Is the tech wreck over? Is President Macron's Centrist Party Victory Just the Energy Needed To Give The Bull Market Wings??

On Friday, June 9, 2017, Goldman Sachs decided to release a report stating the prices of Facebook, Apple, Amazon, Netflix, and Google (collectively known as FAANG) reminded them of prices seen in tech stocks right before the dot com crash. I strongly disagree with that since all of the FAANG stocks are profitable and generate sizable revenues. However, yesterday 1.42% increase for the NASDAQ index seems to confirm that The Party of 1999 is back on.

Also, the European were up around 1% with stories about French President Emmanuel Macron's Centrist Party won the majority in parliament to smoothly implement his policies on reignite the French economy.

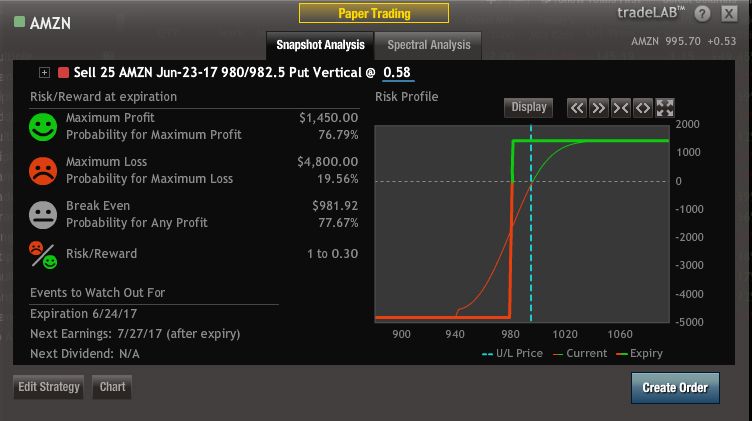

AMZN Bull Put Spread

Of all the stocks I trade on weekly basis, this trade is the only with the best risk-to-reward ratio especially with Amazon continuing to be global retail titan with its recent announcement of goggling up Whole Foods.

Catalyst to this Trade

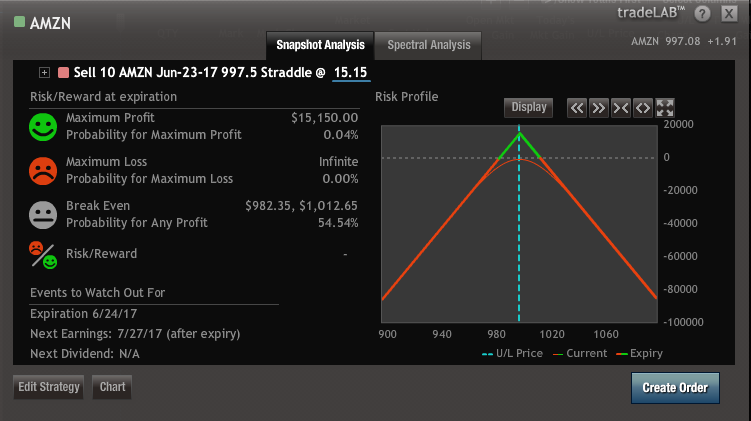

With the NASDAQ having a decent pullback after yesterday's 1.42% run up, I think the retail titan will hover around $1,000 until their next earnings announcement. It made a new high of $1,017 and had a decent profit taking selloff after the Whole Foods buyout announcement. Looking at the first picture above, the lowest price the options' market is currently pricing Amazon to trade at by the close Friday is $982.55, 5 cent above the short leg of this trade. Also, the 20-day Simple Moving Average seems to creating a floor for the stock price since the Whole Foods announcement.

Potential Threats to this Trade

If oil continues to fall closer to $40, it will be a drag on the entire market, including Amazon. Also, there are always unknown unknowns like if Russia is serious about shooting down US jets flying over Syria, Trump's Twitter fingers provoking N. Korea to do something crazy, etc....

Many thanks for the advice, there is much to think about

No problem. Really hope it helps!!