Good afternoon fellow steemians,

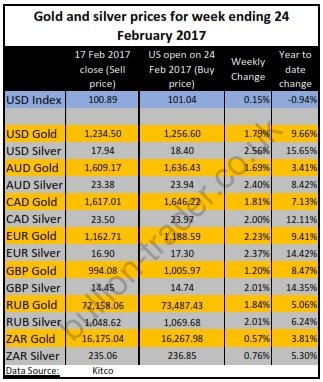

Here is the summary of the weekly price action for gold and silver in USD, AUD, CAD, EUR, GBP, RUB and ZAR. We'll also continue our series on How to buy gold and silver.

The USD index is up slightly so gold and silver prices should be down. The metals prices have risen, which would indicate a little strength in the metals.

How to buy Gold and Silver – Part 2

Part 1 of this series can be found here.

With many different gold or silver ownership options available today, purchasing it online and paying the same company to store it for you, is very popular. It’s quick, it’s easy and can be carried out anywhere with an internet connection.

Unfortunately, these aren’t all created equal.

This option is usually offered in the form of an allocated account or an un-allocated account (also called a pooled account).

Last week we highlighted the allocated option, which can be found here.

Let’s look at the un-allocated account option.

An un-allocated gold account is one in which you, the customer merely has a claim on the account provider (storage company) for an amount of gold (assuming your account is in credit). The storage company in turn has a liability to you, the customer, for the same amount of gold. More importantly, you the customer ‘are an unsecured creditor’ of the storage company.

Your un-allocated account balance means that your account contains a fine ounce balance of gold which is fully backed 1-for-1 by an equivalent quantity of gold. This gold would be held within a larger pooled holding. Your account balance is merely a book keeping entry.

There is no specific gold set aside for you, the customer. The gold backing the account, is owned by the storage company, not you the customer. Such gold is general inventory gold of the company, similar to a bank keeping a fraction of cash on hand to pay customers who wish to withdraw cash from a bank branch or ATM.

If the customer wants to receive actual physical gold, this gold needs to be ‘allocated’ by transforming the un-allocated credit balance into allocated gold.

In a bankruptcy scenario of a gold storage company, the companies general creditors have access to whatever metal is backing an un-allocated account, since it belongs to the company, not you, the customer.

Revealingly, there should be no storage fees charged for holding an un-allocated account, since you the customer don’t own any metal. Likewise, there should be no insurance costs for the customer in holding ‘gold’ in an un-allocated account because there is no customer gold being stored. The only fee you would be charged when holding an un-allocated gold account is an account maintenance fee, just like a chequeing account or savings account fee in a bank.

Even if you, the customer, deposits real physical metal into your un-allocated account, which is possible, the deposited gold then becomes the property of the company, and you, the depositor end up holding a claim on the company for that amount of gold. This process, and the legal rights and obligations of the involved parties, is virtually identical to a regular bank account where cash is deposited. After the gold has been deposited and it becomes the companies property, it is then fungible with the companies’ other gold holdings, and it can be traded, swapped, or loaned out etc. since it has become the companies property and has ceased to be the customer’s property.

A depositor of physical gold into an un-allocated account with a physical gold storage company therefore loses ownership of that gold in return for a mere claim on the companies gold.

In summary.

Allocated gold account = your physical gold.

Unallocated gold account = a claim on the amount of physical gold or silver recorded in your account balance.

A good maxim to live by, if you don’t understand the fine print, leave it alone.

Want to learn more about investing in gold and silver?

The Bullion-Trader education centre is available free of charge for you to use.

Interested in owning or selling physical gold and silver?

Shop now at Bullion-Trader's secure, exclusive, low fee, gold and silver market place, allows users to buy and sell gold and silver at their own price.

In the coming weeks we’ll address the other options for buying gold and silver.

Protect your wealth and take control of your future.

Have a good weekend.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.bullionstar.com/gold-university/bullion-banking-mechanics