It is no secret that the average American has had a terrible savings rate – with only %39 of Americans being able to afford a $1,000 emergency expense (https://www.bankrate.com/banking/savings/financial-security-0118/). This trend of a low savings rate is only getting stronger with the personal savings rate decreasing from a high of %5.9 in Jan’16 to a dismal %3.2 in Jan’18.

The trend of a declining personal savings rate can be attributed to many things:

(1) Stagnant wages since the 2008 financial crisis

(2) No incentive to save as standard bank interest rates on savings accounts is a pitiful%0.01

(3) Insane amounts of student loan debt

(4) The need to purchase lifestyle goods as society ‘dictates’

(5) E-commerce making spending money easier than ever

(6) Increasing expenses and cost of living w.o increase in wages

(7) Increasing healthcare costs

All of these are absolutely valid reasons as to why we may have such a low savings rate. Unfortunately, there are only so many things we can control directly within our lives.

The one thing that we can control is our mindset.

***************DO NOT Save After Spending**************

Money seems to simply disappear from our wallets and checking accounts every day. As the world has become more digital, it is easier than ever to whip out your credit card and buy anything you need. Better yet, most companies have your credit card registered on their website, automatically renewing your subscription and saving you time by having features like ‘1-Click ordering’.

By the time our credit card bills roll around, we have accumulated a huge balance that seems to magically appear out of thin air.

I have news for you, it’s not magic – it’s just bad math.

Spending has become more automated, simpler, and faster than ever before in history. The need to immediately satisfy a want is almost second nature. Like the animals we are, we see a stimulus and react accordingly. For example, when I see a game on sale for a limited time (damn you Steam!), I will buy it immediately before the sale expires as I believe I am saving money.

The problem is that managing your money is something that was never taught in schools. This lack of financial literacy combined with the deceitfulness of credit card companies – (1) pending items not showing up in the balance, (2) hidden variable interest rates, (3) lack of clarity what is principal/interest payments, (4) minimum payments – are at the heart of America’s low personal savings rate.

No wonder nearly half of all Americans immediately spend their paycheck on paying off their credit card upon receiving it. With this approach, you will never be able to accumulate any sort of wealth.

*******************DO Spend After Saving************************

The first thing you need to do when you receive your paycheck is transfer as much as you can afford directly into a savings account – preferably a bank like Ally Bank that yields a %1 interest rate on savings accounts. Forget putting your savings in Bank of America, Chase, or any other major bank as they yield a dismal %0.01 (1/100th of what Ally offers).

The second thing you need to do is make it automatic!

The third thing you need to do is respect your savings and DO NOT spend your savings! Savings are just that – savings – they aren’t called ‘spendings’ for a reason.

Once you have set up an automatic transfer (on payday) from your checking account into your high yielding savings account, you will be on the road to building wealth. If you want to achieve financial independence, then automatically transfer as much as you can – as a %50 savings rate will let you retire in about 20 years. Anything is better than nothing.

Before you know it, you won’t even miss the money that is automatically deducted from your checking account. Any raise/bonus I receive also goes directly into my savings account. After all, I managed to get by before my raise and I will manage to get by if I put the entire raise in my savings account.

A seemingly insignificant change in your mindset and saving/spending behaviour can be the beginning of something much bigger than you have ever imagined.

*****************Understanding The Behavioral Difference*******************

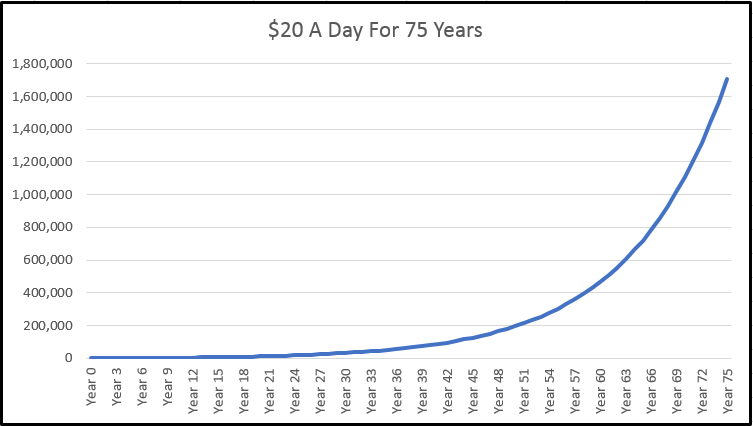

Whatever reasons you may have as to why you are unable to save may be very valid and real. The problem is that we are where we are today and anything is better than nothing. The smallest bit can make the world of difference. Saving $20 a month may seem insignificant, but I promise you it is not. Invested properly, $20 a month can turn into a million dollars over a lifetime.

Baby steps in the right direction (with the combination of compound interest) can change your life dramatically. Starting from $0 and adding $20 a month at %9 interest will turn into $1,707,176 over 75 years! This type of wealth is the type of wealth that can give your children opportunities you only dreamed of. Leaving a legacy of prosperity instead of poverty. All it takes is a few clicks of a button and the willingness to commit.

I realize life is hard and saving money for the future seems secondary to today’s needs, but I promise you it is worth it and you can do it.

All you need is a jacked mindset.

-Jack

P.S. Thanks for reading! If you enjoyed this article, then please SHARE with anyone you think could benefit.

You are right about those automatic deductions. There's no better way to send money into savings BEFORE you spend... sometimes I fall into the opposite habit, spending money in my head before I even get my hands on it. Thats the worst way, so I must be vigilant about it.