Since the equity markets, bonds and residential real estate correlated, this issue is no simple answer.

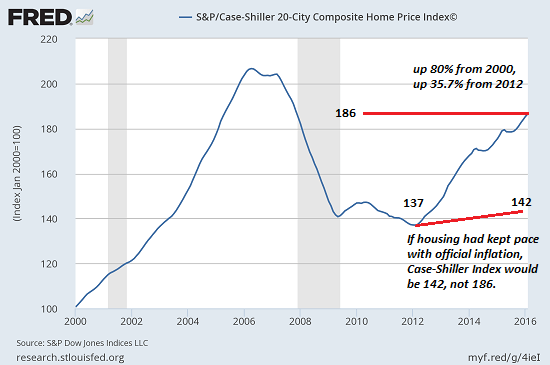

For those who are looking at the surrounding reality sober view, is not a secret that both shares and bonds, and residential real estate are in some stage puzyrya. Rynok residential real estate is not homogeneous and is either an echo bubble burst in 2008, or is a new bubble surpassed the size of the previous one.

Take a look at inflation-adjusted index S & P 500 (SPX) index and margin debt: Yes, it's a bubble.

Against the background of the federal funds rate close to zero, bonds are also in the bubble stage.

One of the consequences of monetary policy easing and intervention in the markets by the central bank, which we are witnessing the last 8 years, was the fact that the movement of all asset classes included in the close correlation between them. Free money staged the race for profitability elsewhere, where it could announce as a result and there was this correlation.

And now investors have found themselves in a situation where they can no longer use the time-tested risk management strategy, which implies redistribution of capital from the revalued assets in undervalued. When the main asset classes are in a bubble stage, you can not find a "cheaper" asset class to send their capital into it.

The only asset classes that are not affected by bubbles - it's a commodity and precious metals. But they do not offer returns, and therefore may be of interest to investors only in terms of value growth, based on the rarity of these resources.

Hot money, however, can buy precious metals, crude oil futures, Bitcoin, etc. The problem is that, due to the collapse of bubbles above three, the capital, which will rush to the market in search of refuge, is in the tens of trillions of dollars, meanwhile, markets, uncorrelated with stocks / bonds / residential real estate, have many times smaller.

Gold stored in private hands, by today's quotations is estimated at $ 3 to $ 4 trillion. (If I remember correctly, all the gold of the world, including reserves of sovereign states, is valued at about $ 7.5 trillion. By today's quotations), and it is only a small part of the value of global equity markets, bonds and residential real estate.

Bitcoin market capitalization of about $ 10 billion, while the value of the whole currency Ethereum -.. About $ 1 billion These figures are so small that even they could not be seen on the pie chart of all global assets, whether this is built.

Where will all the money, when the three bubble burst? Since the equity markets, bonds and residential real estate correlated, this issue is no simple answer. What makes hopping in search of safe haven assets in the amount of $ 10 trillion. with such small classes of assets such as precious metals, and Bitcoin traded (liquidity) sector, a commodity market?

If bubbles in bonds, stocks and residential real estate burst, which markets will be able to absorb hot money, rushing out of the bubble heels? Short answer: no.

The chaos that occurs when trillions of dollars, yen, yuan and euro rush to the fire escape at the time of the collapse of the bubbles will be monumental, and these price spikes of small asset classes in which these streams gush of money, will be no less monumental.

Resource: http://getcoin.today/kuda-pobegut-dengi-kogda-eti-3-puzirya-lopnut/