Hey everyone,

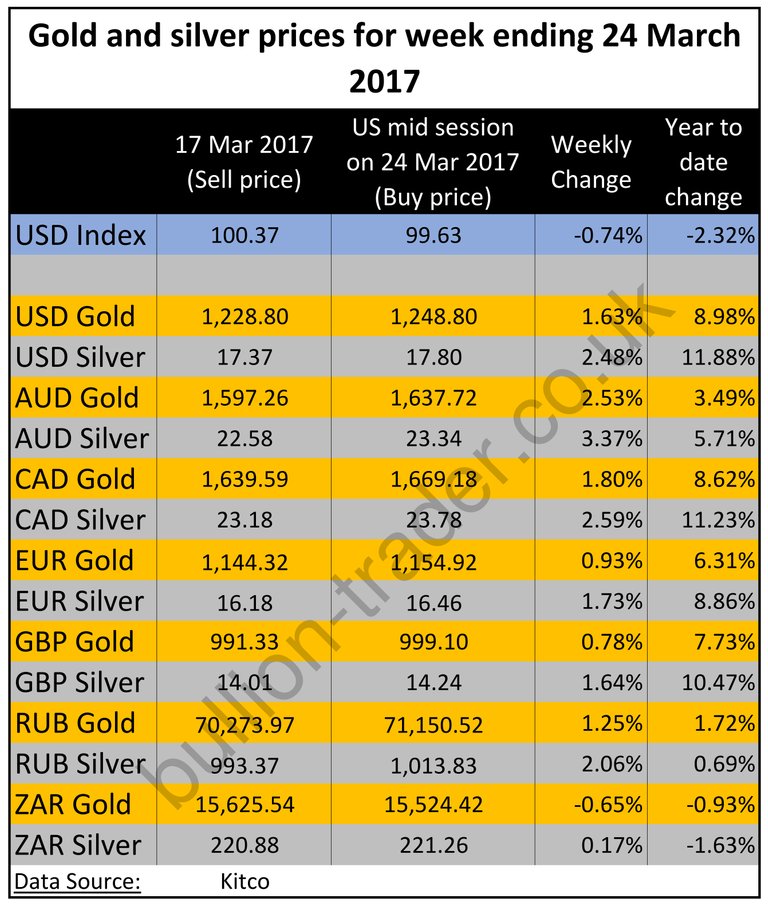

Gold and silver performed well this week partly because the USD index was down, so the price of the shiny stuff will go up, by default.

We're still not convinced there is frenetic buying of the yellow and grey metal as if this was happening the price rises would have been substantially higher, but up is good.

Returns for the year so far are quite impressive, certainly better than any deposits in a bank account.

It came to light this week that the Russian Central Bank has added 9.3 tons of gold in February to it's pile bring their total gold reserves to 1,655 tons. It looks like they know what they are doing, especially since there are no reports of any Western Central Banks adding to their gold reserves.

By now we will all have heard about the terror attack near the Houses of Parliament in the UK on Wednesday 22 March 2017. There was a time when this sort of news would send the price of gold and subsequently silver soaring, but that isn't the case anymore. Sadly we suspect this has become the new "normal" since markets don't react to this in anyway.

It's a short one this week, thanks for following.

Bullion-Trader have revamped their website slightly, pop by and have a look.

Keep those hands strong and buy on the dips.

Have a good week.

These markets are all rigged its well documented the prices are meaningless and are controlled by criminals

@robertsinclair, yes I know. Until pricing is set by SGE - not perfect but way better than current pricing mechanism, we are unfortunately subject to these when we buy and sell.