Hey guys, where are we standing on the road to Financial Independence?

I am currently at c. 15% of my target nest egg which would give me a comfortable early retirement (at <40 y.o.). And hey, Steemit can speed up the entire process - but that's for later. First, I want to focus on the most important aspects of becoming Financially Independent and possibly retiring early. But let's first do a re-cap of my last post...

Your investments are similar to plants - they need time and attention to grow, but can really pay off over time!

If you can get 25 times your annual spending saved up and working for you, that is enough to live off – forever.

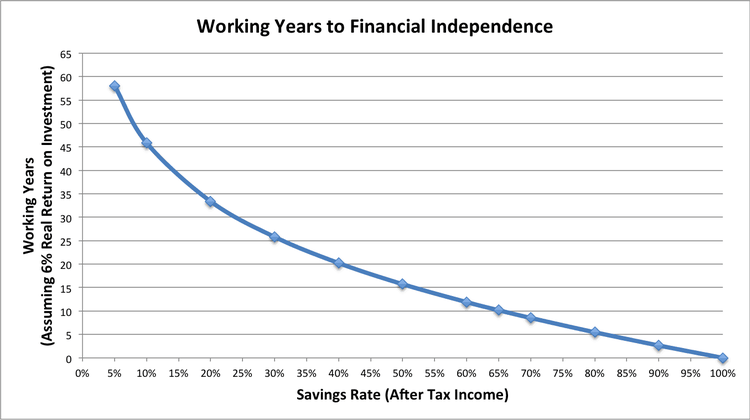

Remember this graph I showed you last time? It is one of the most powerful graphs available, which should make it all more visible. The ONLY factor deciding when you will retire = your savings rate! How you can sustainably increase your savings rate is for a later post, let's dive into how a large part of your investment portfolio should look like.

Source: Go Curry Cracker.

Why I don’t like investment advisors

Investment Advisors earn their money in one of three ways:

- Commissions (paid each time you buy or sell an investment).

- Management fees (paid as percentage of your Assets under Management or AuM).

- Hourly fees.

Or a combination of the above.

The problem with these financial advisors is that their business model is inherently in opposition to the client's. Advisors are drawn not to the best investments but to those that pay the highest commissions and management fees. More often than not their advice leads to sub-par returns (below market). Indeed, 86% of active equity funds underperform their benchmark (the market). (Source: Financial Times, March 2016)

But then what will I do with my money?

You invest it in boring, broadly diversified, low-cost index funds / ETFs, in paying off your own house, in rental houses if you are interested in local real estate. This should form the basis of your asset allocation. Oh yeah, and then you can allocate a small portion of your capital to crowdfunding, personal loan platforms, or cryptocurrency trading.

Currently, I plan to have my retirement income come from a dead-simple asset allocation: a bunch of Vanguard ETFs and an MSCI index fund which all pay or re-invest dividends. In addition, I plan to buy additional real estate to rent out in order to stabilize my cash flow. Steemit / cryptocurrency trading is the final pillar which provides upside.

Make sure you invest monthly/quarterly and over long periods of time (>20 years), and let Einstein's eight Wonder of the World - compound interest - do its magic trick. When you become older and you adjust your risk appetite, you will want to decrease the % in risky assets and move to more stable investments such as bonds (deflation hedge). And always hold a cash (emergency) fund to cover a few months of expenses.

So that’s it. You will have a portfolio consisting of wealth builders (stocks), an inflation hedge (stocks), a deflation hedge (bonds) and cash for daily needs and emergencies. Low cost, effective, diversified and simple. == Your first steps towards Freedom.

Best,

@Finance2Nomad

- UPVOTE and/or RESTEEM if you like this post

- FOLLOW me for more - Personal Finance, Travel, Sports

click here!This post received a 1.0% upvote from @randowhale thanks to @finance2nomad! For more information,

Doesn't look like that randowhale did much under the new structure of payout. Did it cover the cost plus 25% for curator? I'm just wondering.

Barely. Costs are 2 SBD still and only got 3 back, that is gross so subtracting the curator fee leaves you with very little. Note also that it can go lower than the 1% upvote, so the only benefit seems to be to attract more upvoters - this post also surged to the hot lists soon after posting.

Thanks for the details. That's about what I got the last time I did it right before the change. Last week I could get a $10-14 bump.

Great job on the post and glad it's tending. Retirement is a very important topic that is too often ignored by people. I've been saving for retirement since I was 12yrs old with a $100 investment.

No problem mate @mmatrics. Indeed it is an underrepresented topic, especially with younger generations such as mine. I think you can make huge steps if you put your head around it and take action.

ALL IN ON CRYPTO! retire in 12 months instead. <3

All aboard the Cryptotrain!

It has no brakes!!!

Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.Congratulations! This post has been upvoted from the communal account, @minnowsupport, by Finance2Nomad from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, and someguy123. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the

If you like what we're doing please upvote this comment so we can continue to build the community account that's supporting all members.

follow and upped

nicely written...KISS---keep it simple stupid---

cheers

Good basics on investing. It is a good idea to build up reserve cash. With various kinds of investments, risk and time are important aspects and reserves can help you during times have to wait for investments to mature.

Thank you for sharing @finance2nomad

Create a great day,

@kozan

I have seen some articles before on early retirement. Investing in index funds. This is a nice summary. Do you all plan to party together when retired early?

This post has been ranked within the top 50 most undervalued posts in the first half of Jun 25. We estimate that this post is undervalued by $43.46 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Jun 25 - Part I. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.