Do you have $20 to spare? Are you interested in starting your investing journey?

If you answered yes to both of these questions, then let me share my #1 $20 investment for investors that are just starting out!

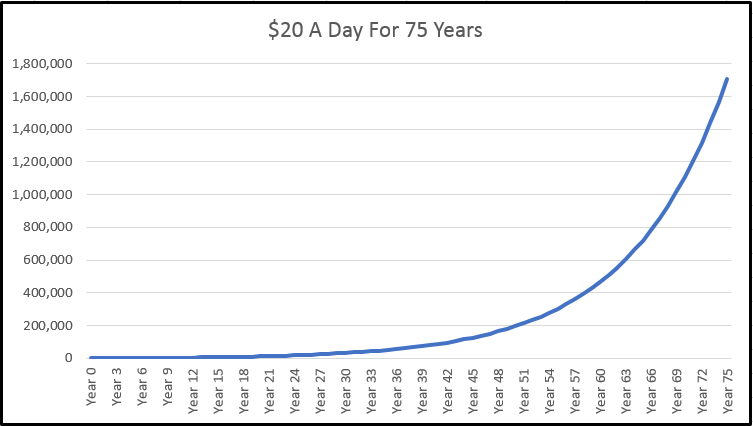

In my last article, “DONT Save After Spending, DO Spend After Savings“, I mention that if you invest $20 a month over a lifetime (75 years) with a %9 rate of return, then you will end up having ~$1,700,000!

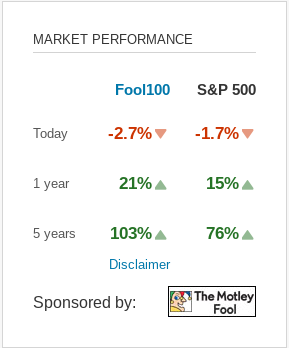

This begs the question; what investment yields at least a 9% return every year? Well, the S&P 500 stock index (a basket of the 500 biggest public companies) returned an average of %11.69 from 1973 to 2016. If you want to invest in a stock that follows the S&P 500, I would recommend looking into an ETF called “SPY” which mimics the S&P 500’s performance.

However, if you want an even better-performing index fund than the S&P 500, then I would suggest The Motley Fool 100 Index (ticker symbol: TMFC)

[[[[[**************THE MOTLEY FOOL 100 INDEX (TMFC)***************]]]]]

First of all, for anyone who does not know about The Motley Fool, you are missing out on some of the best stock analysis out there. Besides having opinionated stock advice on their website, fool.com, ‘The Fool’ (as they refer to themselves) has some of the best podcasts available about the Stock Market. The motto at ‘The Fool’ is ‘help the world invest better’ – and that they do.

Besides being a huge fan of The Motley Fool and all of their free content, they have definitely educated me about fundamental investment philosophies that I wouldn’t have learned anywhere else. The idea of having a minimum holding period of 5 years, the idea that the CEO/founder of a company is just as important as the financials, and the idea that company culture is a key component when picking stocks, have influenced my own personal investment strategy greatly.

It’s needless to say, The Motley Fool has probably helped thousands of people invest better.

So, what is The Motley Fool 100 Index – TMFC?

Simply put, TMFC is an index fund that tracks the Motley Fools best 100 stock ideas across all of their stock services. It is literally a gift from The Fool that allows beginning investors to get instant diversification and access to most of their best ideas!

With a price of $TMFC being under $20, currently $18.59, it is a great starting point for investors that are just starting their investment journey.

[[[[[****************WHY AN INDEX FUND IS GOOD FOR BEGINNERS***************]]]]]

I don’t typically advise my readers to invest in index funds as I think most of us would be better off buying and holding stocks of promising companies over long periods of times.

The problem with buying individual stocks is that people are not diversified and susceptible to what is called “specific risk” – the risk that comes with investing in a single company or a group of companies that are similar (like buying only airline stocks). Buying an index fund is like buying a basket of stocks. TMFC, for instance, is a basket of a 100 different stock that brings instant diversification and removes any potential ‘specific risk’.

The Motley Fool brings a nonconventional – dare I say, contrarian – point-of-view when it comes to stock analysis. They transform complicate financial analysis into practical advice for your average person. They do what the educational system has failed to do – teach financial literacy.

For people that are not familiar with financial statements, market caps, traditional valuations, different types of stocks, P/E ratios, GAAP vs non-GAAP analysis, and other confusing ass terms, index funds are a perfect starting place. When it comes to index funds, the professionals do all of the analysis required for stock-picking, and the professional in this case are capital ‘F’, Fools.

[[[[[*****************DOLLAR COST AVERAGING****************]]]]]

Dollar Cost Averaging is exactly what it sounds like, it is the process in which you automatically and systematically invest a set amount of money over a long period of time. I provided an example of this concept at the beginning of this article.

Too often, beginner investors think investments must be a binary decision where they invest a huge sum of money into a single asset (like Bitcoin…) and are devastated when the price of that asset goes down. Avoid the potential disaster and slowly build up to a portfolio over time.

For example, if you have $1000 to invest right now, I would suggest that you don’t put all $1000 in at the same time. I would invest the $1000 in $100-250 increments over a few weeks/months. That way if the asset price goes down in value, then you will be able to buy the same asset at a lower price. In the reverse scenario, if the stock price goes up, you were able to capture a part of those gains with your initial investment.

Figure out what system works for best for your specific situation. And remember, something is always better than nothing – $20 per month can change your life.

Investing $20 a month at %9 interest over 75 years can turn into ~$1,700,000.

And guess what – now, you have the perfect $20 investment!

–

Thanks for reading! If you enjoyed this article, please like, comment, subscribe, and share!

-Jack

P.S. This article is meant to be general education advice as I am unaware of your specific financial situation. Do not make any investments solely based on the information above – please do your own research. This article/site is meant to be supplementary to your own research and we are not responsible for any monetary gains/losses that you may incur.