hmmm, i had no idea