MinedBlock is a Fintech Crypto Mining & Infrastructure Service Provider specializing in transaction processing, or ‘mining’, for crypto currency transactions. MinedBlock Limited, which is the parent company, will own all of the assets, infrastructure and operation while the ‘Subsidiary’ company will own the ‘Service’. The reason behind this model is to tokenise equity in the subsidiary while retaining private ownership of all the assets in the parent company. 25% of revenues will be retained by the parent company to be used for ongoing expansion and operational costs.

THE BIG PICTURE

MinedBlock envisioned becoming a major player in the cryptocurrency arena and for MinedBlock to own a significant part of the infrastructure required to process transactions and mint new crypto assets. This will enable our investors to reap a significant return on investment while we employ an aggressive growth strategy to position ourselves as the ‘Amazon’ of the crypto mining industry.

You see the above image the comparative advantages of MinedBlock As A Service (MAAS) over self mining and cloud mining. This gives investors a huge leverage on the vision of the company.

MISSION OF MINEDBLOCK

Miners, collectively, provide the backbone infrastructure network for cryptocurrency blockchains, the blockchain provides a single, distributed ledger across multiple ‘nodes’ (specialist mining hardware) which perform the activity of ‘mining’ transactions. The blockchain is a distributed, un-editable database which stores transaction information, crypto wallet* balances and details of minted (newly created) coins. Mining validates those transactions, processes payments and updates them to the distributed ledger in a new block.

Each block contains a reward of new cryptocurrency which is awarded to the miner (minted) along with the transaction fees for the processed payments in that block.

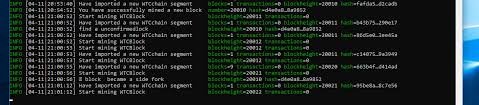

For instance, a miner like myself mines a new bitcoin (btc) block would earn 12.5 Btc plus 0.25 btc in bitcoin transaction fee, as exemplified in this picture below,

MINEDBLOCK REQUIRE A WALLET

- A digital wallet is required to store crypto currency. There will be a public key (the address people can send to) and a private key (your access code to your wallet). This allows balances to be publicly stored on the blockchain but restricts access to your private key.

- Transaction fees vary based on how much a sender allocates to a payment and are generally processed in order of highest transaction fees first. If you wanted to send a payment and it be processed faster, you would commit a higher fee in order to get your payment prioritized.

ADVANTAGES OF MINEDBLOCK OVER SELF MINING AND CLOUD MINING

If you have any mining experience either cloud mining or CPU/GPU mining, you will see what MINEDBLOCK will offer as advantage to you when subscribed to, listed below:

SCALABLE

MinedBlock’s service is endlessly scalable, in order to grow the service we simply would install and configure more mining equipment. There isn’t any technical limitation to how big it could get. MinedBlock has the ability to quickly and easily expand into multiple revenue streams including, but not limited to, expansion of the range of mined crypto assets and the ability to host private mining services.

AGILE

Initially, 40% of our infrastructure will be dedicated to cryptocurrency other than Bitcoin, this will enable the service to flex and switch between the asset being mined allowing us to always target the assets with the best returns based on market demand. The 60% initial allocation to Bitcoin can also be adjusted based on market prices and returns.

SUSTAINABLE

MinedBlock is focussed on hosting our infrastructure in areas that can provide 100% renewable energy.

MARKET IMMUNITY

Phase 2 of the project, which is out of scope for this round of funding, will be to build our own renewable energy sources to offset electricity costs, the primary ongoing cost factor, thus enabling continuous revenue production regardless of crypto market prices.

PROJECTED REVENUE

MinedBlock will produce revenue through mining a strategically selected range of cryptocurrencies. Another way to ‘mine’ crypto is to buy and hold a minimum number of a coin in a wallet which entitles the holder to a share of transaction fees (similar to earning interest on a savings account). This is known as a ‘Proof of Stake’ method of mining.

Publishing a wallet for Proof of Stake mining is called hosting a masternode.

There are always new technological advances in the mining industry including strategies and technologies which we are prepared to adopt and add to our service. The return on investment, in terms of profits, ranges from 6% to 75% of the initial investment each month depending on the wider Crypto market. This represents an estimated range of 72% to 900% ROI over a year. At this stage any exit strategy could be represented by a public flotation or a full management buyout.

Assuming we successfully raise $15m and considering the current crypto market prices we forecast a turnover of ~$23.6m with total company profits of ~$14.3m in year one. If the crypto market stays as it is today, then year two would bring around a 20% increase in revenue and profit.

UNIQUE SELLING POINT (USP)

Our USP compared to the competition is that we plan to make ourselves fully immune from the market, prioritise our investors (over ourselves) and be 100% transparent in everything we say and do. Most other mining firms have focused on just ‘out of the box’ mining and not considered any form of cost reduction or alternative revenue generation such as masternodes, and this has left them unprofitable and unable to continue.

Our aims go far beyond ‘just being another mining company’ we intend to dominate the space as quickly as possible. At this stage, there isn’t really any meaningful competitor in the marketplace as the mining industry is still in its infancy.

READ MORE ON WEBSITE and WHITEPAPER

Bounty0x Username: moneyafric