BUY SILVER!! why? there is several reasons, the main one is:

Silver will be going to 600 Dollars an ounce. I am saying this and I always am right.

But there is quite some other good other reasons too. enjoy ;)

I am not an financail adviser and this post might be uncool due to all the links. I am sorry, but I feel these links explain it better...New Technologies

New wires that will make transmition of touch faster. Its a silver nanowire that creates a “mash”, a web of tiniest silver wires mixed with copper that gives us the possibility of having touchscreen on plastic screens that are flexible.

https://phys.org/news/2017-06-flexible-electronics-nanowire-networks.html

http://www.nanowerk.com/nanotechnology-news/newsid=43372.php

Solar pannels industry will use it more and more. The more we will switch from nuclear energy into solar energy the demand of silver will rise and so will its price.

https://www.bullionvault.com/gold-news/silver-solar-011120173

https://www.ft.com/content/010da6e2-1863-11e6-b197-a4af20d5575e

Windscreens will use more and more silver. This new invention of windscreens will make them able to melt snow and ice. I mean, if this works, who would want a car who couldn't do this?

http://gizmodo.com/volkswagen-put-an-invisible-layer-of-silver-in-its-new-1791624687

Collateral:

People will and always did buy things of “undestroyable” value due to its limited amounts like gold, silver, real estates, other metals or land, in order to prevent them from loosing all their financial assets (fiat currencies) due to a inflation. People talk about a coming inflation since quite a while, being bigger and more devastating than the 2008 one. It happens in Greece, Italy, Spain, and it will spread fast, they say.

https://www.thebalance.com/the-bond-market-bubble-fact-or-fiction-416864

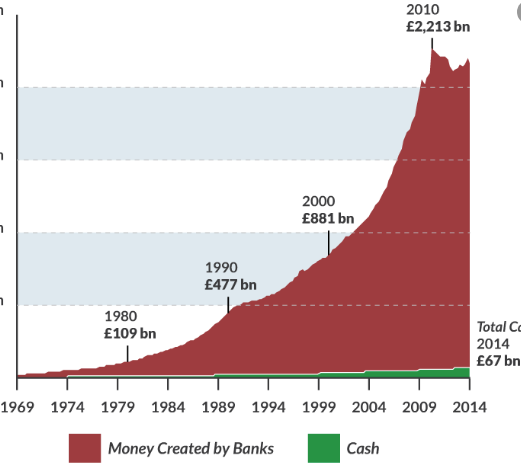

In case the dollar crashes and it threatening the global financial situation to become unstable, precious metals like silver are a good solution to invest in. Also, if you look at this chart, it seems as if the banks created a lot of money in the last couple of years. We know that inflation start by a huge gain of money being printed.

http://positivemoney.org/how-money-works/how-much-money-have-banks-created

Hell, I'd love to make it all the up to being right 50% of the time.

well you just need to know when you are and when you arent and base your decisions on that. then your right 100% too. ;)

Thanks for the info

youre welcome

"I am saying this and I always am right"

I would need a large data sample of your other predictions. Also since you didn't say when silver would be $600 an oz I guess deflation of the dollar over a hundred years or so would get us there eventually... in conclusion, I will remain sceptical.

I can't predict the future, simply because there is way to many things influencing it. But after listening to Cliff High and reading quite a bit bout how the silver price is manipulated, I just put the pieces together. If the industrial needs for silver rise and the dollar inflates (based on the Bond bubble and the amount of money being created), silver is worth a thought about investing, because silver keeps being a precious metal, even if the fiats are inflating. So give it 3 years and lets have a look where it is then. It just is more reliable and less volatile than fiat curencies or even crypto currencies in my opinion. But as always, do your own researches. Thanks for the comment though, I appreciate it!