The government is looking to further lower goods and services tax (GST) in the coming months, starting with construction material such as cement and paints, which are in the top slab of 28%. Separately, sources told TOI, the government is also looking at the possibility of paring the levy on several items that attract high taxes but do not yield much revenue for the government.

“It’s 80:20 formula, with 80% of the revenue coming from a handful of goods and only small amounts collected from bulk of the items. We will look to reduce rates in the coming months, while ensuring that the chain is not broken,” said a source, who did not wish to be identified.

Sources said the move to reduce rates on construction material could come soon and will provide a fillip to the sector battling a slowdown, that has also adversely impacted job generation, a key concern for the Modi government in the run-up to next summer’s general elections. There are several product segments, such as textiles, where the inputs face higher levies than the final product, creating an inverted duty structure and adding to the manufacturers’ woes as the levies are not fully refunded.

While a plan to reduce the rates on cement was on the table in November when the GST Council met in Guwahati, it was dropped as the rate cuts had already left an over Rs 20,000-crore hole. At that time, the government had slashed taxes on over 200 items, the levy on 176 items reduced from 28% to 18%, leaving just 50 in the highest slab.

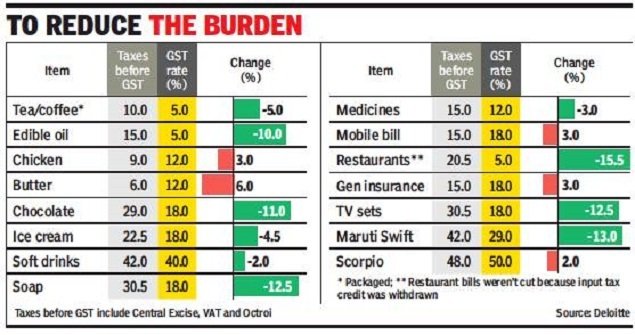

When GST kicked in last year, the government had opted for a revenue-neutral approach and kept rates as close to the prevailing levies (excise and state VAT), although the overall direction of the change was towards lower levies. But the reduction was nominal, prompting the government to go for mid-course correction. More changes were to be made, depending on buoyancy in collections, the government had said, while stating that the long-term objective was to keep as few items as possible in the top bracket of 28% and over a period of time merge the 12% and 18% brackets.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://economictimes.indiatimes.com/news/economy/policy/good-news-more-gst-rate-cuts-are-coming/articleshow/64794020.cms