Mining difficulty is how your payout is calculated and works like this. Every 2 weeks the network adjusts the difficulty by calculating how much hash power was used to mine bitcoins over that 2 week time span and the more hashpower that gets added to the network the higher the difficulty goes.

So let’s look at how that plays out for the miners.

Example

John spends $2,459 on an Antminer S9 and $200 on a PSU. This gives him a hashrate of 13.5 TH/s. His expenses are electricity at $0.12 KW/h and his equipment consumes roughly 1375 Watts constantly. He doesn’t consider the time he will spend maintaining this mining equipment or the bandwidth it uses as an expense. He mines bitcoin from September 30th 2017 to October 14th 2017 and over this time the electricity he uses costs him roughly $55.44, while he earns roughly 0.0029 BTC every 24 hours. The total amount of money John has spent (so far) is $2,659 (he’ll get his electricity bill for this usage later). Over this 2 week time span bitcoin fluctuates between $4,151.11 all the way up to $5,741.42 and he has earned himself 0.0406 BTC. Now Oct 15th has come and the difficulty has increased by roughly 6.22% decreasing Johns mining profits by 6.22% and the cycle repeats. So in a way what John has essentially done in this example is bet that he will get more bitcoins by mining than he would have gotten if he just bought $2,659 worth of bitcoin during that 2 week time span then bought $55.44 worth of addition bitcoin every month till the date he would have stopped mining. At the best BTC price during the first 2 weeks he would have gotten roughly 0.64 BTC if he invested in buying coins vs buying mining equipment

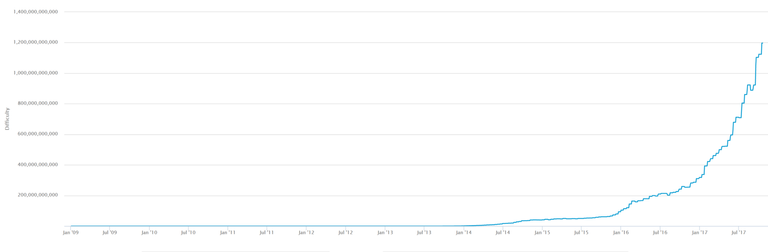

History of bitcoin mining difficulty.

Looking at the difficulty history it’s pretty clear in the early years difficulty increases didn’t pose a real problem for profitability but in today's world a 4%+ decrease in profitability every 2 weeks is a very real possibility.

Why people mine Bitcoin

They want to profit.

They don’t know that the money they spend on buying mining equipment, managing it, and paying for electricity would net them more coins if they used that money to buy coins at market rate instead of mining.

They already have a large stake in mining cryptocurrency.

They are a service company or individual that sells the hashpower they manage to users for a fee.

They want the influence / political power that comes with running a large mining operation.

They are doing it as a way to learn more about Cryptocurrency

They want to support the network by mining.

They are banking on the introduction of additional revenue sources for mining operators. (such as merged mining, being paid to confirm prioritized transactions, ect)

They don’t care about the money.

They are a nation state experiencing sanctions that suppress their ability to see economic growth and want to mine coins to create wealth outside the control of outsiders ability to stunt their growth. (Yes i’m looking at you north korea)

Risks associated with running a mining operation.

Your local laws update and deem it as illegal.

Your local laws update and say you have to comply with a regulatory framework that costs too much for you to comply with.

Your account at the bitcoin exchange you use to convert your profits gets shut down for being connected to a mining operation.

Your account at your bank gets shut down for being associated with a cryptocurrency related venture.

The company you bought mining equipment from is unbeknownst to you on the OFAC list. (you can say this isn’t a risk but it happened to me)

Regulations get updated that prevent the export of mining equipment you ordered to your country.

Risks associated with cloud mining

The difficulty will increase faster than you expected resulting in your ROI taking significantly longer to see or making ROI impossible.

The mining algorithm for the cryptocurrency you’re mining will change making it impossible to mine that specific cryptocurrency with the contract you purchased.

Regulations could change in the place where the mining happens that could force the company to seize operations.

The company you are mining with will merge mine other crypto currencies and not share those profits with you.

The company you are mining with adopts a fork of the cryptocurrency you contracted them to mine that you don’t agree with or has significantly less value.

The company shuts down or is shut down before completing the duration of your contract.

Overhead for mining Cryptocurrency

Electricity

Internet

Location

Maintaining hardware

Taxes / accounting your mining profits in accordance with your local tax agencies rules which depending on your jurisdiction can be pretty complicated.

Originally published here on hackernews.com

(Feel free to comment with any corrections to this article and I will update it)

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://cfd.net.au/article/so-you-want-mine-bitcoin-profit-heres-what-you-need-know-mon-10232017-0127.html

Similar content i.e my article republished elsewhere ;)