Have you ever wondered why the rich get richer and the poor get poorer?

One main cause of this is compound interest.

I will try to keep this very simple for everyone to understand.

We'll use the value of a home as an example.

Let's say the average yearly appreciation on homes in the area is 8%. If we bought the house for $400,000, that means at the end of the year the house should appreciate by $32,000. (400,000 x 8% = 32,000)

Now let's pretend this house over the next 35 years appreciated to being worth $2,000,000.

At the same yearly appreciation of 8%, the house now this year gains in value by $160,000! Almost half of the purchase price and will continue to be more each year.

You can see when you get to this position, it gets much easier to accumulate money.

This can be applied to any investment and that is why reinvesting your profits into a working system is a very smart decision that will reap big time rewards.

On the other hand, the financially poor, are not saving and investing profits. They are paying only the bills, consuming more then they can afford and never have any extra to save. It is impossible to get financially secure this way, unless you have a big windfall of cash. Also, many in these situations end up borrowing money and paying high interest. This is the exact opposite of compounding to accumulate wealth.

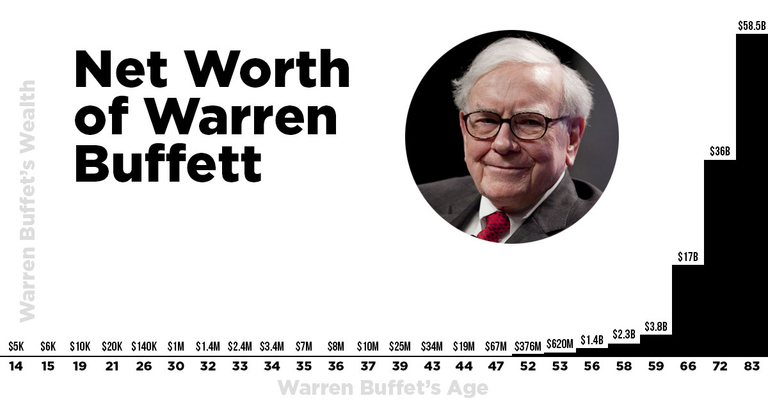

Make sure you save, invest, and compound your profits! This is how you get up to an abundance of grow that is really hard to slow down. (If you see the picture above, you can see once you get to a certain level, your growth skyrockets!)

BTW, Steemit does this for us by forcing us to invest in Steempower for 2 years. You may not understand why... but it could be a big blessing in disguise.

Hope you enjoyed this post. Please upvote, comment, follow, and restreem for more content.

Great post! Interest has made only a few rich and has kept many poor!

Absolutely! Good point. Compounding can do amazing things

Outside of compounding... you also have tax benefits for capital gains vs payroll income. You have tax credits for mortgage interest payments. You have those with capital able to invest and take more risk, and thus generate more capital. Heck even at the low end, those with capital can buy higher quality goods which do not have to be replaced as often and those have a lower lifetime-cost.

Really great points, thank you for your input

First rule: people struggle with is spending less than they earn.

Second rule: dont keep your excess currency in the bank. Inflation destroys purchasing power. You need to invest in assets than generate cashflow or act as insurance and store value.

Third: become financial free buying back your time from the slave masters. Stop the consumer culture.

The poor buy liabilities, the rich invest in assetd

Perfect comment!

good thing to know about you @bitdollar

Thank you @johnrenald I appreciate the support

Most powerful force in the universe!