Monero Analysis & Review for Investors and Miners - 5 minutes read : -

Monero Main Specs:-

=> ABOUT MONERO

To most people, financial privacy is very important. Yet in recent years, we have seen a staggering amount of big corporations, banks and governments have their records compromised, each time leaking information about their users, their practices, and their balance sheets. The unfortunate but undeniable conclusion is that there is no safe place to conduct private transactions.

There was no safe place to conduct private transactions. Monero provides a place where your financial activities are private. Monero is one of the leading cryptocurrencies in the post-Bitcoin world, and it is built on principles of privacy, decentralization, and scalability.

From an economic point of view, a currency needs to be fungible. Fungibility is a property of money that makes all units "equal." Without fungibility, money flows can be tracked and tainted, making it very difficult to use the digital tokens as money.

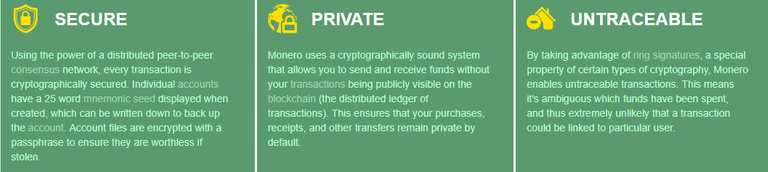

Monero is a secure, private, untraceable currency. It is open source, freely available to all, and was fairly launched on April 18th, 2014, without premine or instamine. The technology behind Monero has already spiked the interest of several established people in the Bitcoin development world and the cryptography community. Monero development is completely donation-based and community-driven, with a strong focus on decentralization and scalability. With Monero, you are your own bank. Only you control and are responsible for your funds, and your accounts and transactions are kept private from prying eyes.

Read on to find out how Monero is helping to solve real problems and limitations of existing cryptocurrencies, and building a more private blockchain.

The community approach behind the development of this crypto currency is completely based upon donations from the token users themselves, blockchain technology enthusiasts and other people that want to influence the future of digital banking.

PRIVACY

Monero seeks to provide absolute transactional privacy in an effort to create true electronic cash. With Bitcoin, as well as with the vast majority of cryptocurrencies that have been established since, any and all transactions are entirely traceable. Any casual observer can read through the Bitcoin blockchain, and for any transaction, this observer can find out the exact amount that was transacted, as well as the precise transaction origin (sender address) and destination (recipient address).

With Monero, for any private transaction, the same observer has no means to uncover the origin, destination, or amount transacted. As such, transactions on the Monero blockchain, are private and fundamentally untraceable.

But Monero is more than a currency. Driving the official slogan - “secure, private, untraceable” - are a multitude of applications where the parties involved wish to remain private. The Monero blockchain can keep confidential contracts confidential. Since the forthcoming, blockchain-powered internet of things will place the cloud all around us, it is then increasingly important that open access tools like Monero exist to provide a secure boundary for private settlements.

An often overlooked, but nonetheless important layer of privacy in a connected world, is that of the networking infrastructure. We have teamed up with Privacy Solutions, and development is well underway to incorporate an i2p router in Monero. In a world where ill-intentioned governments and ISPs can void an individual’s basic privacy rights on a whim, it then becomes necessary to establish a private communication platform.

The underlying technologies and cryptography upon which Monero is built, has been (and continues to be) the subject of extensive analysis and review by numerous individuals and research groups. It has garnered favorable attention by some of the most prominent figures of the Bitcoin and cryptography world, such as Andrew Poelstra (andytoshi), Gregory Maxwell, and Nicolas Courtois.

With Monero, transactions are private by default. However, each user has the ability to select different levels of privacy, optionally disclosing their transaction information, or even provide audit access (view only) to their full Monero account.

DECENTRALIZATION

While most cryptocurrencies align to theoretical principles of decentralization, the reality is that most fall short of such a claim. More often than not, it is not just one branch of a cryptocurrency system that is centralized in one form or another, it is that many branches are so.

With Proof of Stake currencies, irregular emission and distribution models cause most of the staking power to end up in the hands of a privileged few. Participants of lesser weight are reduced to second class citizens, with little chance of ever obtaining similar returns.

With Proof of Work currencies, of which Bitcoin remains the most significant reference, the mining process is largely concentrated in a handful of pools. This centralization of mining power, combined with a transparent blockchain, has already lead to various occurrences of transaction censorship.

Other currencies opt for a closed development model, thus centralizing the invention process itself. These closed platforms commonly fail to meet any form of public audit or expert review. More importantly, these are platforms that will at anytime swing left and right, in order to satisfy the interests of the restricted group that holds control of development.

Monero contrasts with these examples in various and meaningful ways. Monero is powered strictly by Proof of Work, but specifically, it employs a mining algorithm that has the potential to be efficiently tasked to billions of existing devices (any modern x86 CPU). This very characteristic, and more so once it is coupled with @Smart Mining, has the potential to ensure that for long years to come, the process of mining new Monero coins is within reach of the common individual, not an exclusive opportunity to the owners of large mining operations.

Furthermore, as transactions are private by default on the Monero blockchain, transaction censorship is inherently void. The Monero development landscape, on the other hand, is very much the opposite of a closed or restricted access model. The core branch currently enjoys more than 30 contributors, pushing 1000+ commits over the past year. The project is happy to take on new contributors and any future plans, long-term direction and priorities are openly discussed with the community. Indeed, the policy that governs contribution to the Monero codebase is exhaustingly inclusive - all contributions are accepted into the development branch, where new code can be scrutinized and tested by the entire community.

Most contributors in the Monero development landscape are quite passionate for an open source philosophy, and in this rich creative environment, new projects have sparked to life. OpenAlias is one notable example, which has seen adoption by (amongst others) a major Bitcoin-related software product.

SCALEABILITY

One of the problems with cryptocurrencies is scaleability. Most cryptocurrencies are derived from the Bitcoin codebase and thus have a "block size limit." This limit has become a big issue in the Bitcoin community and led to fierce discussions. Monero doesn't suffer from this block size debate, because it has a dynamic block size limit. This limit is automatically recalculated regularly based on a look-back window. A penalty system prevents out of control growth of the block size. Another issue with most cryptocurrencies is the development of a fee market. This issue is somewhat linked to the block size debate: the narrative is that when you limit the block size, a fee market will eventually develop. But this claim is highly debatable. When the transaction fees are supposed to be the main incentive for miners to secure the blockchain, it is possible the current consensus model will not be sustainable. At the moment, miners still act as they are expected: they mine on the longest chain. When they don't do that, they risk losing the block reward. But when that block reward becomes small compared to the mining fees, it's possible miners will have an incentive to not mine on the longest chain and start a fork trying to "steal" high transaction fees which were included in the latest blocks. Therefore, Monero implements a "permanent block reward." The block reward will never drop below 0.3 XMR, making Monero a disinflationary currency: the inflation will be roughly 1% in 2022 and go down forever, but the nominal inflation will stay at 0.3 XMR per minute. This means that there will always be an incentive for miners to mine Monero and thus keeping the blockchain secure, with or without a fee market.

FUNGIBILITY

Fungibility is an important property of any functioning currency. You can try to hide your bitcoins as much as you want, if you tried to mix your non-fungible coins using a mixer, coinjoin or another type of "anonymity enhancing feature," these transactions can still be flagged as "possible suspicious activity on the blockchain," even if you are anonymous. Using non-fungible tokens as currency can eventually lead to blacklisting/whitelisting either by governments or through self-censorship. Some examples of these measures could be payment processors or exchanges refusing your tainted coins as a payment or deposit or miners refusing to include your suspicious transaction. On the other hand, Monero transaction outputs have "plausible deniability" about their state: you can't tell if they are spent or unspent in a certain transaction or not. This leads to an opaque (non-transparent) blockchain making all coins "equal." fungibility is built into Monero at protocol level, making it real "digital cash."

Monero is a secure, private, untraceable, open source currency that has been created to offer the anonymity that couldn’t be achieved with Bitcoin.

Built upon strong set of ethics and principles of decentralization and scalability, Monero was launched in the first quarter of 2014, without pre mine, insta mine and not even with an Initial Coin Offering. Even just from these basic indicators it’s easy to understand how different this token is, compared to what we are used to in the blockchain backed crypto currencies world (especially in this later stage of this kind of technology, with all the ERC20 alt coins that have popped up recently).

As they aim towards creating a digital currency that works just like cash, Monero developers’ goal is to provide complete privacy of transaction and the parties involved in it.The problem with BTC and other crypto currencies is how open the system is, every fund transfer can be traced back to the original wallets from which bitcoins have been sent and the wallet to which they arrived, along with the exact amount of currency that has been involved.

Within the Monero ecosystem, things are different: casual onlookers have no way to discover who sent the funds, who received them and what the transferred amount would be. This means that, on the Monero blockchain, transactions are private and untraceable.

But secure, private and untraceable transactions of funds are not the only thing that this crypto currency ecosystem can offer. Other services offered on the same blockchain, which follow the same anonymity ethical principles of Monero, have been implemented. Smart contracts that have been made famous to the mainstream audience on the Ethereum blockchain can be implemented here as well, but with added anonymity and confidentiality which are not to be seen anywhere else. This will progressively become more useful in the future when internet of things devices that are backed up by blockchain technologies will begin to be adopted by the mainstream market. One example of such devices could be the the small size, physical wallets that several crypto currency exchanges are starting to market to their public.

Another important privacy aspect that has been ignored in the creation, implementation and development of Bitcoin is upon which set of regulamentations the networking infrastructure used to access it is based. To ensure that the networking aspect of trading within this ecosystem is as secure, private and untraceable as possible, Monero developers have been teaming up with Privacy Solutions and began developing a way to incorporate i2p (Invisible Internet Protocol, a garlic routing overlay network and dark net that permit pseudo anonymous communication, web surfing and file transfers) routing within the Monero platform. This will permit the creation of a secure exchange marked and a private communication platform that cannot be circumvented by internet service providers or government willing to censor citizens that are willing to protect their own privacy and their digital assets.

Thanks to the heavy testing and extensive analysis by reviewers and penetration testers that are among the best in the crypto currency and cypherpunk circles, within the Monero ecosystem transaction of funds are secure and private by default. Users can decide how private they want their account to be, from completely secure, to partially obfuscated and even completely visible by auditors that might need to be granted total, view only access to one’s Monero account, its funds and its status.

Being able to decide and easily set the amount of transparency needed for one’s account is a valuable tool that can be useful in several user cases. While most currency traders might opt for a fully anonymous and obfuscated account, no profit organizations might want to opt for a completely transparent setup to guarantee clarity of fund transfers to their donors.

In most blockchain backed crypto currencies ecosystems, complete decentralization is just a theoretical goal which is hardly implemented in the correct way. As long as there is even just a part of the system that requires a centralized, focal point to operate, decentralization fails on all aspects.

By the way they are implemented, Proof of Stake (PoS) crypto tokens necessarily favor a group of whales that gain an incredible power and can leverage on it to modify the market and other traders’ behavior; all this while gaining massive traction in terms of contractual power and returns in the long term, given the higher amount of available funds they have.

A third common instance of centralization within the crypto currency world is the closed source approach that several “alt crypto coins” sometime take. This means that only a restrict, approved group of developers and other people can operate on the problem solving and future development of a given token, effectively creating not only a central bottleneck which can slow down bug fixes, but also a very important security pitfall. Closed source systems cannot be publicly audited for back doors or be reviewed by third party IT security experts. Trusting one’s funds with a closed source token means actively delegating its future to the decision of someone else, giving them complete control and without having a way to check how malicious their actions are going to be.

In Proof of Work (POW) tokens, such as Bitcoin, the whole mining process is necessarily centralized within a closed group of available pools, which progressively gain power and can influence the way such tokens get developed. One clear example of such power is the amount of drama that is connected to the discussions regarding Bitcoin’s SegWit, which will happen on the first day of August 2017. Bitcoin mining pools, especially from parts of the world where mining is less expensive such as China and areas of South East Asia, do not want to see their power diminish and are actively trying to influence the market with their decision by carteling and trying to build a cohesive front. This centralization of power is extremely risky, especially when it’s coupled with a system that lets anyone see which are the Bitcoin wallets involved in a transaction and what is the amount of funds that are moved on the blockchain.

At last, integration of Monero into wallets like Coinomi, Exodus and the Ledger Nano S hardware wallet will definitely help this token gain the trust required for global end user recognition as a great alternative to less secure, centralized blockchain technologies. In fact, wallets that are accessible to non tech savvy users are in my opinion what the whole crypto currency economy needs right now to make the big jump between the dark side of the net and being able, in an hopefully very near future, to spend one’s tokens the same way we do with cash; the advantages of the structure we use in the current economy has to be exploited to introduce the general public to this groundbreaking technology, and simplifying user adoption is the effective strategy towards gaining media exposure that can be similar to Bitcoin’s. It’s only when people will get used to it and to the use of crypto wallets that other aspects of Monero will begin to shine, such as the impossibility to censor it, the well developed security behind this currency and the blockchain platform behind it and finally the complete anonymity that it can offer. #welovesteemit

RISK ANALYSIS -

Investment Rating :- A+

Investment Risk :- Low

Short Term Investment Risk/Reward Ratio :- 4/6

Long Term Investment Risk/Reward Ratio :- 1/9

Don't Forget to Follow me to get the best updates about Cryptocurrencies and Bitcoins, Resteemit , Vote, interact, Altcoins, Mining, Go ahead of the latest updates.

Informative post!

Thnq..

First thanks for the #welovesteemit 😉

You get a nice upvote for the reactivity.

Is this your content?

I might add the word crypto or blockchain to the risk analysis part.

We can not complain about Monero, it has been a good investement so far (but the competition is hard)!

welcome for praising on #Welovesteemit

Yeah It's my own content created by me it took more research and skills to explore it.

I'll be posting usable and important stuffs instead of criticised topics.

Agreed on competition part but see it's growing now like never before and adoption is also a part of it. the miners will use mining XMR it will be growing good. and It has less Hard cap so this can be good deal as an investment. I've given Risk Analysis to see the profitability and rest is up to people who really keen to hodl.

Great informative post. Thanks for posting bro. 8D

not bro is my lady boss ...:)

hahahaha so Funny ...

Thank you

That was a lot of information. I am still trying to figure out bitcoin. I'm kind of new to all this. Thank you.

Good to see you here. if you're new grab more and more stuffs that would help you to maximise your potential

The future will be yours, It's trend of new kind of Currency Born. New ERA