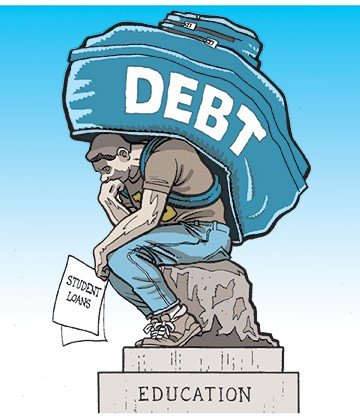

Something has been going on for a while now and although people talk about it, not many seem like they take it seriously. Becuase it isnt an imminent problem with many effects we can see upfront, people want to turn a blind eye. This problem is the destruction of financial independence for the students of the next generation, mostly due college loans in the United States.

The whole university system in the United States is a catch 22. You either go into debt to earn more money, which ends up paying less because you need to pay loans back, or you dont go into debt and end up making less because you didnt go to college. There are some exceptions for certain jobs, but this idea that you need to go to college is held up by the largest corporations and the majority of the jobs in the country.

College tuition alone, not counting the living costs while at university, has grown exponentially in the last 20 years. Our parents were paying a fraction in inflation adjusted dollars than we are now. Even state schools which are supposed to be reasonable and inexpensive have jacked up prices and are exploiting their own tax payers. Some places are more progressive than others, but even a state school will run you about 100k in debt. Much of this debt is at interest rates higher than 6%, which will take you until your 30s to pay off.

Most people want to chalk it up to millennials complaining about their situation, but in many cases it is the generation above us and the baby boomers that ruined it. We have to pay into social security that we will never get, we will be renting from souless corporations that have eaten up all of the real estate in the country because you destroyed the housing market. If you move out on your own by the age of 30 these days, you are fortunate.

The long term side effects have yet to be felt as well. The housing market will continue to shrink as less and less buyers can afford homes. Loans are going to skyrocket as banks lose money on potential credit worthy individuals. The stock market is going to hurt because people dont have money to invest, ect. The student loan crisis is a huge problem that in my opinion is going to explode in the next 10 or so years. The financial security and freedom we once had the ability of attaining is becoming harder and harder to get.

I am very fortunate to not be in the same situation as many others, but even from my siblings I see the long lasting effects. Everything has consequences and every day the government milks students for every penny they have via state schools and allows private loan companies to offer loans at credit card level rates, we are screwed. The average person is going to take on the debt and either not pay it back or give up 30 years of earning,saving and purchasing potential.

-Calaber24p

I am a university student..I can not remove these borrowings from my mind at all.I can not concentrate on exams..I do not know what to do.... Thanks for post my friend ! @calaber24p

Its crazy the amount of debt people realize they actually have when they get out. I wish you the best!

well in my country i am in favor of student loan because they do not take interest here

Great post. Students should read a book by Robert Kiyosaki "Rich Dad, Poor Dad".

today the most problem of your education system is the high fees,due to this many students have leave college.govt has to taken a positive step to solve the issue so that our young generation can get educations

I think the loan is a very bad thing that leads people to ruin and I think that whatever should be done with whatever is available to them is the work that should be done.

loans at a reasonable rate and college at a reasonable price is fine, but the way things work now is completely ridiculous.

That’s why the millennial generation is the crypto generation.

Crypto can make them easier to gain the financial independence they lost because of the rigged system that is in place right now.

Well still have to play by the old guy's rules. Fiat isnt going away any time soon even if crypto does offer an alternative.

The best way to avoid debt is to learn about finances, learn a trade or skill, and earn certifications.

The biggest downfall of my generation is the lack of knowledge and ability to assess risk using cost/benefit analysis.

At what point does University become a liability?

May be it's time the Internet affects Universities in a similar way that crypto affects banks.

May be we should start thinking about new ways of learning and certifyig knowledge.

Right now, for most people, university doesn't pay.

The UK has, over the last 10-15 years, seen a shift from largely government-funded third level education, via grants and direct funding of universities to a model where a much greater proportion of the cost is borne by students taking loans from, effectively, a government department (The Department of Business, Innovation and Skills), via a state owned entity known as the Student Loan Company.

For students enrolling at university post-2012, they face a 6%+ interest rate (currently 6.1%) on increasingly large sums.

An argument given in favour is that it makes the 'market' for third level education freer, but in practice universities are incentivised to game the system in ways that produce some dysfunctional outcomes.

And it's not as if the new policy necessarily yields better outcomes for public finances; the plan seems to be to sell the debt off periodically to private finance firms, and write off unpayable loans.

It's hard to see how this is an improvement, given that contemporary UK students are among the most indebted in the developed world, which reduces disposable income going forward. If you wanted to reduce future economic growth, that would be one way to do it.

It's a paradigm failure. The paradigm was that, if going to college was beneficial back when just a few did it, then think of the benefit if everyone could do it! So roll out the student debt to anyone with a pulse and society can just continue to improve itself until we are all above average.

Problem was -- the benefit from a college education was that it was a differentiator back when going to college made a difference. Having a college degree did open doors because few people had one.

But now that everyone has one -- it has ceased to be a differentiator. So education turns into an arms race. Now to differentiate you need at least a secondary degree like a masters if not a PhD. And thus pay more than average in order to appear above average on paper.

And meanwhile, the ceaseless flow of debt money into the system has created massive inflation in the field of education, and construction is booming in the educational field as they try to expand capacity to handle the influx. And the increasing costs make it mandatory to take on debt to afford it -- no "working your way through college" like you used to be able to do.

Only once you exit college do you realized that the educational system is a racket -- not one where everyone owns stock, but one where everyone, every educator from kindergarten to the top, is invested in the concept that society can improve itself through education. Hence the heavy tilt of that field towards Progressivism. Educate everyone and thus leave ignorance and societal dysfunction behind.

But this is the headspace from which safe spaces and nonsense like using discrimination to eliminate discrimination emerges from. Same "high quality thinking" that supposed that by educating everyone we could all have white collar jobs and all be above average.

Paradigm failure. Blind leading the blind.

You summed it up pretty well. Easy credit has allowed sub-par people the ability to mingle with average people. That's why we are seeing nonsense like "safe spaces" and "micro-aggression". Give it time. It will all balance out. 😉

Agreed. I suspect electronic education will surpass in person, and more difficult testing will start to spread out the herd again.

Great article. I agree this is a major problem facing many young people. Starting life with student loan payment that rivals a house payment puts slot of pressure on a young person

This situation is in America too! I thought only third world countries are having such problem!!

you are completly right .. we have so any problems .. and this one is the biggest ...

Here! take this debt for the rest of your life and in return you will recieve a piece of paper for education that didn't make you anymore productive or give you any more skill than you had before! What a ponzi scheme folks.

I believe the crypto space it's only one that can give a chance of the new generation. All other tangible assets... house, education, health, stocks are already owned and you guys come far too late to the party. Crypto space spreads wealth more equally and with each new crypto new possibilities arrives.

The debt crisis is because of easy credit. If lenders weren't lending to everyone, we wouldn't have this problem. And, it seems like very few people consider a loan is something that needs to be paid back. I personally only spend what I can pay back in a month.

I don't blame boomers. I blame everyone for not thinking things through.

I have always thought that the government of your country should make certain educational reforms, especially to make the costs more flexible or at least to use very different loans from the current ones, without a doubt it has repercussions at the psychological level and therefore in the academic performance

And the average taxpayer gets stuck with the bail out....everytime smh. Let the system fail. Great things can come from failures