Penny stocks are technically any stock under $5. In my mind, penny stocks are anything under a buck. Some people will warn you to NEVER trade penny stocks, for good reason. These companies do not have to provide full financial information. In the past, hundreds or thousands of penny stock companies have been fraudulent. Anyone invested in one of these companies lost everything.

The first thing to know about penny stocks in that they are VERY speculative. If they were making tons of profit, they wouldn't be penny stocks in the first place! You have to dig into what they company is doing and see what type of profits they could be doing years from now.

Not all penny stocks are bad. I believe that the five I am about to mention are some of the good ones. But don't just take my word for it. If you are interested, please research further on your own.

CALIBRE MINING CORP. (CXBMF) Current Price $0.20 (Market Cap: 61.38 million)

Calibre Mining Corp. is an exploration stage company for the exploration and development of gold, silver, and copper.

It holds a 100% interest in the Borosi concessions covering an area of 275 square kilometers located in Nicaragua.

They also have joint-ventures with multi-billion dollar gold miners IAMGOLD (IAG), B2GOLD (BTG), and CENTERRA GOLD (CG).

The joint-venture with B2GOLD was that B2 would provide $8 million dollars to fund the drilling in exchange for a 51% stake in the projects. The deal was renegotiated in November 2016, and B2 asked for 23.45 million shares instead. Well, $8 million for 23.45 million shares comes out to $0.34/share, almost double the current price!

In December 2016, Calibre Mining Announced NI 43-101 Inferred Resource Estimate of 1.2 Million Gold Equivalent Ounces for the 100% Owned Primavera Gold-Copper Porphyry Deposit.

Calibre has a clean balance sheet with $3.9 million in cash, no long or short-term debt, and $24 million in equity.

The big thing with this company is that it Pierre Lassonde (the guy who founded both Newmont Mining and Franco-Nevada, the combined market cap for these two companies is $36 billion) is the largest shareholder with 37.5 million shares. He had 25 million shares and just recently optioned another 12.5 million shares in September. He now owns 14.13%.

He sees value in this company and so do I.

WESTERN POTASH CORP. (WPSHF) Current Price $0.18 (Market Cap: 79.14 million)

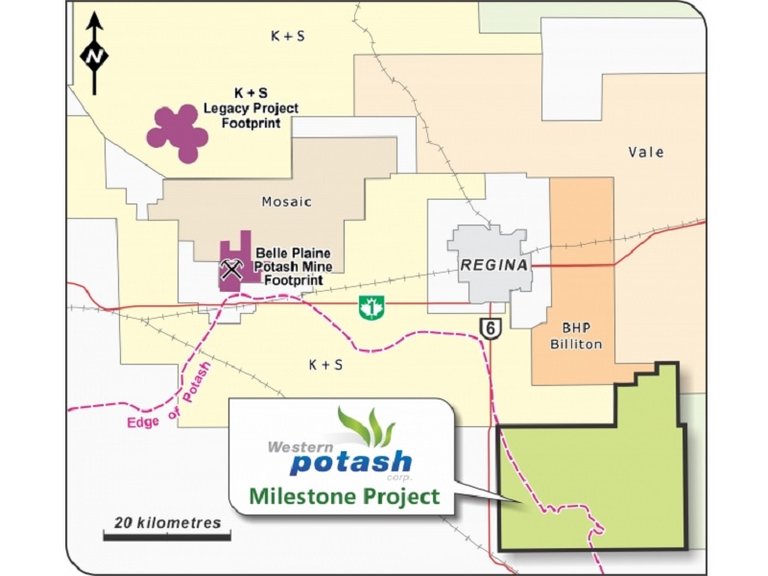

Potash is potassium-bearing minerals and chemicals, 95% of which is used in fertilizers. Estimates say about half of the world's known potash is located in Saskatchewan, Canada. Western Potash owns 88,500 acres in the prime potash area near the city of Regina and have been working towards bringing the plot into production calling it the 'Milestone Potash Project'.

China has a huge population to feed and not much potash within their borders. This has led Chinese companies to search out potash deals worldwide.

On January 19th, 2017 Western Potash held a technical review meeting in Beijing. Attending the meeting were representatives from China National Petroleum and Chemical Planning Institute, China Inorganic Salts Industry Association, China Development Bank- Beijing Branch, Beijing Tairui Innovative Capital Management Ltd., China BlueChemical Ltd., Guoxin International Investment Corporation Ltd, and China CAMCE Engineering Co. Ltd.

They have developed an innovative “horizontal drilling + selective solution mining + crystal pond” technique will significantly reduce the project CAPEX and waste salt generation if proven successful. This would reduce the cost of the project from billions of dollars to around $100 million.

Recently, China CAMCE Engineering (a $3 Billion dollar company) has been buying up shares of Western Potash and have at least a 4.7% stake.

Certainly, Western Potash has the backing of many powerful companies and I feel comfortable riding along.

I feel even better when I look at their last financial report which was independently audited and states that they have over 70 million in cash and CDs with zero debt.

K92 MINING INC. (KNTNF) Current Price $0.81 (Market Cap: 108.3 million)

My first ever post on steemit was about this company.

Back in 2007 Barrick Gold (The world's leading gold miner) bought the Kainantu mine project in Papua New Guinea for $141.5 million dollars. The previous owner had spent $80 million so far. They then spent about $100 million dollars and 6 years on putting up buildings and other infrastructure and $41.3 million on exploration drilling and mine expansion.

Barrick didn't get much gold out of the ground, they only mined the site for 6 months before they shut it down to focus on the exploration and expansion of it. So from 2008 to 2014 it sat mainly unused as the above-mentioned projects were taking place. In 2014, Barrick needed to raise capital and decided to sell off their non-core assets. Kainantu mine was sold to K92 Mining for just $2 million and possible future payments of up to $60 million if certain production levels are reached - namely 3 million gold-equivalent ounces mined or found in the next 9 years. This is broken down into $20 million dollar payments per million ounces discovered or mined. The terms were very favorable for K92 Mining.

K92 restarted mining on October 5th, 2016.This means the first quarter report in 2017 will be the first time they will show a full 3 months of mining. If they have been getting good gold out of the ground, the market should take notice. Wouldn't it be nice to own the stock before they catch the eye of the market?

LITHIUM AMERICAS CORP. (LACDF) Current Price $0.80 (Market Cap: 243.71 million)

I am a huge bull on Lithium. It is used in the most powerful batteries, from inside of mobile electronics like tablets and cell phones, to electric cars (EV) like Teslas. In fact, the industry predicts lithium usage to triple by 2025. Goldman Sachs has called lithium “the new gasoline”.

The actual and predicted increase in usage has given rise to plenty of new companies hoping to cash in.

Lithium Americas is one of the better ones, in my opinion.

Their main project is an Argentinian 50-50 joint-venture with lithium giant SQM. Cauchari-Olaroz is the largest fully-permitted, shovel-ready lithium brine development project in the world. They just needed some cash to finance their 50% portion of this huge lithium production area. This mine also has potash resources that will be harvested as well.

They also fully own lithium producing land in Nevada (through subsidiary Lithium Nevada Corp.), near USA's only lithium producing mine owned by Albermarle.

On January 17th, 2017 they received $174 million from Gangfeng Lithium and on January 19th they got another $112 million from Bangchak Petroleum. Both companies invested this money in exchange for shares with a value of $0.85. 4.7% higher than the stock was upon closing on Friday.

This money has seriously reduced the risk of failure.

They plan to be producing lithium by 2019. I expect them to be worth over double their current price by then.

GALAXY RESOURCES LIMITED (GALXF) Current Price $0.44 (Market Cap: 733.95 million)

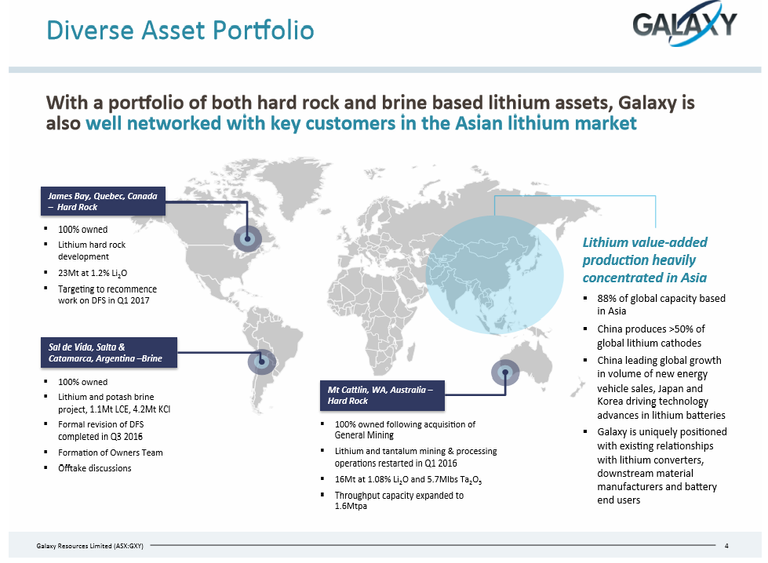

There are two main ways of mining lithium. One is a salty brine that is pumped up and allowed to evaporate, the other is a rocky spodumene ore. Brine mining results in a higher price per tonne, but takes years to set up the mine. Spodumene mining, however, can be up and running much faster but at a lower price per tonne.

Galaxy fully owns both types of mining in three properties. Mt Cattlin (Australia) and James Bay (Canada) projects are spodumene, and Sal de Vida in Argentina is brine. The Sal de Vida is the flagship project. The deposit is one of the world's largest and highest quality, undeveloped lithium brine deposits with significant expansion potential.

They are currently mining at their Mt. Cattlin property, while the other two are scheduled to be in production by 2019.

They sold stock on February 8th to raise $61 million AUD. The offering was significantly oversubscribed, with support shown by existing shareholders and new investors alike. This strong demand shows that the company is highly sought after.

Disclosure: I am long all stocks mentioned. I wrote this article myself, and it expresses my own opinions. This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

DO NOT BASE ANY INVESTMENT DECISION UPON ANY INFORMATION I PROVIDED.

My Website: Doubling Dollars

Very nice collection of cheap stocks that should yield nice returns. I like the recommendation on Potash, if only I had the extra funds to invest.

Great job, my bro...

Stop wishing, start hustlin' @ezzy! :D

If you want something, YOU have to go and make it happen.

Nice work- thanks for sharing!

Thank you very much. ;)

There are not many posts in penny stocks in Steemit. glad I found you. I'm in penny stocks in the UK.

Nice, I like that more people are joining up that don't just talk about cryptocurrencies or Steemit all day. Followed you.

This post has been ranked within the top 10 most undervalued posts in the first half of Feb 12. We estimate that this post is undervalued by $15.62 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Feb 12 - Part I. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

Here are some related articles readers might be interested in

https://steemit.com/steemit/@yash2212/what-s-the-best-cryptocurrency-to-invest-in-long-term-why

https://steemit.com/stocks/@yash2212/the-ultimate-guide-to-becoming-an-investor

Great info.

Thanks.