Mining is the backbone of public blockchains. Without mining, we wouldn’t have Bitcoin, Litecoin, Ethereum, and a whole host of other cryptocurrencies. A miner contributes to the very success of the network, and is rewarded to do so. Crypto-economics is the term for the space looking to create incentives for people to participate to help the network to grow and thrive. Mining is the original incentive for users to participate in blockchains, and is a large reason many people got into blockchain security so early. Miners keep track of who is paying who on the network and verify that these transactions are legitimate, all without having to trust any other actor on the network. It is a revolutionary way to run a payment network, and it allows a network to exist globally, 24/7/365, and without censorship.

[THIS POST IS NOT TO BE CONSTRUED AS INVESTMENT ADVICE]

After searching high and low for historical profitability calculators, and failing to find one, I decided to write this blog post.(if someone finds one, let me know.) I thought it would be interesting for newbies in the space to look at past mining profits when determining whether or not to get into the mining space. Here at BitCap, we thought it would be more informative to show past mining profitability than to try to predict the crazy volatile swings in price and mining difficulty to try to calculate clients’ returns moving forward. There are more Proof-of-Work blockchains that will launch in 2018, in addition to all the blockchains currently available to mine, so this trend may repeat itself. This is an attempt to highlight what miners theoretically would have earned during some popular Proof-of-Work blockchains’ infancies (LTC, ETH, and ZEC. I omitted Bitcoin because no one had a 6 GPU miner at the time of its launch. Additionally, keep in mind this is an imprecise calculation, and should be considered more of an art than a science. Certain variables such as miner optimization, DAG size growth, daily variability of difficulty, changing block rewards, luck, mining pool, miner optimizations, network transaction fees, and other variables unique to each blockchain that can be difficult to numerically define but must be considered. Furthermore, this analysis focuses on revenues, and not costs associated with mining which include the cost of the rig, power, maintenance, etc.

Methodology: I take the difficulty of a network on the first of every month from its creation until today or until it is no longer feasible to run on GPU’s due to ASIC’s. We also can compare profitability of the coins analyzed. I then take what an average 6x GPU miner from the era mined on that particular algorithm to guess how many coins that miner would have earned over time.

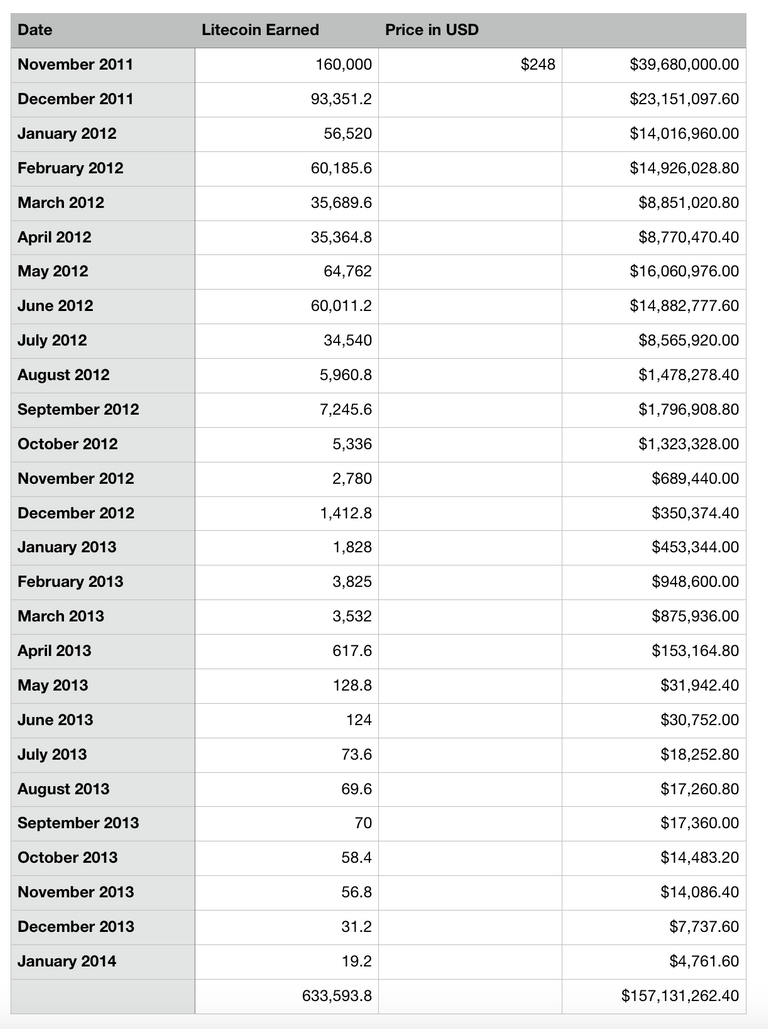

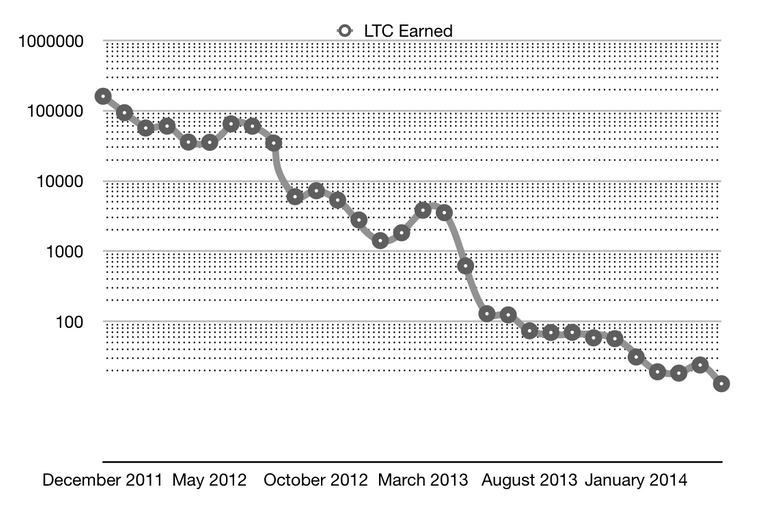

Litecoin: A GPU miner (6 AMD 7970’s) from 2012 would theoretically mine at 4.26 Mh/s of Scrypt, which is the algorithm for Litecoin. Litecoin experiences “halvenings” where the block reward is reduced by half every four and a half years or so. Also Litecoin’s hashrates was dramatically affected by ASIC’s, which is specialized hardware designed for mining Litecoin, and renders GPU’s obsolete. Once the first batch of ASIC’s are released to the public, I stop my analysis. However the effects of ASICs are felt through increased difficulty far before they are released to the public. This is a big reason why BitCap is not interested in ASICs. ASIC developers tend to develop their hardware for themselves and sell to the public after it is economical for them to do so. The LTC analysis below take the number of coins that 6 GPU miner would have earned, but attaches today’s value to those coins. If a miner had started mining Litecoin back during its creation and held all of the coins mined until today, this is how much money roughly would have been generated for the contribution to Litecoin’s network security.

Click here to be taken to BitCap's Blog on their site.

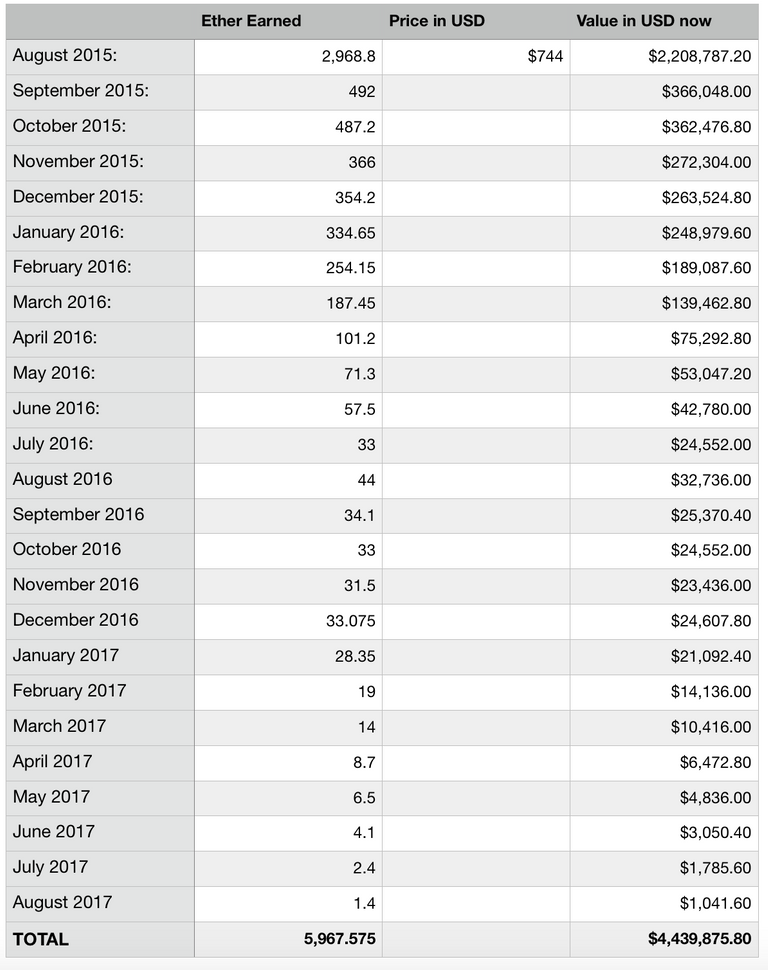

Ethereum, the Swiss army knife of the blockchain world has an estimation that is a bit more complicated. While you may have a constant supply, the DAG size changes and effects hashing speeds of hardware as well as block times are now changing due to the Difficulty Bomb which is helping usher in the next phase of Ethereum which does not involve mining. I did my best to incorporate them into my calculation by increasing initial hashing speed by 20% to starting and slowly rolling it back to where it is now. If you had purchased $5250 in Ethereum the day Ethereum launched (their ICO price), you would have 5,250 Ether.

EDIT: The difficulty bomb was delayed due to Casper not being ready yet, so mining rewards were recently reduced to 3 Ether per block, but the difficulty has dropped considerably. My analysis stops before this occurs.

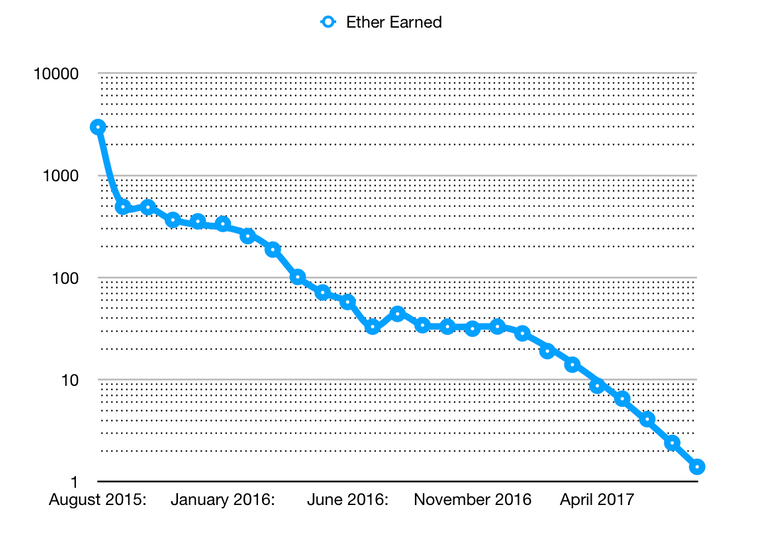

If a miner had purchased a $4,250 mining rig in that era (6x r9 290’s) that mined an average of 168 Mh/s (slightly more with a smaller DAG at the time of Ethereum’s launch), he or she would have earned 5,967 Ethereum and still owned the hardware whereon the Ether was mined. See Below.

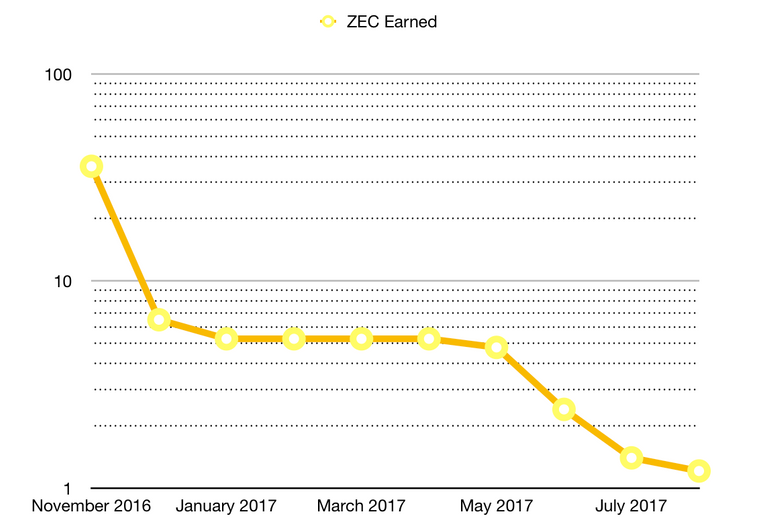

Zcash is one of the more recent blockchain projects. ZK-snarks, the underlying tech behind the Zcash blockchain, is a protocol that improved upon decentralized consensus by allowing the blockchain to verify that events existed without actually knowing what the events contain or who they involve. For example, the miners can verify that A paid B 1000 Zcash without knowing who A or B are, nor knowing that the amount was 1000 ZEC. This analysis was interesting because the coin was actually traded on exchanges the moment it launched, and actually started at $1000 a coin and fell in price throughout the first few months of its existence. If this trend of a higher price that falls at launch may mean miners are in a great position to capitalize on new blockchains because mining difficulty moves far slower than price. This is the most recent mining example in this post. If you were buying this coin when it launched, you might have been paying up to $1,000 for one coin. If you mined it, far different story.

As you can see from these three analyses, that mining the most popular cryptocurrencies in their infancies follows a logarithmic curve, where the earliest adopters are rewarded the most. Again, note we did not factor in cost to our analysis as power costs’ range in the US is too wide to capture. The beauty of the crypto-sphere is that there are now a few hundreds projects all solving various problems. It is up to you as a miner to support what project you believe will have the most impact on the world, or be realized to fill a specific niche. After all, the blockchain is the first time that humanity can digitize scarcity, and the use cases are staggering. The hardware that BitCap hosts is able to mine most currencies in their infancies and many into their maturity, where GPU’s are almost guaranteed to have a level playing field with other miners unlike ASIC dominated cryptocurrencies like Bitcoin. A prudent miner with the same machine could have mined all of these currencies and seriously cashed in. How do you want to approach your engagement into the crypto space? Hardware that doesn’t require a full financial commitment to any particular cryptocurrency, with a long lifespan that retains its value, and that actively participates in the security and success of various blockchain technologies? Or would you settle to purchase your favorite coin and speculate on its rise in value? Or finally, would you purchase an ASIC where the value is tied to the success of one coin or algorithm? We hope you see the benefits of GPU’s in the cryptocurrency space as we do.

Click here to get engaged with own some GPU's in the crypto mining space.

Congratulations @lmaonade80! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!