Yes, my 8 year old son has his own budget! Why is it that most adults don't have one? 😬

So, I was recently pondering when I should start teaching my 8 year old son to start budgeting… At 12? 15 maybe?

Well, I came across this article by the amazing guys at YNAB (You Need A Budget).

I’ve been a huge fan (and user) of YNAB for quite a few years now!! In my opinion - they have the best budgeting app available on the market 😁 I have tried many budgeting apps in the past few years but just keep coming back to YNAB - they just are the best!!

So, getting back to the article, they suggested a good age to start is 8.

We’ve landed on eight. Eight is the perfect age to start budgeting with your kids.

They are old enough to understand, to learn from mistakes, to benefit from good choices. You can’t just throw them to the wolves, of course, you have to work with them on it quite a bit, but eight has been the magic number for us.

And what do you know - my son is 8! Perfect time to start 😁

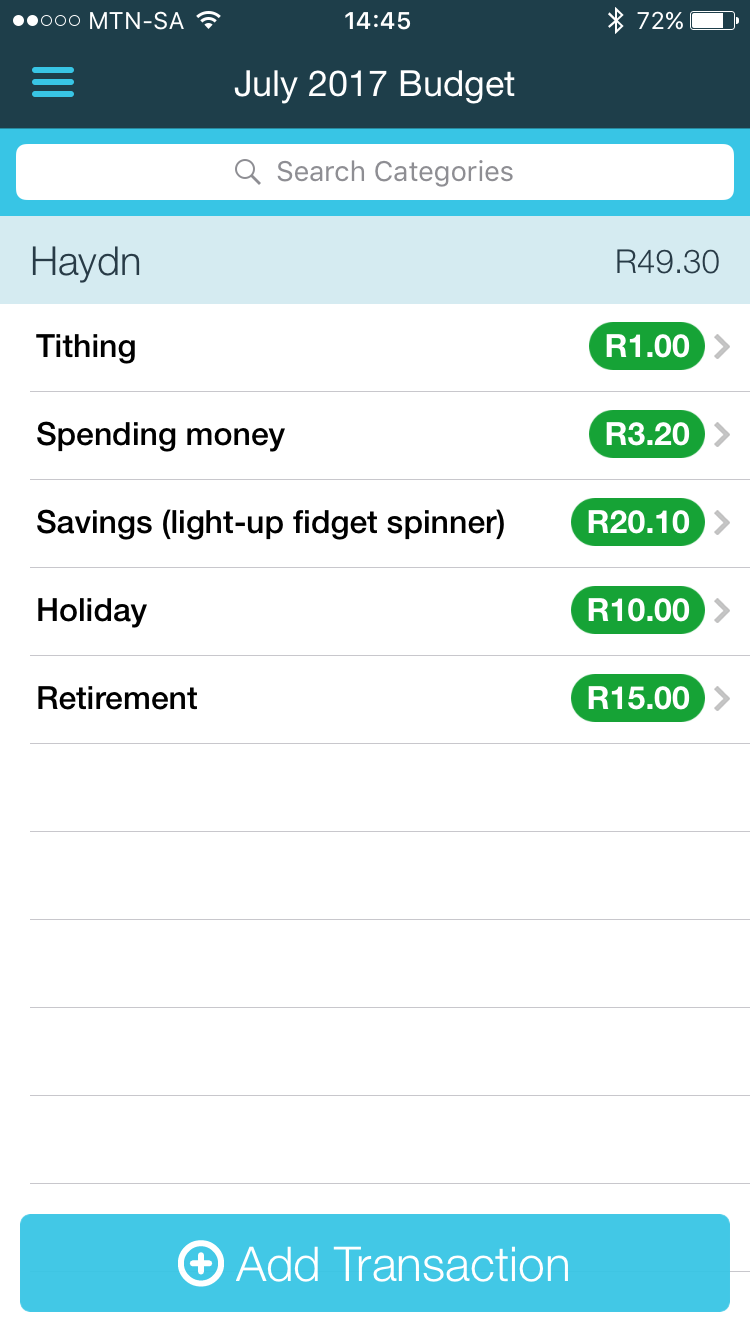

So we created a new budget for him on our existing YNAB subscription (fortunately they allow this).

We've kept it really simple for now - so he's currently getting R10 a week (thought breaking this down weekly might be easier for him than monthly). We've budgeted his money as follows:

- R1 to tithing.

- R1 to retirement.

(Trying to teach him from day 1 that he needs to put away for retirement.) - R5 to savings.

(He uses this to save for a few weeks to buy a specific toy he wants. Hoping this will help with the "instant gratification" challenge most people experience.) - R3 to spending money.

(He does whatever he pleases with this - usually ends up buying a chocolate.) - Technically, he currently has a 5th category where he's saving up some money (extra cash he gets from his granny and grandpa) for our upcoming Cape Town holiday 😎

It's actually quite amazing how well this has been running...

We sit every Sunday evening and do his budget for the next week. He really loves seeing his savings grow and thus counts down the weeks before he can purchase a new toy 😎

He's so into it that he even remembers what's in his savings and his spending money! When he buys something at the mall, I basically just check the app to double-check his balances 😉

Most adults I know don’t budget properly. Yes, they have an idea what goes into their bank account each month and what they need to cover the debit orders that go off their account. But that’s about where it ends…

Do they actually have a system to follow how much they’ve spent on food, entertainment etc. and how much is left for each of these categories? More than often - NO!!

I really hope my 8 year old learns from this and does not become one of these "unbudgeting" adults...

Check YNAB out and sign up for a free 34-day trial (with an extra month free if you join after the trial).

I got a bellyRub and this post has received a 8.86 % upvote from @bellyrub thanks to: @cheeto.blue.

You have your son set up to become a bright young man. I really admire you for putting retirement on their too. I've never seen anyone do that before. Do you actually do anything (or plan to when it has grown) with that money?

Thanks for stopping by and the kind word @frugallady :)

For now we not investing the retirement money as yet (it's just too little) but I want him to learn that 10% of his salary (technically 20% if I include the tithing) is never his - he can't use it in his planning. Just this principle alone is gold!!

Later on when we up his allowance a bit then we'll start doing something with his retirement money :)

It really is. Both my husband and I were taught the value of saving from our parents and it has been such a great help.

Definitely one of the best lessons your parents could have taught you guys!! Good on you :)

Wow! I am really impressed that you have decided to teach your son to tithe in such a young age! Maybe that is a great way for kids at 8 to learn the importance of responsibility!

For me (during my young age), my school started encouraging us to save by working closely with a local bank. The bank gave us free piggy banks when we opened a new account at the age of 7 with parents' support.

During my young age technology was not available so multiple piggy banks was the way for us to plan . But of course, I did not have as detailed as yours. LOL.

One thing for sure I was not taught to save up for retirement. This is definitely a good idea to teach the kids (because you never know what happens).

upvote and resteem you for your creative and wonderful effort! @cheeto.blue

Wow, thanks so much @littlenewthings.

Yip, he has to know, whatever money he gets is not his - it all comes from God so he has to give back...

The first 20% (tithing and retirement) he basically "never had" and only really gets to budget the remaining 20%. If he can learn this at a young age then I'm sure he'll be financially sound for the rest of his life :)

That is so true. You are truly a very wise parent!

Haha - thanks for the kind words... All we can do is try our best and trust God ;)

That's awesome that you've started budgeting so soon! I'm still amazed that financial management is not taught in school but thankfully there are parents like you who realize its important. Our daughter is almost two and we will definitely working on budgeting. Thank you for sharing your experience so far.

I know right - this should actually be taught in school!! But yes, ultimately it's up to us parents to get our kids ready for the real world :)

At least you have a few years to plan for your daughter - teach them young!! :)

Thanks for stopping by @teamturnerlive

This post received a 3.6% upvote from @randowhale thanks to @cheeto.blue! For more information, click here!

Nice choice to do! It's better to learn from that age, like this when he will grow up he will menage his money perfectly without any problems.

Good job :)

We certainly hope so!!

Thanks for stopping by :)

Dude that's amazing! lol i'm currently using learn vest, but honestly can't say when was the last time I checked it.

Definitely give YNAB a look - if you decide to go with them it's only like $50 a year. Really not bad for an AMAZING budgeting app... I'd easily pay 3 to 5 times that a year for them :)

This post got a

2.79% upvote thanks to @cheeto.blue - Hail Eris !@cheeto.blue got you a $0.86 @minnowbooster upgoat, nice! (Image: pixabay.com)

Want a boost? Click here to read more!

This post has received a 0.91 % upvote from @booster thanks to: @cheeto.blue.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by cheeto.blue from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, and someguy123. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you like what we're doing please upvote this comment so we can continue to build the community account that's supporting all members.

This post has received a sweet gift of Dank Amps in the flavor of 17.44 % upvote from @lovejuice thanks to: @binarie. Vote for Aggroed!

Dude... amazing!! this is fantastic!!! I remember writing this same sorta info in between my brothers and my bedroom on a piece of paper that my dad had printed with some lines and some headings... lol the memories your pics are bringing back 😍!!

Got to learn to work with money from a young age. Sounds like your parents raised you well 👍🏻