SUMMARY

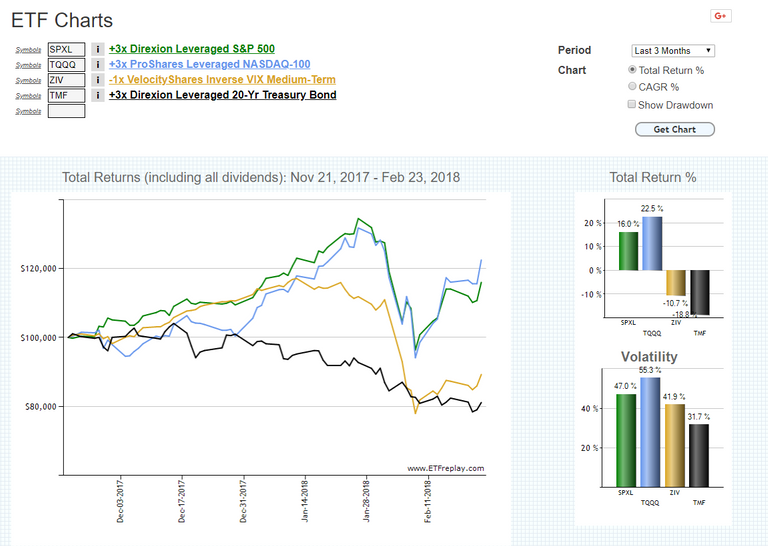

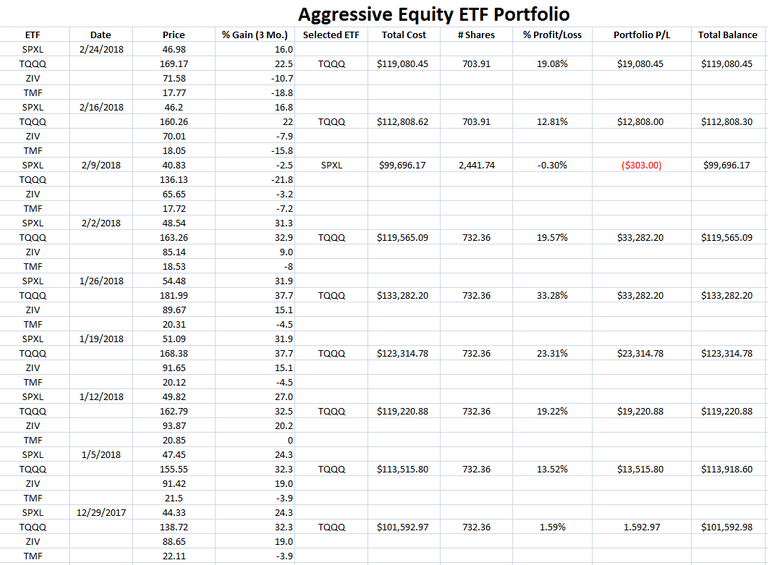

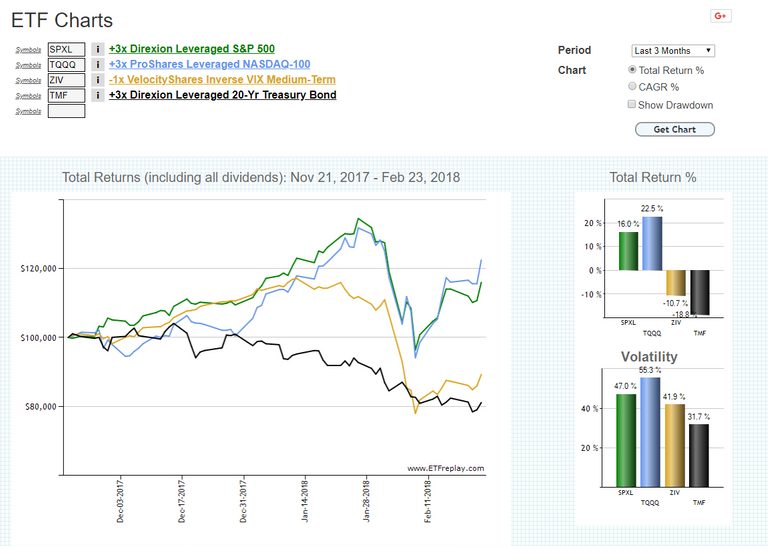

This is a day late but not the profits! The Aggressive ETF strategy is showing that TQQQ remains the winner for this week. Thus, funds will remain in TQQQ as it shows the highest 3 month rolling % return at 22.5% with SPXL coming second at 16%. Simple as that...until there is a new winner, money stays where it was.

The Excel breakdown shows that 703.91 shares of TQQQ ownership remains for another week. The overall profit is currently at 19.08%; not too shabby recovery from a prior $-303 loss on February 9th.

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

What Verge will do?

Whatever bitcoin does, only more :P

Thanks, @starjuno!

https://steemit.com/esteem/@dahri/semut-yang-imuttttt-cute-ants

Awesome! I've been in SPXL for a while now, might look into TQQQ. Giving great gains!! Also if you're interested in airdrops and everything related you should check out my page :) can't complain with some free coins!

ETF maybe the next investment to look into for me...Thanks for info.

I like to read every post you ..Whether it's writing or photos.My curiosity you want to visit my blog awaiting for me..

👍👍

Interesting posts and strong character mister I like with your post

Hey, @haejin !!! Nice Post.

I always Expecting such type of informative post on your blog.

Giving awesome additions!! Likewise in case you're occupied with airdrops and everything related you should look at my page can't whine about some free coins! I jump at the chance to peruse each post you.Whether it's composition or photos.My interest you need to visit my blog sitting tight for me. ETF might be the following venture to investigate for me...Thanks for the information.

This is really awesome. ETF seems its going to rock!

Thanks for sharing:)

yeh thats parfect time

Could u do another ETC one? I am really wondering if it will another swing down or keeps going up

i bought TQQQ at $98 and UDOW at $63. So far I am doing much better with those than crypto (less stress too!)

Congratulations, your post received one of the top 10 most powerful upvotes in the last 12 hours. You received an upvote from @ranchorelaxo valued at 217.84 SBD, based on the pending payout at the time the data was extracted.

If you do not wish to receive these messages in future, reply with the word "stop".

Congratulations @haejin, this post is the forth most rewarded post (based on pending payouts) in the last 12 hours written by a Superhero or Legend account holder (accounts hold greater than 100 Mega Vests). The total number of posts by Superhero and Legend account holders during this period was 38 and the total pending payments to posts in these categories was $2267.14. To see the full list of highest paid posts across all accounts categories, click here.

If you do not wish to receive these messages in future, please reply stop to this comment.

Haejin why are you not posting videos to YouTube anymore?

Thank you @Haejin! This is so cool:) Question, how do you choose which ETFs to look at? When you look at the ETFs do you apply EW and chart patterns to this as well? Thank you for your time!

Nice information..i liked it