This is my daily preparation for my trading day and it is for your educational purpose only and definitely cannot be considered as financial advice. There is a substantial risk in derivative trading and it might not be suitable for you. Don't rely on past performance as it is not indicative of future results.

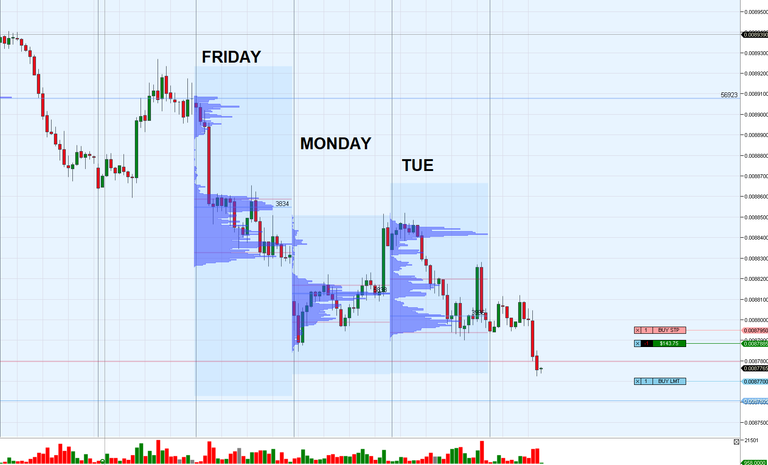

We started a week with a small gap downwards after Japan elections. However, Monday session was relatively balanced which resulted in more active buying and closing the gap towards the market close.

Yesterday (Tuesday 10.24.2017), was trading inside Monday's range. However, market's unwillingness to get back into Friday's range and accumulation around Monday's high, made short players more active. (Forex traders keep in mind that this is future contract and it is opposite to USDJPY pair).

Considering the fact that we are still in the range of high volume area that was formed since the beginning 2017, the primary focus for longer term players is still that market will remain inside this range, meaning that primarily long positions should be considered. As it is ranging market. CFTC reports and open interest changes doesn't show that there is a significant change in attitudes of longer term players.

However, the shorter-term players and swing traders seem to look towards short side in market's attempt to check lows of the year's range, as there were no signals for change in the trend on 1h and 4h charts. This would mean following targets for today and upcoming Thursday and Friday:

First around the spike made on 7 June 0.008764-0.008760 area for 6J future contracts (which would be around 114.30-114.50 area on FX charts).

In case longer term player will not be actively covering their shorts around this area, the next target would be profile's low 0.008744-0.008737 area (FX levels in the zone between 115.60-116.00)

The third targets would be around very low of the year's range - around 0.00870 prices.

Around all of these levels, a further consideration will be needed to see if longer term players are active in closing their position, for this analysis I will be watching open interest and CFTC reports.

As of today, I won't be considering long positions on futures (or shorts on USDJPY pair charts). Long positions will be considered only in case market will actively get back to the yesterday's range.

Congratulations @egoism4beginners! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Congratulations @egoism4beginners! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard: