To most people, money and currency are the same. They are a medium of exchange that makes trade possible. However, there is a very important difference between the two. That is their natural value. Money has natural value while currency does not. Money is naturally valuable by their physical properties. While currency is artificially valuable because people believes or government says it is valuable.

Gold, for example, is money because it is beautiful, rare, and naturally valuable for the past several thousand years. A US $100 Dollar note is a currency because it is just a piece of paper that cost less than 50 cents to print. No one would use it even as toilet paper because it's too dirty. The only reason it is worth $100 is that of international adoption and confidence in the US government.

Natural Value

Long before currency exists, people use some form of money to trade. In the past, money were commodities that everyone needs. This includes rice, tea, salt, and metals. However, these commodities are heavy and not durable. Gold and silver eventually became the money in most places. Gold, in particular, is very good as money. Since gold is very rare, even a small quantity of gold is expensive. Gold is physically stable. It does not rust or tarnish due to moisture. Gold is naturally shiny and beautiful.

For these reasons, gold is a great store of wealth over time. Since gold is very rare, some countries used other metals such as silver, copper, and iron as money instead. Regardless, these metals are naturally (or intrinsically) valuable since they have applications in many industries. For an example, gold, silver, and copper can conduct electricity very well. All electronic devices today use these metals.

Artificial Value

After a while, paper IOU ('I-owe-you') notes replaced physical gold and silver as currency. These IOU notes eventually become currency bills as we commonly use today. In the past, people can redeem these notes for gold in the bank. Eventually, the bank realized that people do not redeem their gold as they would rather trade IOU notes instead of actual gold because they trust the bank. However, unlike gold, IOU notes are artificially valuable. The note itself is paper so its natural value is near zero. The belief that these notes represent actual gold make the notes artificially valuable.

Motivated by their greed, the bank issues more IOU notes more than the actual amount of gold they have. This increase in the currency supply (inflation) causes the value of the currency to decrease. When the value of a currency decreases, the price of everything increases. This adjustment in price is not obvious at first if the currency does not change hands quickly. But over time, the currency become worthless. The banks benefit the most from this. They get to spend the currency before its value decreases.

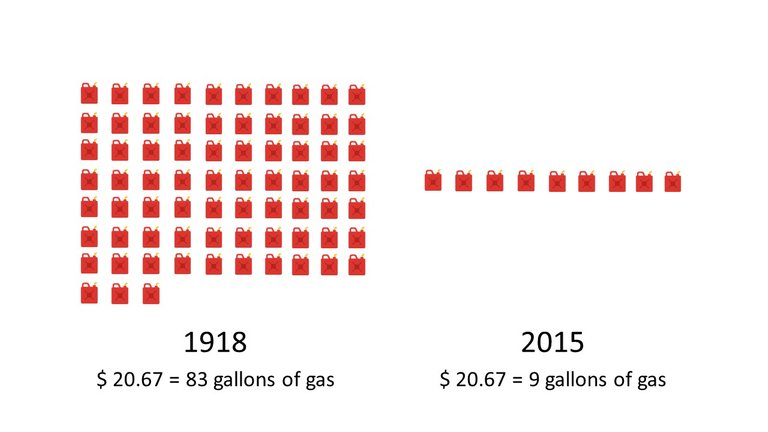

About 100 years ago, twenty dollars can buy a lot more things than what it can buy today. Here are the gallons of gas one can buy at 1918 and 2015 with twenty dollars.

About 100 years ago, twenty dollars can buy a lot more things than what it can buy today. Here are the gallons of gas one can buy at 1918 and 2015 with twenty dollars.

This pattern of events happened all the time in history. Many civilizations destroyed themselves with currency expansion. In the law of supply and demand, the more there is something, the less valuable that thing is. When the supply of currency is limitless, the currency becomes worthless.

China's Experiment with Currency

As the country that invented paper, China is the first place to use paper currency since Tang Dynasty in the 7th century. Before using paper currency, Chinese used mostly iron as money. After the end of Tang Dynasty, gold, silver, and copper were illegal to use as money. Iron is not very valuable so one would have to carry a large quantity to trade. This was a problem for merchants who often have to travel and carry a lot of money. To fix this, the merchants created IOU notes for these metals.

As time went by, the merchants created more IOU notes than the actual iron they have. In 1023, the Song Dynasty established itself as the only entity to create paper currency - Jiao Zi. This monopoly of currency allowed the government to print currency to fund deficit spendings. At first, Jiao Zi is backed by iron. Song Dynasty gradually printed Jiao Zi more than the iron it has available. By 1107, Jiao Zi became Qian Yin. Unlike before, Qian Yin is completely a fiat currency. There is no physical commodity to back Qian Yin. In 1279, the Song Dynasty ended along with its currency.

China experimented with fiat currency until 1436 when silver became money. In fact, the word bank in Chinese (銀行) literally translates to "silver row". The Opium War that started in 1839 should have been called the Silver War. It happened because the United Kingdom wanted to pay for Chinese goods with opium instead of silver. Silver was so important that China fought in a war for it.

Repeated History

This story is boring because it happened before many times. Even before paper exists, the Roman Empire devalued its currency by melting copper with its silver coin. The coins eventually have as little as five percent silver content of the original silver coins. Similar events also happened in Athens and the Weimar Republic.

United States Dollars

Today, United States is in the same development. The US Dollar started off as silver. The word dollar originally came from German thaler. Thaler is the short version of Joachimsthaler. Joachimsthalers are silver coins minted from a town named Joachimsthal. In the past, a dollar is a silver coin. Today, it is a fiat currency. By the US Constitution, US dollars are gold and silver. But since 1971, US dollars became just papers.

The only reason US Dollar is valuable today is that many countries use it to trade. The dollar is the world reserve currency. In the past ten years (2007 - 2017), the supply of US Dollar expanded dramatically. But the currency does not lose its value because they went oversea when Americans pay for imported goods and services. The US exports currency while China, for example, exports goods. This relationship cannot last because the currency is not as valuable as real goods. Yes, even cheap Chinese goods are more valuable than US Dollar papers.

US Dollars were once backed by gold.

Now, the dollars are backed by faith.

Many large countries such as Russia and China are bypassing US Dollars to trade with gold as the medium instead. Then there is also the invention of cryptocurrency for the general population to trade without using dollars. Although Bitcoin is still a currency with no natural value, its predictable and transparent inflation makes Bitcoin a safer currency than the dollars. There are also "cryptocurrency" with potential a natural value such as Ethereum too. At this point, no one is sure what will be the future currency. But anyone informed will say that it's not the dollars.

Preserve your Wealth with Money

Again, money and currency are not the same. Money is a physical asset that has natural value. Currency is a representation of a naturally valuable physical asset. Currency itself is just a piece of information in the form of paper or computer data. If a currency is not based on a physical asset, its value is entirely determined by the trust people placed in its system.

For long term wealth preservation, use physical money such as precious metals. For everyday purchases, use currency for its convenience.

The first step to wealth is to fully understand what money is. By reading this, you can now protect your wealth and even make some gain in the process. Please share this with people you care about.

Congratulations @jackchalat! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIf you want to support the SteemitBoard project, your upvote for this notification is welcome!

Jack, well done and much needed to help as many people as possible to avoid the financial calamity that is coming. Too many people are asleep, distracted by the media/political and geopolitical BS to hide the financial wealth transfer being concocted by these International Banksters. It is the Roaring 20's to Great Depression all over again, except this time it's Global. The "Robber Barons" of the 30's have nothing on the .001% who currently own more than half of the wealth of the world. Debt slavery and power are their goals.

However on a brighter note, once you realize who you are spiritually, whatever happens materially in this World is of limited importance. You will find completeness and peace regardless of your financial situation. Focus on what you love to do, find the beauty in every single moment and intensely focus on it. Get out of your mind and thoughts of past or future. Control your mental thoughts and emotions which lead you haphazardly in all directions as a victim. As you've mentioned in another post, once you learn to conquer yourself, then you are a balancing element to the negativity in the World and become a positive force for change. Every single decision and action we take has a ripple effect on the World, no matter how small. Even the energy of our thoughts effect the world around us as they are mirrored back onto us and affect those we come into contact with.