How one could use the blockchain technology to finance your app? In this article we will discover different mining technologies from a commercial perspective.

Photo by Marko Ahtisaari

The conventional way financing an app by advertisement on the screen or by creating a motion profile and selling the Geo data is annoying for the user. The recent cases of crypto hijacking showed us a new way of creating value by using the CPU power of the victims system. As a consequence, Microsoft updated the Windows Defender, which is now capable of detecting the CryptoNote PoW algorithm. This algorithm was often smuggled onto the victims system to mine privacy coin Monero. But can we use this technique for a regular business model? Lets take a look:

Lets take some assumptions: Mining must take place under the following conditions:

- Mobile devices

- Limited CPU/GPU performance

- Time limited usage of the app

The only hard currency we have is the time of the users . But can we take profit from it with the blockchain technology?

When the hardware setup is fixed, the more time you spend on mining, the more revenue you collect. This can be used as an incentive to keep the user at your app by rewarding him with some in app/ingame bonuses. This is nothing new when you think about that an advertiser usually want the users attention.

On the basis of our assumptions, the following consensus algorithms seem to be suitable for our use case:

However, for my application, Pythonic, I choosed a classical Proof of Work algorithm. Of course this wont work on mobile devices but due to I developed Pythonic for desktop deployment, this fact is less important.

I also decided to pick Moneros consensus algorithms (CryptoNote) which is designed to run best on ordinary CPU's. Monero already hardforked in the past due to the rise of uncommon hash rate increases which could be caused by the use of ASICs. The idea behind the privacy coin Monero also covers the decentralization of the mining power, thus it is most advantageous when everybody has the capability to participate with realistic chances of finding the next block when using their own standard PC hardware. That’s why CryptoNote runs best on ordinary CPU's and you can expect decent results even without an ASIC.

So as not to exhaust the CPU of the user unnecessarily, I did some test with my notebook to check how many CPU time I can spend for mining without any constraints at ordinary usage:

The Intel Core i7–2670QM @ 2.20 GHz of my notebook is an 8 year old CPU with 8 logical cores. For the mining software, I picked XMR-Stak because you can get pre-compiled binaries for almost every platform, which speedup test significantly.

When the algorithm is executed on one core only, the normal usage is not affected and the CPU fan is not getting loud.

Pythonic is intended as a tool to setup mining bots so we can assume that it is run 24/7.

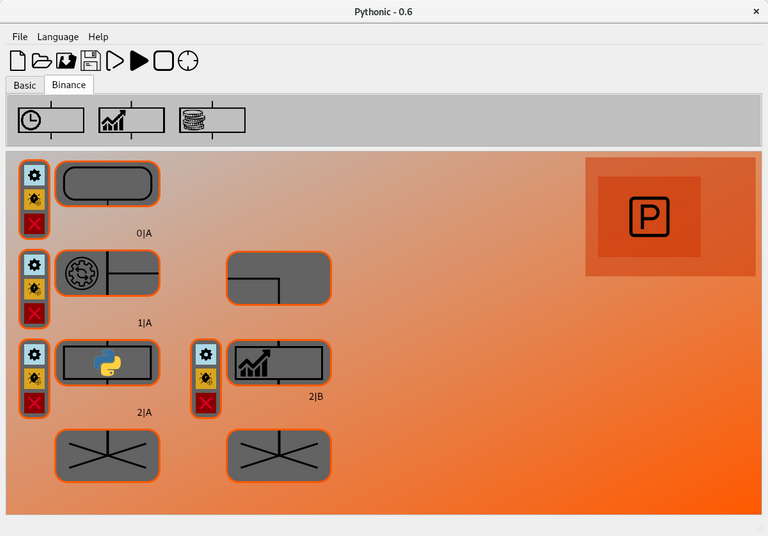

Pythonic v0.6

According to CryptoCompare, we can expect a revenue of

193.9 * 10^(-6) XMR/day. The actual price level of XMR is at

53.50 USD/XMR. So at the end of the month you get 0.31 $ per user.

In practical terms, this means it will need 16,130 user who are running Pythonic in 24/7 operation to generate a revenue of 5k$/month.

Well, that sounds not very promising and its getting worse:

As I stated above, Microsoft updated the Windows Defender. If you want to run XMR-Stak on Windows, you have to add an exception for the installation folder. And who wants to deactivate its virus scanner for an application which usually runs fine with ordinary user rights? All in all this gives an application a dubious touch on Windows based systems.

Conclusion

For the moment we can summarize that mining takes an subordinated role as a business model for financing an app.

As a consequence, the miner which comes with Pythonic will be removed with the next release. But its definitely worth keeping an eye on this topic in the future.