Why You Need to Pay Attention to Precious Metals and Mining Stocks:

Precious metals and mining stocks are by far the most undervalued and unloved asset classes in this market environment. Both stocks and the metals themselves have been in a brutal 7-year bear market. Since their 2011 highs, gold is trading 28% below, silver at 65% below, GDX at 65% below, and SIL at 66% below it's high.

After reading this set of facts you might be wondering why you would ever want to invest in such a terrible asset class.

I guarantee that if you go to a financial advisor they will recommend that you stay away from precious metals because of their volatility. For some advisors it may be because they can't make a commission off of having you buy gold. But most well-established investors most likely just don't want to be attached to the volatility that comes with owning precious metals and mining stocks.

Keep reading, because I'm about to go against everything you might believe about this asset class.

The Past Precious Metals Bull Runs:

During our most recent precious metals bull run in 2011, gold rose 420% in 11 years with silver outpacing gold up to over 800%.

This bull run is nothing in comparison to what happened from 1960-1979 for precious metals.

In 1960, an ounce of silver was $0.92 per ounce and gold was $35.30 per ounce. By 1979, Silver peaked at $35.50 per ounce and gold peaked at $670 per ounce. That is a rise of over 3,800% for silver and nearly 1,900% for gold.

So, what happened?

Raging inflation.

In 1971, inflation, high interest rates of 20%, a beat up stock market, low employment, and oil supply issues destroyed consumers' purchasing power and put many in a world of hurt. A situation like this is commonly referred to as stagflation. People couldn't afford to buy houses, cars, or even gasoline and at the same time, the purchasing power of their savings was being destroyed. After coming off of the gold standard in 1971, this wasn't a good look for the Federal Reserve's "stable currency" goal (read more about America's economic situation in he 1970's here).

So what will it look like when (I didn't say if) the dollar is ravaged by inflation once again?

Right now, silver is at $16.80 and gold is at $1,353. To make our calculations simpler, let's say silver is at $16 per ounce and gold is at $1,350 per ounce.

Silver: $16 x 3,800% = $608 per ounce

Gold: $1,350 x 1,900% = $25,650 per ounce

Almost a Bitcoin-esque scenario.

You're listening now aren't you?

Gold

Gold has been used in the form of money for the past 5,000 years. All of this changed when President Richard Nixon took us off the gold standard in 1971. Ever since the US dollar was taken off of the gold standard, it has lost most of it's value.

Many economists have been known to price things in ounces of gold in order to find fair value. It's been done with real estate, silver, The Dow Jones, and much more. Gold is an excellent barometer for determining fair value throughout all asset classes.

A great resource that provides charts showing how gold correlates with economic factors is Macro Trends.

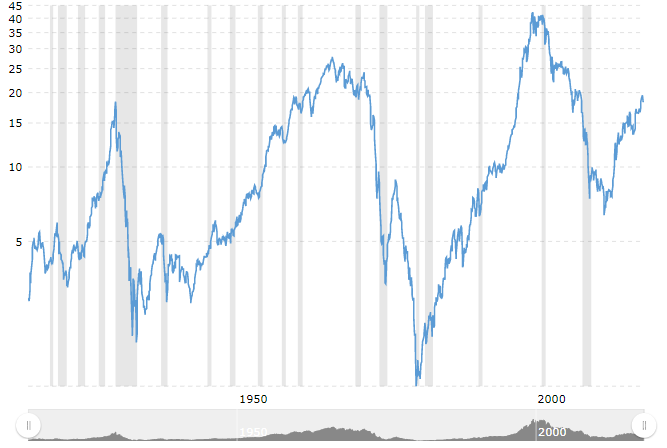

The Dow/Gold Ratio:

Right now, the Dow/Gold ratio is at about 19. This means that 1 share of the Dow at about 25,000 can buy 19 ounces of gold. In the past, this ratio has been as low as about 1.3 This means that 1 ounce of gold could almost buy an entire share of the Dow. When the ratio is high, the Dow is overvalued. When the ratio is low, Gold is overvalued compared to the stock market and you should probably sell your gold and start buying stocks.

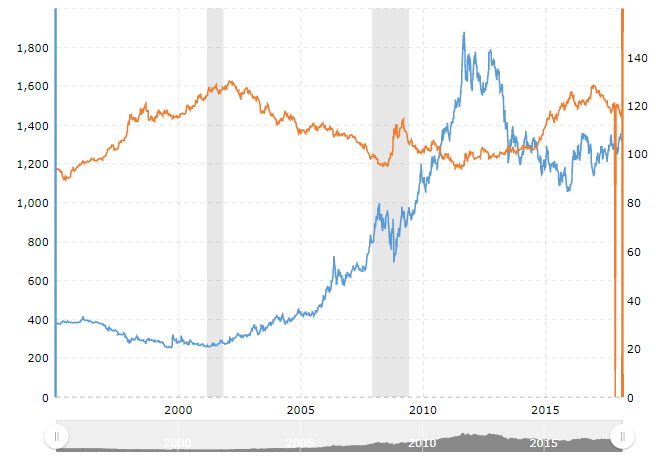

Gold vs The US Dollar

Gold and the US Dollar are negatively correlated. As the Federal Reserve continues to print our money in oblivion, gold will continue to rise. You can see that gold and the dollar have an inverse relationship. When one goes up, the other goes down.

Gold the past 5 years:

Gold has seen a terrible bull market these past 5 years and has undoubtedly pushed out the weak hands. Investors who bought up at the $1800 level are hurting and have been getting motion sickness from this wild roller coaster that they signed up for. Many holding the yellow metal have thrown in the towel. Some of these folks traded their dirt cheap gold for Bitcoin at $19k. Ouch. That must sting. They'll hurt when they see gold make new highs as well.

Gold's Performance Since 2000:

Contrary to popular belief, gold has performed exceptionally well since 2000. Most people think that this bear market will stick around forever. I know for a fact that this is just a medium term bear market in the middle of a long term (macro) bull run.

Gold's Performance vs the Dow

In fact, if you look at the Dow Jones vs Gold since 2000, gold has been the better investment. Even when pulling back nearly 42% from 2011 to 2015. The only caveat here is that gold does not pay dividends and, at times, is an expense to store.

Silver

The Gold/Silver Ratio:

The Gold/Silver ratio is a ratio that was established to show how undervalued silver is to gold. Right now the ratio is sitting at about 80. This means one ounce of gold can currently buy 80 ounces of silver. This is absurd. The natural mining rate of silver to gold is about 10 to 1. This means for every ounce of gold mined out of the ground there are 10 ounces of silver. Silver is also consumed and disposed of at such a high rate per year that it is becoming more scarce than gold. Almost every ounce of gold is hoarded away.

Silver the Past 5 Years:

Between the two metals, silver has definitely taken more of a beating. Down 65% from it's previous high, silver is sitting at rock-bottom prices. The good thing about this is that it has the most upside potential. It might look like a bad investment, but you would be saying otherwise if you bought in 2000 and sold 10 years later.

Silver Since 2000:

Silver has had a halfway decent run since 2000, but the most impressive portion was prior to 2012. Silver and gold do go up and down together, but it is important to note that silver does not hold support as well as gold and tends to get smashed down pretty hard.

While silver may look unappealing to the conservative investor, I remain bullish in the long term. This is not a get rich quick investment, but silver does have the ability to protect me during stock market downturns as well as preserve and increase my purchasing power during times of raging inflation.

The same 'smart money' that was going into Bitcoin in 2009 is going into silver now.

You can run with the bulls if you'd like. As for me, I would rather be early than late.

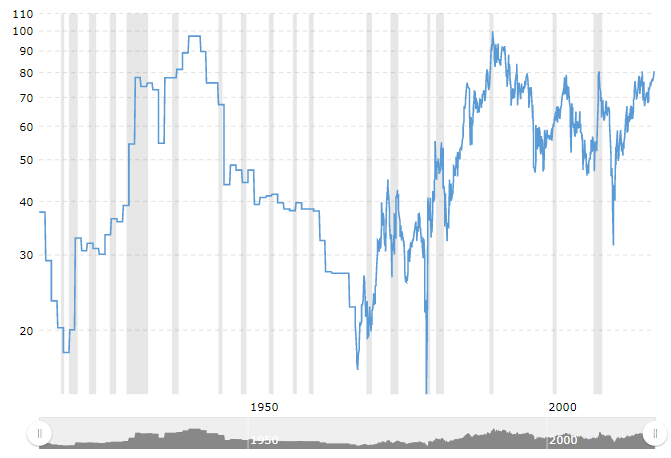

Global Gold Miner Index (GDX)

The GDX is a global ETF that tracks all of the top active gold miners around the world. What's great about the GDX is that it gives you exposure to the gold price without you ever having to pay storage fees. At the same time you are able to capitalize on the dividend income that these miners produce.

Since 2011, the GDX is down 65%. This is a screaming buy. Though the volatility of these stocks might scare the weaker-stomached investor away, these stocks have some major upside to them. In my opinion, that upside far outweighs the downside and the wild ride that you will go through as an owner of this index will be worth it in the long run.

I personally am buying GDX shares at it's current lows.

Global Silver Miner Index (SIL)

SIL is a global index of all of the top silver miners around the world. A lot of silver miners are still struggling as silver lingers down near $16 per ounce. In my opinion, SIL is more risky of a buy than GDX.

While silver production was low and demand was high back in 2016, the silver miners had a hay day. Though mostly a speculative run, SIL rose 230% in a matter of months. As you can see by the lines I drew, SIL is trapped in a downward trend and may continue to fall until the silver miners reach a more fair value OR if silver takes a leap upward in price.

I personally am not yet accumulating shares of SIL. I will wait until the charts and company financials look a bit more bullish.

Overview:

Gold, Silver and mining stocks may be the only undervalued assets at this moment. In my opinion stocks, real estate, bonds, and yes even cryptocurrencies are all overvalued. Right now times are good and the money is flowing. People have such a high tolerance for risk. I've even seen individuals talk about mortgaging their home to get into the stock market year 9 of the current bull run. The hype and madness is unbelievable.

What I am not seeing is a large amount of people talk about precious metals. If this article hasn't convinced you to place some of your capital in this sector, than that fact alone should change your mind.

Gold is holding great support at the $1,250 range and even seems to have entered into an upward trend. As gold prices continue to rise, so will GDX. Next, the silver price will follow as well as the SIL.

Attention! If you're interested in receiving a free share of stock, sign up for an account on Robinhood using my referral link:

http://share.robinhood.com/micahm18

Robinhood is a zero fee stock market broker. I make all my trades on this platform and pay no commission. This is a zero obligation sign up. All you need is your personal information such as your ssn, birthdate, and your name. Robinhood is an SEC and FINRA regulated company. It's monitored by the federal government and is 100% safe. But don't believe me, just look it up for yourself.

1 in 150 chance of getting a Facebook, Microsoft, or Apple Stock

1 in 90 chance of getting Ford, snapchat, or AMD stock

100% chance of getting a free stock

Robinhood... Taking from the rich, giving to the poor...

Thanks for Reading!

Follow me on social media:

This is great info mate. You need some exposure! Talk about an undervalued post.

I appreciate that! Thanks for taking the time.